MBX Biosciences Stock Skyrockets Following Promising Clinical Trial Update

Biotech investor portfolios just got a serious adrenaline shot as MBX Biosciences shares launch into orbit.

The Catalyst Behind the Surge

Positive Phase 2 data for their lead candidate sent institutional money flooding in—proving once again that clinical success remains the ultimate market mover in biotech.

Trading Floor Frenzy

Volume spiked 300% in the first hour alone as algorithms scrambled to catch the wave. The stock ripped through resistance levels like tissue paper, leaving short sellers nursing serious losses.

Wall Street's Selective Amnesia

Suddenly every analyst remembers why they loved this story six months ago—funny how double-digit percentage gains can cure collective memory loss on the Street.

Another day, another biotech moonshot proving that in traditional markets, hope springs eternal right after the data hits.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The big news here is that the Phase 2 clinical trial met its primary endpoint, as 63% of canvuparatide-treated patients met the prespecified primary composite endpoint with zero contribution from PRN rescue therapy. In the open-label extension, 79% of patients achieved responder status at 6 months.

Kent Hawryluk, President and CEO of MBX Biosciences, said, “These 12-week and 6-month results represent the potential for a meaningful improvement over current treatment options for HP patients and provide a strong foundation for further development. We look forward to sharing additional once-weekly canvuparatide clinical data at an upcoming medical meeting as we prepare for initiation of our Phase 3 trial.”

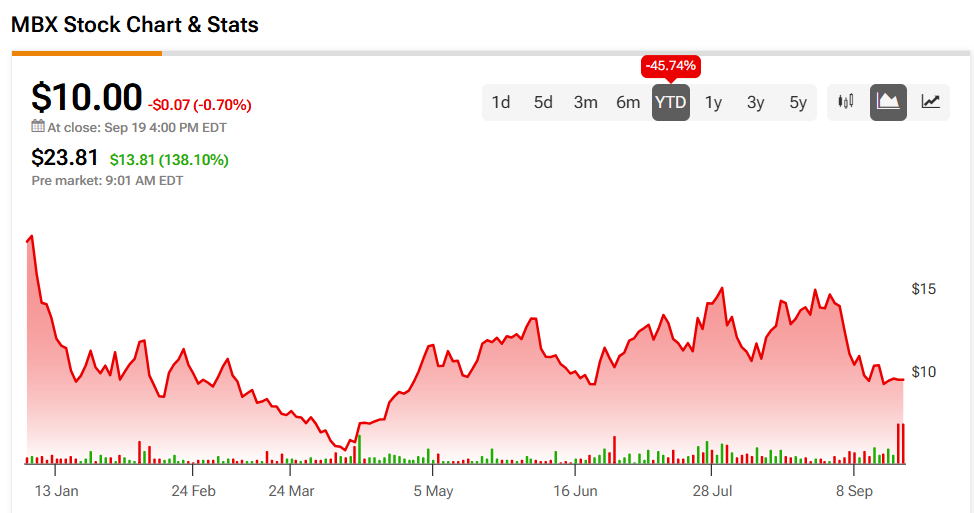

MBX Biosciences Stock Movement Today

MBX Biosciences stock rallied 138.1% in pre-market trading on Monday, following a 0.7% slip on Friday. The shares have also decreased 45.74% year-to-date and 55.1% over the past 12 months. With that came heavy trading, as some 10.5 million shares changed hands, compared to a three-month daily average of about 422,000 units.

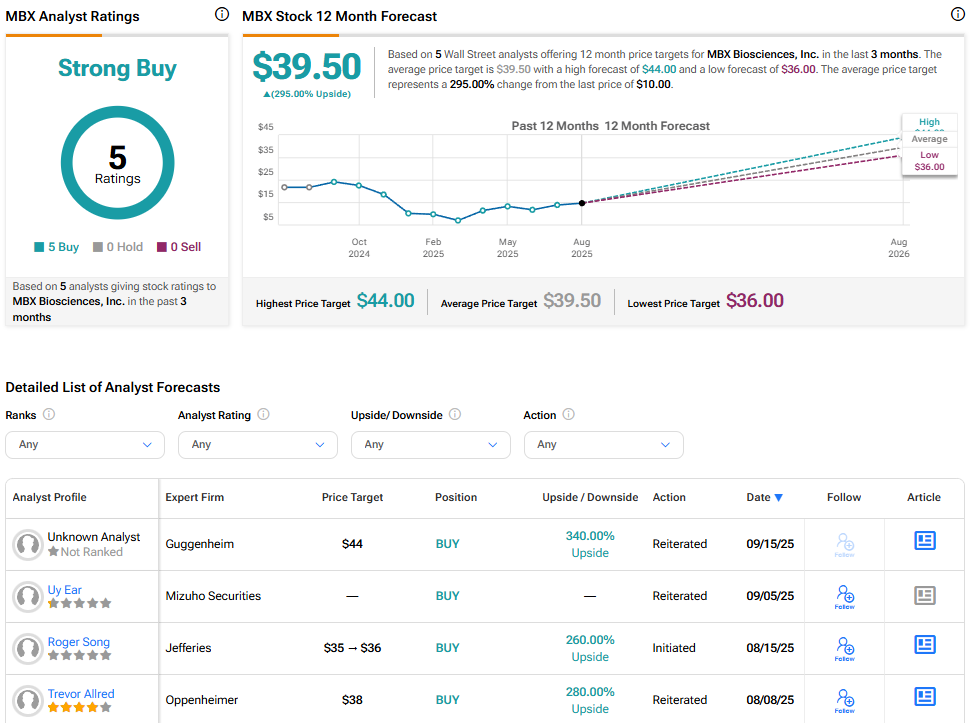

Is MBX Biosciences Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for MBX Biosciences is Strong Buy, based on five Buy ratings over the past three months. With that comes an average MBX stock price target of $39.50, representing a potential 295% upside for the shares.