Yield Basis Unlocks Native BTC Yield - The Passive Income Revolution Arrives

Bitcoin just got a paycheck. Yield Basis cracks the code on native yield for the world's largest cryptocurrency, turning digital gold into a productive asset.

The Yield Conundrum Solved

For years, Bitcoin sat idle in wallets—a store of value, sure, but not an income generator. The ecosystem wrapped it, lent it, and staked derivatives of it. Yield Basis cuts through the complexity and goes straight to the source.

How It Works: No Wraps, No Middlemen

The protocol bypasses traditional intermediaries and synthetic asset creation. It taps directly into Bitcoin's native capabilities through a novel consensus-layer mechanism. Think of it as programmable yield built into the asset's core DNA—no third-party promises required.

Why This Changes Everything

This shifts the entire value proposition. Holders no longer face the false choice between security and returns. They secure the network and earn a yield—simultaneously. It turns passive HODLing into active, reward-generating participation.

The Finance World's Blind Spot

Traditional finance still views crypto as a speculative casino. Meanwhile, protocols like Yield Basis are building the foundational plumbing for a new financial system—one where the hardest asset finally pays its own rent. Try getting that from your bank's savings account.

The era of sterile Bitcoin is over. Yield is now native.

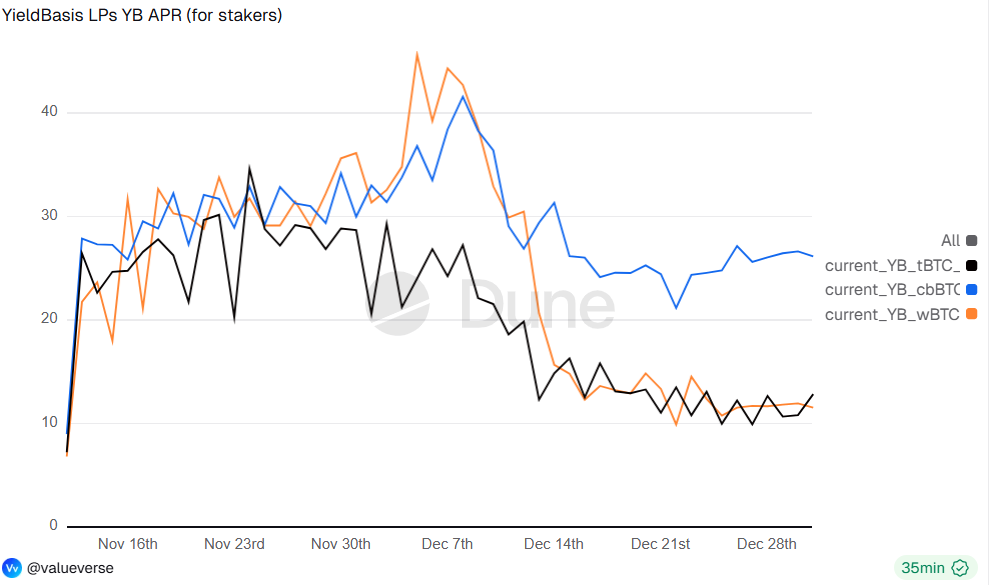

Moreover, this means that (wrapped) BTC token holders can now earn yield while supplying liquidity. Historically, the seven-day moving average for this (supply) yield has ranged between 4% and 40%.

And since many of us don’t LP into AMMs (unless we’re farming something), you might have forgotten that yields are earned in the pool tokens. So yes, that means native BTC yields.

As for the token itself, it’s not just a meme governance token — there’s actual value. The fee switch was turned on earlier this month. YieldBasis LPs have two options for generating yield from provided liquidity: (a) hold the ybBTC LP token and receive BTC-denominated trading fees, or (b) stake ybBTC, forgo BTC-denominated trading fees and participate in YB emissions.

Corporate Finance 201 agrees with me when I say, “Don’t buy back the token, give me the earnings from the protocol, and I can decide for myself if and when I want to buy the token.” What I mean is, dividends give optionality, especially when you can choose which type of yield to receive. For perspective, for the week ending Dec. 25, roughly $450,000 was distributed (and this figure is despite caps on the LP pools).

If you’ve read this and think there’s finally a way to earn native yield on BTC without IL and without the risks, effort and costs of hedging, then you’d be right — but there could be more. YB is positioned as more than just an IL-free AMM: It is a yield and liquidity infrastructure designed to make otherwise non-productive assets yield-bearing while establishing secondary markets. By targeting wrapped native assets and tokenized RWAs, YB can theoretically make any sufficiently liquid and volatile asset productive, allowing issuers to earn from liquidity rather than subsidize market making, while also enabling holders to access yield and downstream DeFi use cases such as collateralization.

This model extends beyond crypto majors like BTC and ETH to tokenized commodities and equities such as Gold, Silver, and NVDA, whose onchain adoption is currently constrained by IL, shallow liquidity, and the absence of yield or liquidation pathways. Yield Basis could unlock these markets by offering a unique, superior yield option with an attractive risk-reward profile, deep liquidity and strong network effects.

YB is not without risk. I encourage you to read the paper (or get AI to explain it) and understand the potential downsides, but also the potential unlocks that YB has to offer.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.