XRP’s Rally Hits Speed Bumps—2 Critical On-Chain Red Flags Traders Are Ignoring

XRP’s recent surge might be running out of gas—and the blockchain doesn’t lie. Here’s what the data screams while the hype train chugs along.

Red Flag #1: Whale Movements Get Suspicious

Large holders are shuffling stacks off exchanges—or onto them. Either way, someone’s preparing to make a move.

Red Flag #2: Network Activity Flatlines

Transaction counts stagnate even as prices pump. Classic divergence—retail’s late to the party again.

Meanwhile, crypto bros still think ‘this time is different.’ Spoiler: It’s never different. Smart money watches the chain, not the charts.

XRP Traders Brace for Pullback as On-Chain Signals Flash Red

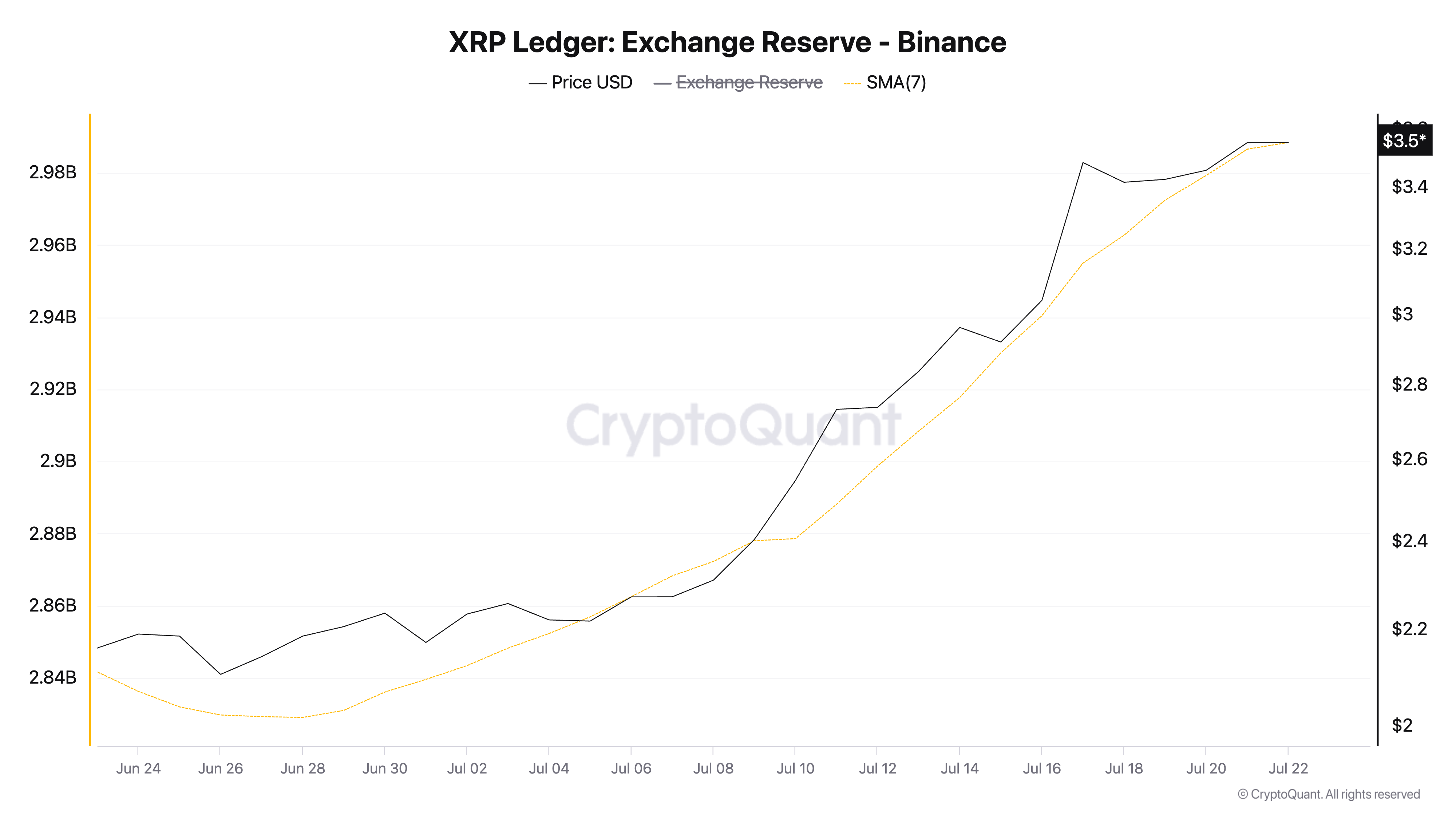

First, XRP’s exchange reserve on leading exchange Binance has spiked sharply, reaching its highest level of the year. According to CryptoQuant, XRP’s exchange reserve—measured using a seven-day moving average—closed at a year-to-date high of 2.98 million tokens on July 22, valued over $10 million at current market prices.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

A spike in an asset’s exchange reserve indicates that more tokens are being moved onto centralized exchanges, often in preparation for selling. When investors transfer large amounts of a coin to exchanges, they may be positioning to take profits or exit positions.

