3 Dividend ETFs with Massive Yields Wall Street Hopes You’ll Overlook

Forget chasing meme stocks—these cash-generating machines deliver real returns while traditional finance sleeps.

Hidden Gems in Plain Sight

While crypto volatility dominates headlines, these three dividend ETFs quietly outperform with yields that crush most traditional investments. They're the antithesis of speculative assets—boring, predictable, and consistently profitable.

The Contrarian's Playbook

Each fund targets overlooked sectors that print money regardless of market sentiment. We're talking about infrastructure plays, essential services, and global enterprises that pay shareholders first. Unlike crypto's 'number go up' mentality, these vehicles generate actual cash flow.

Yield Versus Hype

One fund's methodology focuses on companies raising dividends for 25+ consecutive years—a track record no cryptocurrency can match. Another captures international dividend aristocrats diversifying beyond US markets. The third? A high-yield strategy that makes bond returns look pathetic.

Of course, traditional finance will tell you to avoid these for 'growth opportunities'—meaning their underperforming actively managed funds. But smart investors know: sometimes the best disruption is owning assets that actually make money.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, a dividend ETF (Exchange-Traded Fund) is a fund that holds a basket of dividend-paying stocks and trades on an exchange like a regular stock.

TipRanks Makes Dividend Investing Easier

TipRanks provides a range of tools to help investors find and track dividend opportunities that fit their goals. The Best Dividend Stocks list highlights top dividend-paying companies along with key comparison metrics. Meanwhile, the Dividend Calendar makes it simple to track upcoming payouts, so investors can plan purchases in time to qualify for the next distribution.

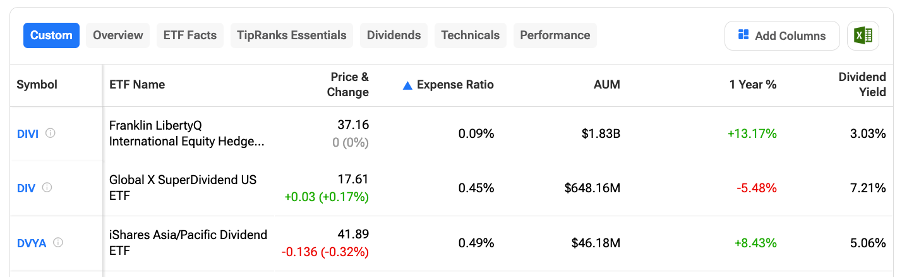

For those interested in ETFs, TipRanks also offers powerful comparison features. TipRanks’ ETF Comparison Tool lets investors compare funds across metrics such as AUM (assets under management), expense ratios, technicals, dividend analysis, etc.

Franklin LibertyQ International Equity Hedged ETF (DIVI)

Franklin LibertyQ International Equity Hedged ETF (DIVI) is an attractive option for investors looking for high dividend income from global stocks. It seeks to track the Morningstar Developed Markets ex-North America Dividend Enhanced Select index.

Importantly, DIVI has an expense ratio of 0.09%. Notably, ETFs with low expense ratios cost less to own, helping investors keep more of their returns.

DIVI pays a dividend of $0.185 per share, reflecting a yield of 3.03%. In terms of holdings, the fund has a total of 459 holdings with total assets of $1.83 billion.

Global X SuperDividend US ETF (DIV)

The Global X SuperDividend US ETF is a solid option for investors seeking steady income from high-dividend U.S. stocks. By following the Indxx SuperDividend U.S. Low Volatility Index, DIV provides exposure to a diversified mix of high-yield, U.S.-based equities.

DIV pays a monthly dividend of $0.108 per share, reflecting a yield of 7.21%. Meanwhile, DIV has an expense ratio of 0.45%. In terms of holdings, it has a total of 51 holdings with total assets of $648.16 million.

iShares Asia/Pacific Dividend ETF (DVYA)

The iShares Asia/Pacific Dividend ETF tracks the Dow Jones Asia/Pacific Select Dividend 50 Index, providing exposure to a diverse range of high-yielding stocks across the Asia-Pacific region.

Meanwhile, DVYA pays a quarterly dividend of $0.663 per share, reflecting a 5.06% yield, and carries a low expense ratio of 0.49%. The ETF holds 51 stocks with total assets of $46.18 million, with its top 10 holdings accounting for 41.3% of the portfolio.