3 US Crypto Stocks Primed for Explosive Growth in Q3 2025

Wall Street's sleeping giants wake up—these digital asset plays could mint new millionaires by Labor Day.

1. The Miner Defying Bitcoin's Gravity

While retail traders panic-sell, one NASDAQ-listed rig operator keeps stacking sats at sub-$60k levels. Their Q2 earnings call hinted at a nuclear-grade hash rate upgrade—just as the halving's supply shock kicks in.

2. The Exchange Out-Trading Its Peers

Coinbase? Too mainstream. This regulated platform's derivatives volume spiked 217% last quarter while dodging the SEC's enforcement dragnet. Their OTC desk just onboarded three sovereign wealth funds.

3. The Dark Horse Staking Play

A little-known fintech quietly became Ethereum's third-largest validator. Now it's pivoting to restaking—because why earn 5% when you can lever up that yield eightfold?

Remember: these picks could moon harder than a DeFi shitcoin... or crash faster than a Celsius withdrawal request. Choose wisely.

Bitfarms Ltd (BITF)

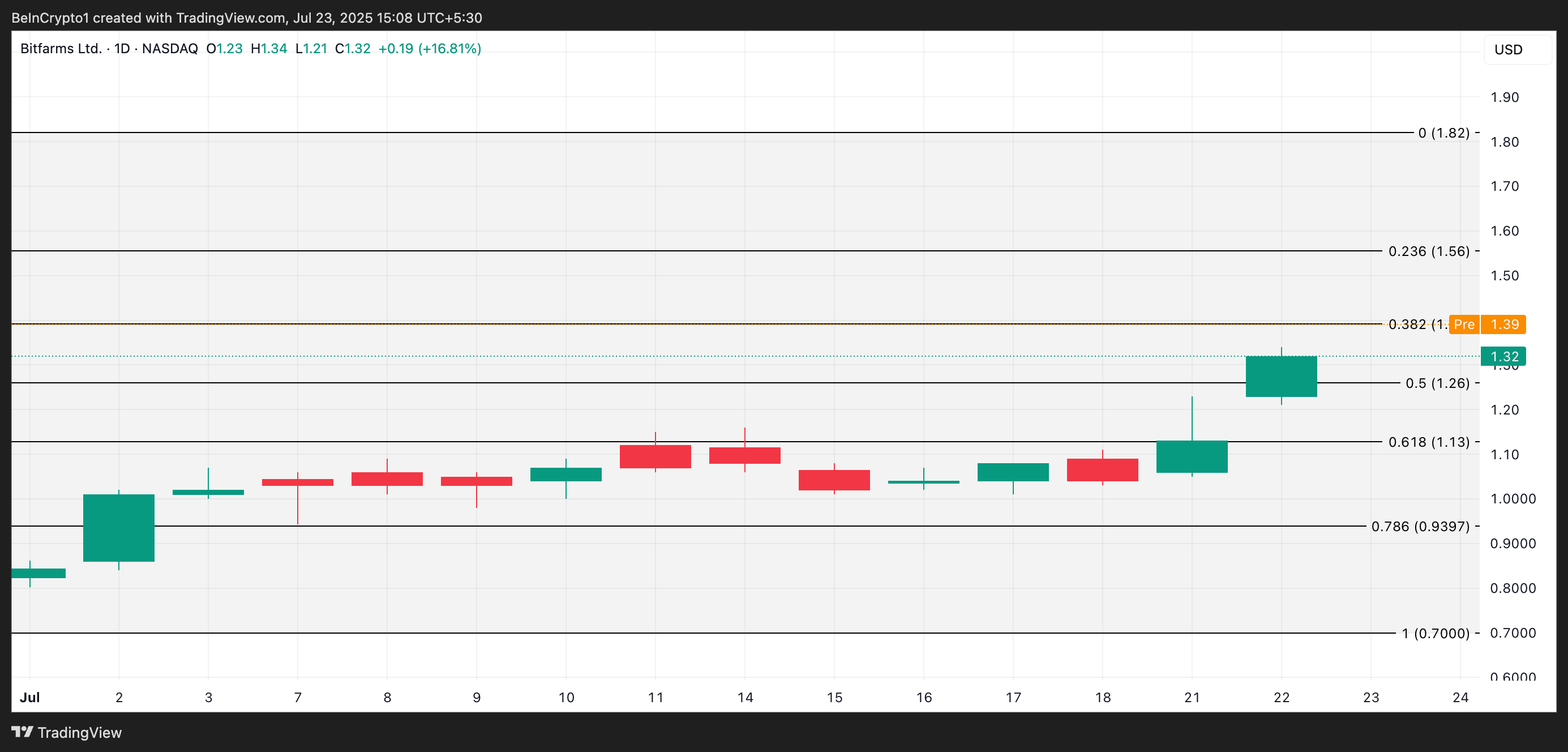

Bitfarms Ltd shares ROSE 16.81% on Tuesday to close at $1.32, following news of a major share buyback initiative approved by its board of directors.

In a statement released yesterday, the company confirmed that the Toronto Stock Exchange (TSX) has accepted its notice to initiate a normal course issuer bid program. Under the program, Bitfarms is authorized to repurchase up to 49,943,031 of its common shares—roughly 10% of its 499 million-share public float—as of July 14, 2025.

The program officially begins on July 28 and runs through July 27, 2026.

