Ethereum (ETH) Price Prediction: ETH Smashes Through $4K Barrier as Wall Street Goes Crypto-Crazy - $5,700 Target in Sight

Ethereum just reclaimed its throne above $4,000 - and this time, the big money's leading the charge.

Institutional FOMO Fuels the Fire

Wall Street's finally waking up to what crypto natives knew years ago. Major funds are piling into ETH like there's no tomorrow, driving the price surge that's got every trader watching the charts.

The $5,700 Target: Pipe Dream or Inevitable?

Analysts point to the institutional buying spree as the catalyst that could propel Ethereum to unprecedented heights. The $5,700 target suddenly doesn't seem so crazy when BlackRock and Fidelity are building positions.

Market Mechanics Favor the Bulls

Supply dynamics, staking yields, and network activity all scream bullish. Even the traditional finance skeptics are quietly allocating - though they'll never admit it at their country club lunches.

Remember when your financial advisor said crypto was a scam? He's probably buying ETH through a Cayman Islands shell company right now.

Market watchers highlight that institutional activity and strong support levels are fueling renewed Optimism in the crypto space.

Ethereum Holds Critical Support Zone

The price of ethereum has been consolidating in the $3,800–$4,000 range, a zone identified as a strong weekly support. Crypto analyst EzyBitcoin noted on X that ETH is “moving exactly along the line I drew,” pointing out the overlap with the so-called Gray Cloud projection, a technical indicator signaling robust accumulation potential.

ETH consolidates at $3,800–$4,000 support, aligned with the Gray Cloud, as traders await a CrossX buy signal toward $5,700–$7,500. Source: @EzyBitcoin via X

“Staying above this support zone is crucial,” the analyst emphasized, adding that confirmation from a CrossX buy signal could signal a reversal toward $5,700–$7,500 targets. The current sideways movement aligns with historical Wyckoff re-accumulation patterns, which have often preceded major bull cycles in cryptocurrency markets.

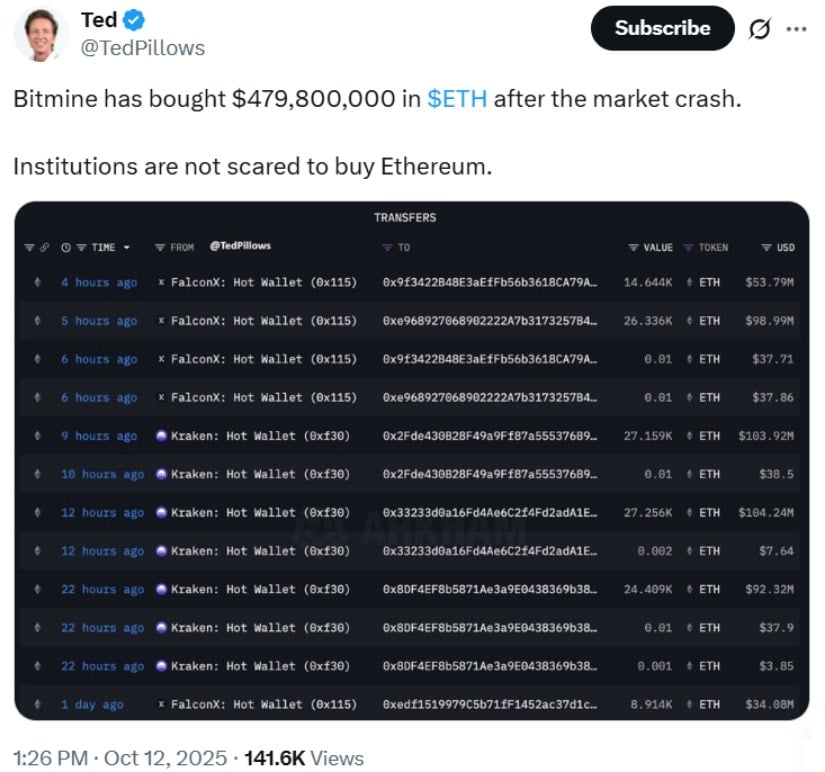

Institutional Buying Drives Confidence

Institutional involvement continues to bolster Ethereum’s outlook. Bitmine Immersion Technologies recently acquired approximately $480 million in ETH, expanding its holdings to 2.96 million tokens—worth over $12 billion. The acquisition, conducted through on-chain transfers from FalconX and Kraken wallets, marks one of the largest corporate Ethereum treasuries to date.