In XRP’s case, the surge to a 2.98 million token reserve implies heightened selling intent. If this influx of supply is not met with equal or greater demand from buyers, downward pressure on XRP’s price could quickly build.

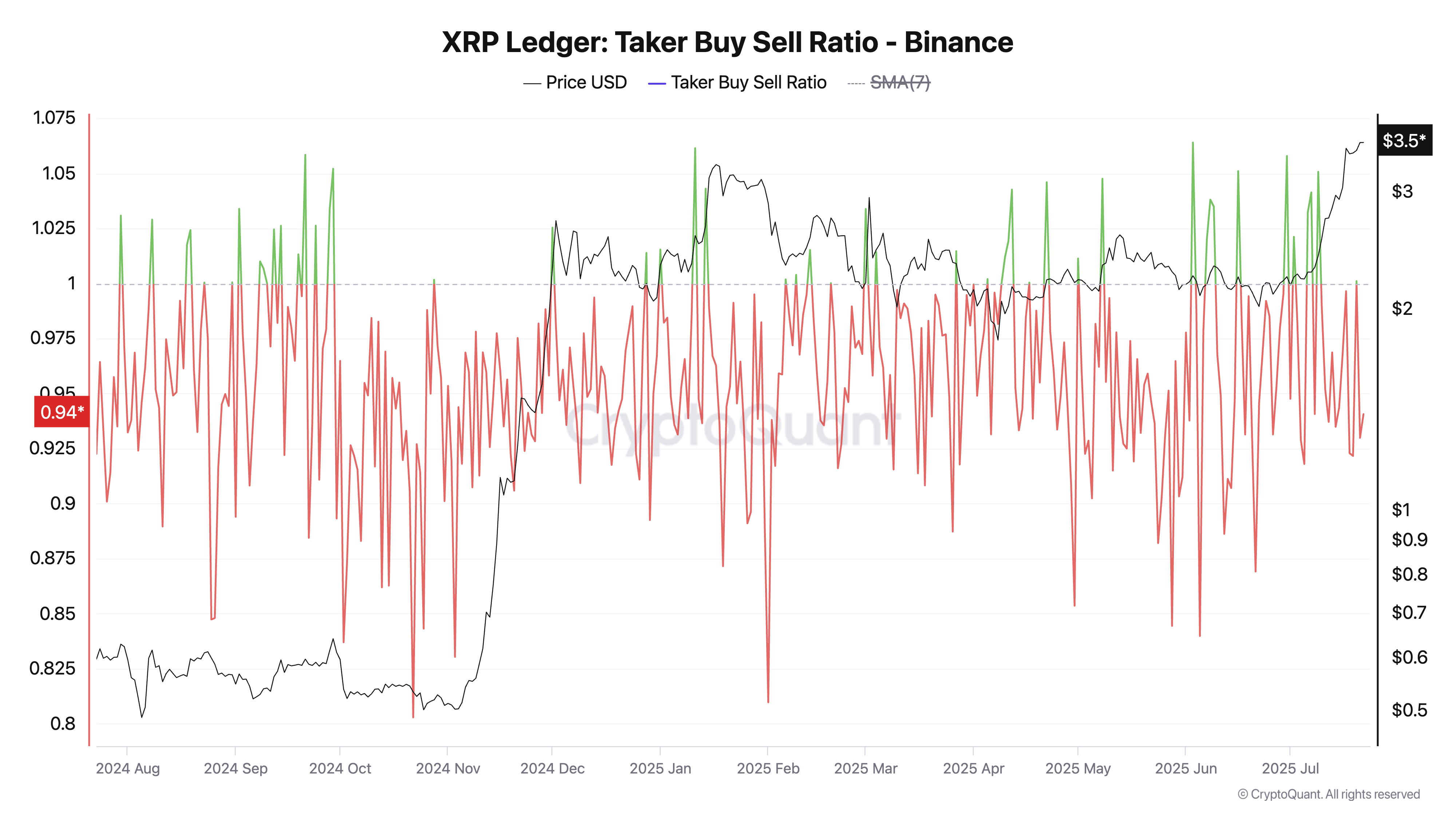

Furthermore, CryptoQuant’s data shows that XRP’s taker buy/sell ratio has consistently remained below one since July 10. As of this writing, the metric stands at 0.94

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

The fluctuation in XRP’s taker buy/sell ratio below one over the past two weeks points to a sell-off trend among futures traders as its price climbs. This mounting sell-side pressure confirms weakening sentiment and could trigger price declines over the next few sessions if it continues.