The announcement sparked strong investor interest. In the pre-market session, BITF trades at $1.43. If demand continues to build after the market opens, the stock could rally toward the $1.56 level.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Conversely, if momentum fades, BITF could retreat below the $1.39 mark.

Soluna Holdings (SLNH)

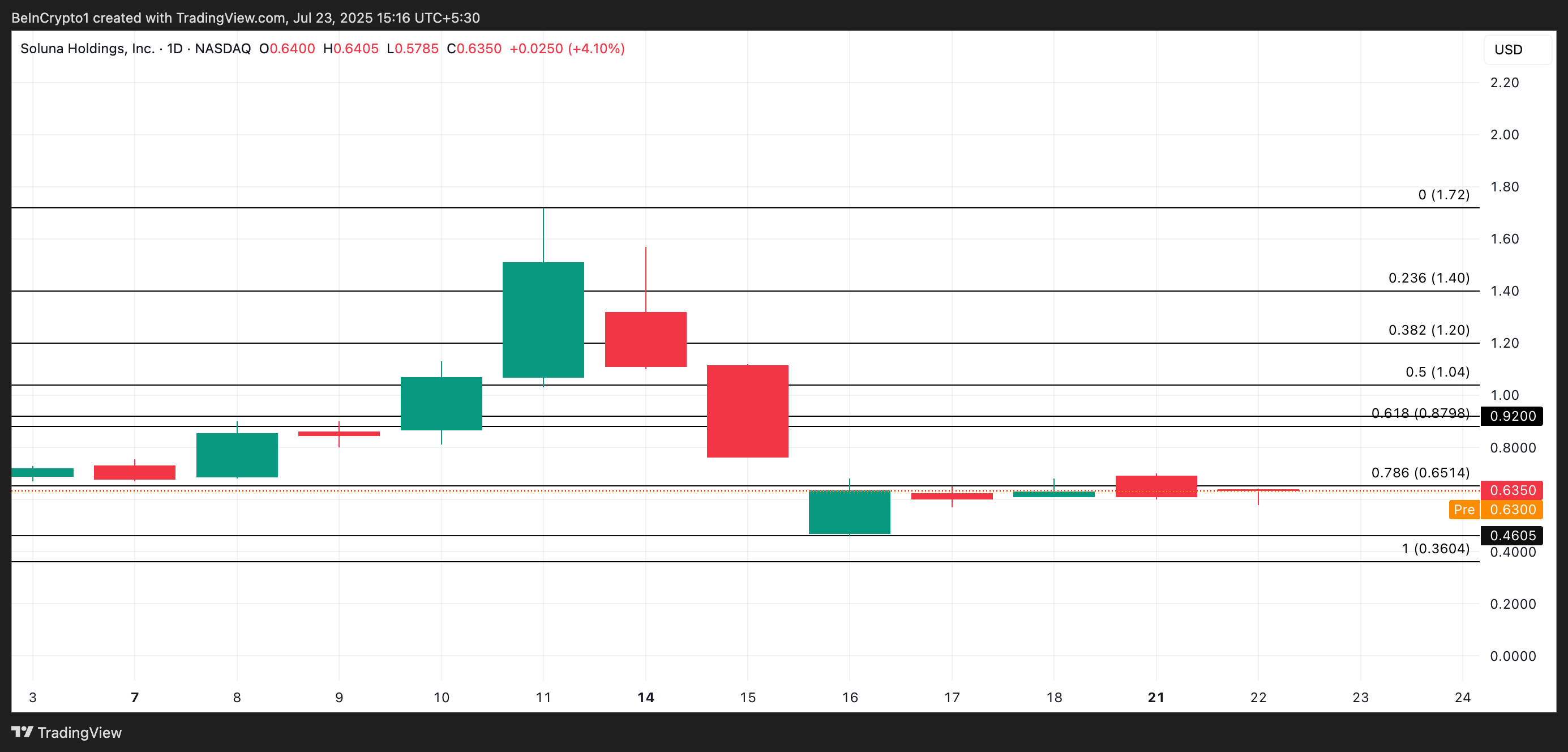

SLNH climbed over 4% yesterday to close at $0.64 after Soluna Holdings announced it had secured a fresh round of financing from Spring Lane Capital for a major expansion of its Bitcoin and AI-focused data center infrastructure in Texas.

The $20 million funding will kickstart construction of Project Kati 1, a 35-megawatt green data center set to begin development in Q3 2025, with operations expected to start in early 2026. The project will host around 12,000 next-gen bitcoin mining rigs and forms part of a broader 83MW expansion.

In pre-market trading, SLNH is slightly lower at $0.63. If buying pressure increases when the market opens, SLNH could rally toward $0.65.

However, if bearish momentum takes hold, the stock risks falling below $0.46.

Coinbase Global (COIN)

Coinbase shares are in focus today following news of a major strategic partnership with PNC Bank. The deal will see PNC offering Coinbase’s Crypto-as-a-Service (CaaS) platform to its banking clients and institutional investors, giving them streamlined access to secure digital asset services.

PNC will also provide select banking infrastructure to Coinbase, reinforcing both firms’ commitment to building a resilient digital financial system.

As of the last trade, COIN stock closed at $404.44, down 2.22%. However, in pre-market trading today, COIN is up at $406.16. If buying momentum picks up at the opening bell, the stock could rally toward $420.98.

On the downside, a break below $394.37 could signal further weakness.