Bitcoin Mining Pressure Eases After First Difficulty Adjustment Of The Year

Bitcoin's network just caught its breath—and miners are breathing easier.

The Hash Rate Hurdle Drops

For the first time in 2026, the Bitcoin protocol has automatically dialed down the mining difficulty. That complex cryptographic puzzle miners race to solve? It just got a little less punishing. This isn't a policy change or a boardroom decision; it's the network's built-in stabilizer kicking in, responding to real-time conditions on the ground.

Why The Adjustment Matters

Think of it as the network's thermostat. When too many miners plug in, competition skyrockets, profits get squeezed, and the energy bill becomes a nightmare. This adjustment turns the heat down a notch. It means existing mining rigs can find blocks a bit faster without guzzling extra juice. Efficiency jumps. Margins, theoretically, get a lifeline. It's the protocol's way of saying, 'Okay, ease up, everyone.'

The Ripple Effect for Miners

This isn't just a technical tweak; it's an economic signal. Lower difficulty translates directly to lower operational costs for the miners securing the network. For publicly traded mining firms, it could mean the difference between a red and a black line on the next quarterly report—something Wall Street analysts will dissect with the usual mix of glee and dread. It temporarily pauses the relentless arms race for more hashing power, giving the industry a moment to recalibrate.

A Temporary Respite or a New Trend?

Don't break out the champagne just yet. Bitcoin's difficulty adjusts automatically every two weeks based on the total computational power dedicated to mining. This dip suggests some miners powered down—maybe due to seasonal energy prices, maybe due to older hardware finally becoming unprofitable. The next adjustment could just as easily hike the difficulty back up if the hash rate recovers. It's a constant, automated tug-of-war between competition and accessibility.

The Bigger Picture

This easing of pressure is a masterclass in decentralized protocol design. No central bank intervened; no emergency committee was formed. The code executed as written, self-correcting to keep block times steady and the network secure. In a traditional finance world obsessed with Fed meetings and rate decisions, Bitcoin just quietly rebalanced itself—offering a brief, cynical reminder that while traders watch charts, the real action is in the unstoppable, automated rules of the protocol. The mining game just got a tiny bit less brutal. For now.

First Adjustment Offers Brief Relief

Average block times across the network were running NEAR 9.88 minutes at the time of the change — a touch faster than Bitcoin’s target of 10 minutes — which helped produce the slight downshift in difficulty. That gap means the protocol briefly eased the hurdle miners face, because blocks were being produced a little quicker than expected.

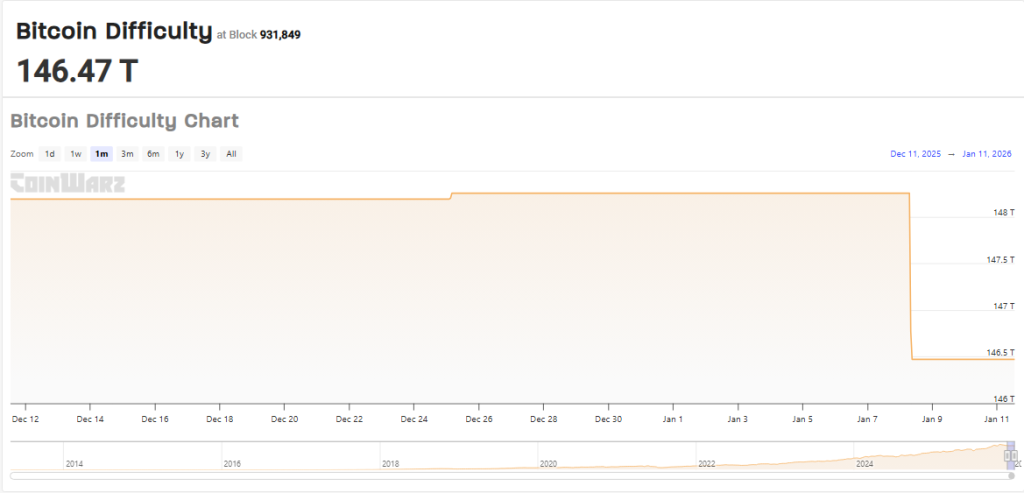

Reports have noted that, even with this dip, difficulty remains high compared with earlier years and miner margins are under pressure following the 2024 halving and heavy hardware investment in 2025. Some miners reported thinner returns as hash price softened and energy and equipment costs stayed elevated. The drop to 146.4T gives a short window of relief, not a turnaround.

Next Adjustment Expected On January 22

Based on CoinWarz estimates and other trackers, the next difficulty recalculation is projected for January 22, 2026, with a likely uptick toward 148 trillion as average block times slow back toward the 10-minute target. If that pattern holds, the pause in difficulty will be temporary and competition among miners may ramp up again.

Difficulty is the protocol’s built-in way of keeping block production steady: it changes every two weeks (2016 blocks) to match the total computing power securing the chain. When more hash power joins, difficulty rises; when it drops or blocks come too fast, difficulty ease. These adjustments affect how quickly miners find blocks and how much work they must perform to earn rewards.

Miners will be watching hash rate trends, power costs, and Bitcoin’s price because those factors determine profitability in the days after an adjustment. Markets, meanwhile, often take such technical tweaks in stride, but sustained moves in difficulty or hash power can signal broader shifts in miner behavior that may influence supply dynamics over time.

According to the latest coverage, January’s first adjustment cut difficulty to roughly 146.4T and came as block times averaged 9.88 minutes. Estimates point to a likely rise around January 22 to roughly 148.20T if conditions change as expected. Observers say the change offers temporary breathing room for miners but does not erase the financial pressures many faced through 2025.

Featured image from Unsplash, chart from TradingView