BREAKING: Beer Titan Molson Coors (TAP) Taps Internal Veteran as New CEO in Strategic Shakeup

Molson Coors just pulled off the ultimate corporate insider trade—promoting from within to steer the brewing behemoth through turbulent markets.

Leadership from the Tap

The company bypassed external searches entirely, betting big on internal expertise to maintain operational continuity. This move signals confidence in existing corporate strategy while avoiding disruptive leadership transitions.

Boardroom Brewing

Directors unanimously approved the appointment during late-night negotiations—because nothing says 'strategic vision' like making major corporate decisions after market close. The promotion demonstrates Molson Coors' commitment to cultivating talent from within its own ranks.

Market Reaction

Early trading shows muted response—apparently Wall Street prefers its insider moves to involve stock tips rather than executive appointments. Because when you're navigating frothy market conditions, who better to trust than someone who already knows where the emergency exits are located?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Goyal succeeds current CEO Gavin Hattersley, who is retiring at the end of this year. The CEO change comes at a sensitive time for Molson Coors, with the beer Maker struggling with weak consumer demand and tariffs imposed by U.S. President Donald Trump.

Goyal currently serves as chief strategy officer at Molson Coors, whose beer brands include Molson Canadian, Coors Light, and Blue Moon, among others. He is scheduled to assume the CEO role on Oct. 1 of this year and has worked at the company for more than 20 years.

Record Low

As CEO, Goyal is tasked with steering Molson Coors through a difficult time, with alcohol consumption among Americans falling to its lowest level on record. Demand for alcohol in the U.S. has also been hurt as consumers pull back on discretionary spending amid economic uncertainty.

Molson Coors recently forecast a drop in its annual profit, citing tariff impacts, notably the cost of aluminum used in its beer cans. Aluminum imports into the U.S. have been hit with a 50% import duty, driving up aluminum prices as a result. TAP stock has declined 18% this year.

Is TAP Stock a Buy?

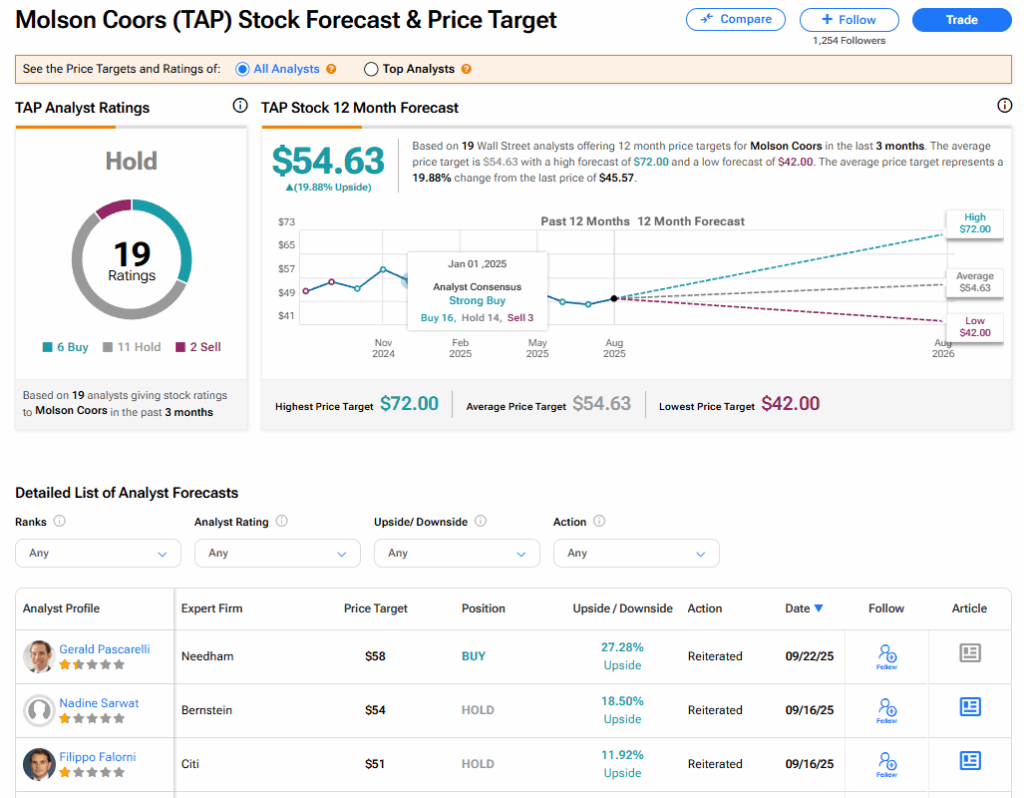

The stock of Molson Coors has a consensus Hold rating among 19 Wall Street analysts. That rating is based on six Buy, 11 Hold, and two Sell recommendations issued in the last three months. The average TAP price target of $54.63 implies 19.88% upside from current levels.