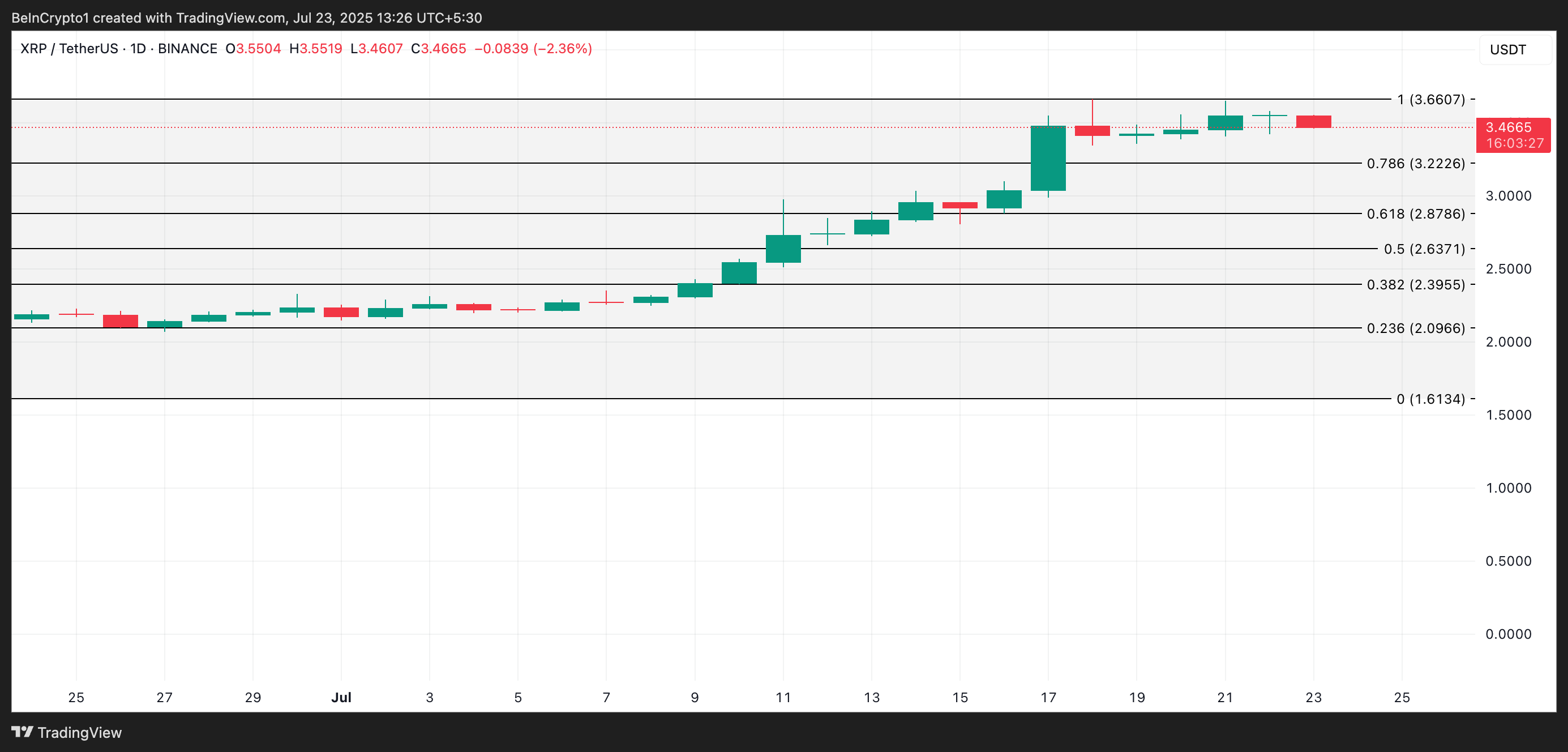

XRP Bulls Face Key Test at $3.22

At press time, XRP trades at $3.47, just below its all-time high of $3.66. However, mounting sell-side pressure increases the probability of a near-term correction toward the $3.22 support level.

Should this floor give way, XRP could extend its decline to around $2.87.

However, if selling pressure eases and fresh demand enters the market, the altcoin may reclaim its price peak and potentially chart new gains beyond $3.66.