Max Keiser Declares MicroStrategy ‘Rewriting the Rules’ in Bold Quest for 1 Million Bitcoin | US Crypto News

MicroStrategy isn’t just buying Bitcoin—it’s bulldozing Wall Street’s playbook to get there first.

### The Bitcoin Accumulation Game Just Got Aggressive

No more dipping toes—MicroStrategy’s going all-in, with CEO Michael Saylor leading the charge. Forget dollar-cost averaging; this is corporate treasury warfare.

### Why 1 Million BTC? Because ‘Enough’ Is for Banks

While traditional finance hedges, MicroStrategy treats Bitcoin like a finite resource (because it is). Gold 2.0? Try ‘the only ledger that can’t be printed into oblivion.’

### The Cynic’s Corner: Wall Street Still Thinks It’s a Phase

Meanwhile, Jamie Dimon’s probably drafting another ‘blockchain good, Bitcoin bad’ memo—between bailouts, of course.

One thing’s clear: When the rules are rigged, winners tear them up.

Crypto News of the Day: Strategy Rips Up Rulebook on Path to 1 Million Bitcoin, Says Max Keiser

Strategy, now MicroStrategy, recently revealed a new offering called STRC, or “Stretch.” Marketed as a perpetual preferred stock with an initial 9% dividend, the product is explicitly designed to support the company’s goal of accumulating more Bitcoin.

Michael Saylor, executive chairman of Strategy, announced the IPO via X (Twitter), calling it a new lever for bitcoin accumulation.

Strategy is offering $STRC (“Stretch”), a new Perpetual Preferred Stock via IPO, to select investors. $MSTR pic.twitter.com/LaQSrrMsEg

— Michael Saylor (@saylor) July 21, 2025Strategy’s post echoed the same language, reaffirming that net proceeds will go toward general corporate purposes, including acquiring Bitcoin.

That mission, however, was punctuated more dramatically in an exclusive comment to BeInCrypto by Bitcoin evangelist Max Keiser.

“Strategy is committed to 1 million Bitcoin by any means necessary. They’re tearing up the corporate finance rule book and charging hell-bent for leather to the 1 million Bitcoin promised land,” Keiser told BeInCrypto.

Morgan Stanley, Barclays, Moelis & Co., and TD Securities are joint bookrunners, signaling strong institutional coordination.

However, Keiser’s comment cuts through the finance speak, articulating that MicroStrategy does not want more Bitcoin. Rather, it wants all the Bitcoin.

This aggressive tone is consistent with Strategy’s decade-long shift from an enterprise software firm to a Bitcoin holding company.

Meanwhile, even as the firm progressively pivots to BTC, analysts say the firm could trigger a Bitcoin cascade worse than Mt. Gox or Three Arrows Capital.

MARA Raises $850 Million to Double Down on Bitcoin

MARA Holdings, the world’s largest public Bitcoin miner, is joining the Bitcoin accumulation wave. The firm revealed a $850 million private offering of convertible senior notes due in 2032.

MARA Holdings, the world's largest public bitcoin miner, raises $850 million to continue buying bitcoin. MARA Holdings currently holds more than 50k BTC. pic.twitter.com/ZxeujEwGFk

— Wu Blockchain (@WuBlockchain) July 23, 2025The MOVE signals continued strategic conviction in Bitcoin as a treasury reserve and a core asset in the company’s business model. The offering consists of 0.00% convertible senior notes, with an option for initial purchasers to buy an additional $150 million.

Redemption terms kick in from January 2030, and the company has embedded multiple mechanisms to manage dilution.

MARA intends to use the bulk of the proceeds to buy additional Bitcoin and fund general corporate purposes. This raise highlights MARA’s role as a miner and digital asset treasury operator.

Like Strategy, MARA is positioning itself to amass more Bitcoin while fortifying its balance sheet against future market disruptions.

$BTC is up by $11.4K since Q3 started which means that $MARA is already sitting on over $573 Million Quarterly Net Profit

Bitcoin increased by $24.6K in Q2 which will result in nearly $1.2 Billion in FASB GAAP Net Profit when MARA reports earnings on July 29 @ 5pm

HODL MATTERS https://t.co/9cHSPK8YAQ pic.twitter.com/Z4JYGxdKKc

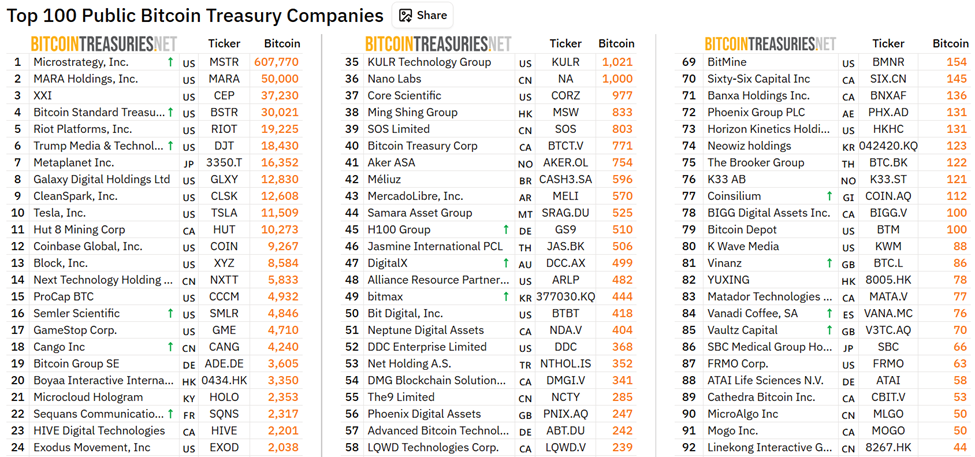

Data on Bitcoin Treasuries shows MARA is a distant second among public corporate holders of BTC, holding 50,000 tokens.

Meanwhile, as of this writing, MicroStrategy is the largest holder, with a 607,770 portfolio valued at $71.80 billion.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Tether expands beyond stablecoins as profit fuels 120+ investments.

- 21Shares seeks SEC nod to launch Ondo ETF.

- Bitwise sees a $20 billion institutional surge ahead for Ethereum.

- Solana rises 20% in a week, but an analyst warns of a LUNA-like breakdown ahead.

- Wall Street is set to benefit as in-kind crypto ETF redemptions gain momentum.

- Coinbase teases 3 new altcoin listings, market reacts with price jumps.

- Public companies’ Bitcoin bet: Can they weather the bear market storm?

- BNB price hits new all-time high; 2021 pattern signals altcoin season is imminent.

- Should investors buy low-cap altcoins in Q3 2025? Analysts weigh in.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 22 | Pre-Market Overview |

| Strategy (MSTR) | $426.40 | $425.74 (-0.15%) |

| Coinbase Global (COIN) | $404.44 | $405.50 (+0.26%) |

| Galaxy Digital Holdings (GLXY) | $29.11 | $29.90 (+2.71%) |

| MARA Holdings (MARA) | $19.88 | $18.86 (-5.33%) |

| Riot Platforms (RIOT) | $14.27 | $14.13 (-0.98%) |

| Core Scientific (CORZ) | $13.48 | $13.60 (+0.89%) |