Mt. Gox Hacker Dumps 1,300 Bitcoin – But $360 Million Haul Still Looms Over Market

A ghost from crypto's past just rattled the vault.

The Unloading Begins

After years of silence, a wallet linked to the infamous Mt. Gox breach has sprung to life. The move sent 1,300 Bitcoin into circulation—a not-so-subtle reminder that old wounds in this space can reopen at any moment.

The Shadow Portfolio

Here's the real kicker: this transaction is just a fraction of the story. The entity behind it still controls a staggering $360 million worth of Bitcoin. That's a massive overhang—a Sword of Damocles dangling by a digital thread, waiting to see if the market can stomach the next wave.

Market Mechanics vs. Old Money

Every large, aged wallet that stirs forces the market to answer a simple, brutal question: is current demand deep enough to absorb supply from a different era? It's a stress test no traditional finance regulator would ever sign off on, but in crypto, it's just another Tuesday.

The saga proves a cynical truth of modern finance: the most patient capital is often the kind that wasn't obtained through conventional means. While Wall Street frets over quarterly earnings, the real power moves happen in the shadows, where time is measured in blockchain confirmations, not fiscal years.

Mt. Gox Hacker Unloads More Bitcoin

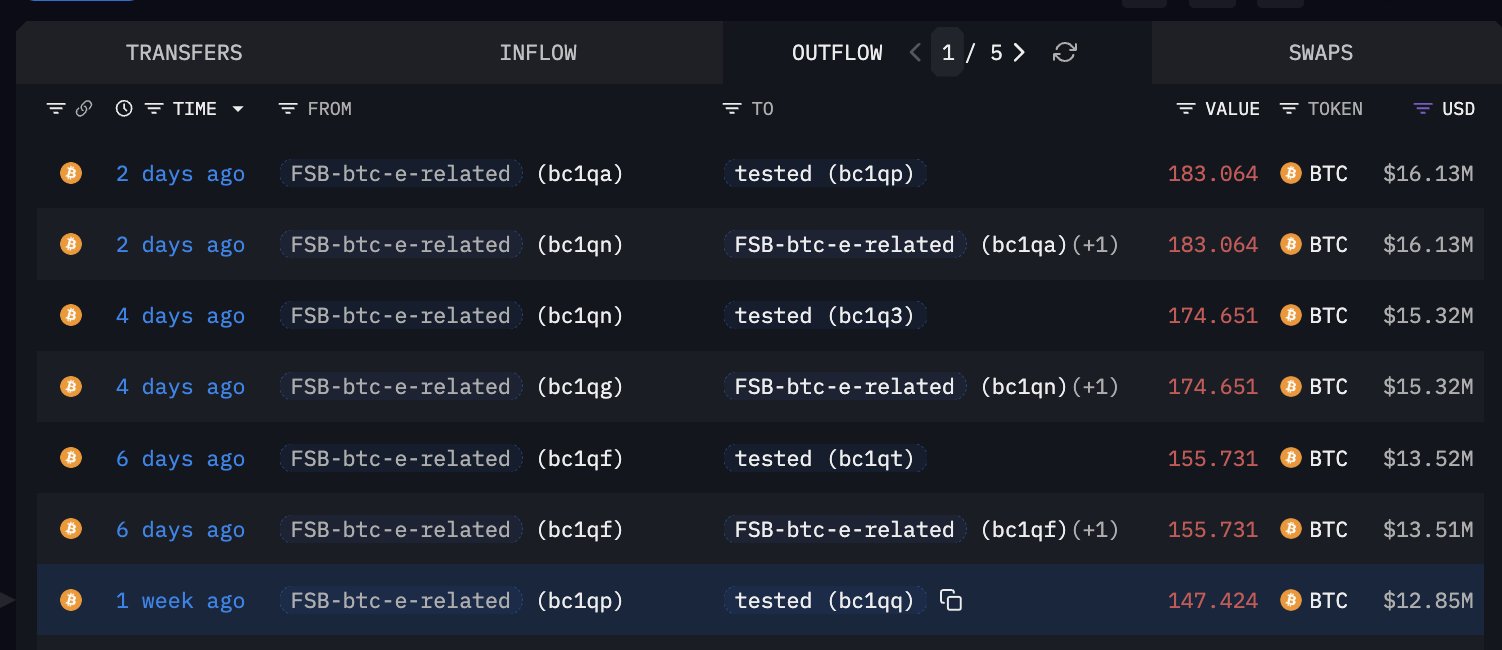

Arkham analyst Emmett Gallic said entities related to Aleksey Bilyuchenko deposited another 1,300 BTC, about $114 million, into unknown exchanges over the past seven days. The wallets still hold roughly 4,100 BTC (around $360 million), and have sold a total of 2,300 BTC.

Gallic wrote via X on Dec. 23: “The entity related to Aleksey Bilyuchenko has deposited another 1.3K BTC ($114M) to the unknown exchanges in the past 7 days. They still hold 4.1K BTC ($360M). They have sold a total of 2.3K BTC.”

Bilyuchenko has been charged by the US Department of Justice in connection with the Mt. Gox hack.

The Dec. 23 deposits build on earlier posts in which Gallic described a methodical unwind rather than a one-off dump. On Nov. 9, he said bitcoins “once belonging to BTC-E cofounder Aleksey Bilyuchenko are slowly being sold off through unknown exchanges,” citing 110 BTC deposited over two days.

That Nov. 9 note also emphasized uncertainty around who is actually controlling the funds. “Unclear if he’s still jailed in Russia or in control of these funds, but Moscow courts have seized most of his other assets,” Gallic wrote.

The repeated use of “unknown exchanges” suggests the destination clusters are not cleanly attributable to major, labeled venues in the datasets Gallic is using. For market participants, that makes the FLOW harder to handicap: deposits can signal intent to sell, but the execution path is less transparent than transfers into well-known exchange wallets.

In an Oct. 17 post, Gallic went further, alleging that “almost 8K BTC … related to the WEX/BTCE case are controlled by Russian authorities,” including “the 6.5K BTC that moved earlier today.” He attributed that control to a specific unit—“3rd department of the 2nd service of the CSS of the FSB”—and linked to a Russian-language investigative article.

Who Is Bilyuchenko?

In Russia, Bilyuchenko has faced a separate WEX-related criminal case that has already produced a conviction. On March 18, 2024, the Moscow City Court upheld an earlier guilty verdict against Alexey Bilyuchenko, described in local reporting as a system administrator of the WEX exchange.

Bilyuchenko was accused of embezzling 3.1 billion rubles in WEX assets; the Meshchansky District Court sentenced him in September 2023 to 3.5 years in prison and a 500,000-ruble fine, and the appeal court left that decision in place, bringing the verdict into legal force.

In the United States, the posture is different: prosecutors have unsealed charges. The case is still ongoing. In June 2023, the Department of Justice announced the unsealing of charges against Bilyuchenko and Aleksandr Verner in the Southern District of New York, accusing them of conspiring to launder approximately 647,000 bitcoin tied to the 2011 Mt. Gox hack. The SDNY indictment charges both men with conspiracy to commit money laundering, carrying a maximum potential penalty of 20 years in prison.

Separately, Bilyuchenko is charged in the Northern District of California with conspiracy to commit money laundering and operating an unlicensed money services business, tied to allegations that he worked with Alexander Vinnik and others to operate BTC-e from 2011 until it was shut down in July 2017. DOJ listed a maximum potential penalty of 25 years on those NDCA charges.

At press time, BTC traded at $87,756.