Bitmine scoops up $480M in ETH post-crash, showing institutions remain confident in Ethereum. Source: @TedPillows via X

Ted Pillows, reporting the move, highlighted that “institutions are not scared to buy Ethereum,” underlining the growing corporate adoption of ETH despite recent market volatility. While some market participants view institutional purchases as a bullish sign, others caution that corporations may capitalize on retail sell-offs to redistribute at higher prices, a pattern previously observed in 2022.

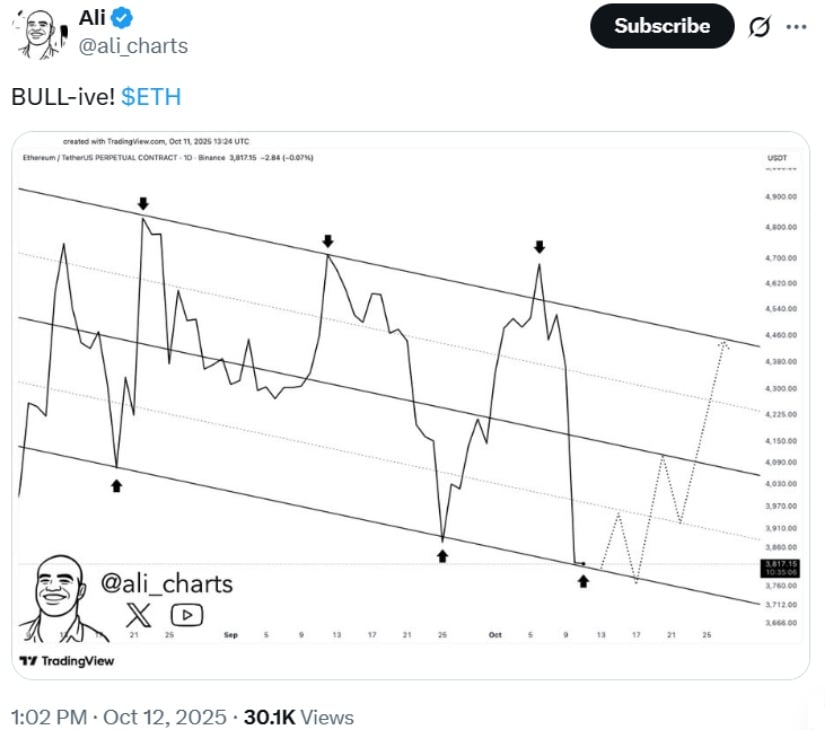

Technical Analysis and Market Trends

Ethereum’s technical charts indicate a descending resistance trendline from late August 2025 highs near $4,900 to October lows around $3,700. According to crypto analyst Ali_charts, recent bounces from the $3,800–$4,000 support range suggest a potential bullish reversal.

BULL-ive! ETH bounces from $3,800–$4,000 support, signaling a potential bullish reversal as institutional buying strengthens momentum. Source: @ali_charts via X

“BULL-ive!” the analyst tweeted, reflecting optimism amid consolidation and institutional accumulation. Peer-reviewed studies, however, caution that technical trading rules—such as trendline strategies—may underperform in highly volatile crypto markets. Institutional adoption, on the other hand, has been linked with reduced volatility and improved price stability.

Final Thoughts

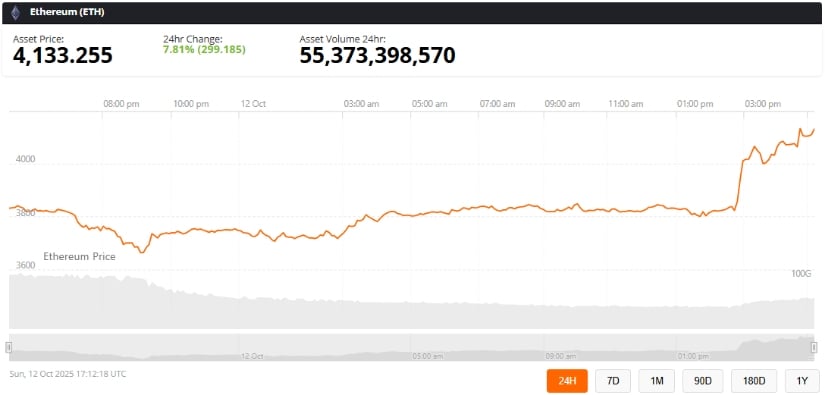

As Ethereum stabilizes above $4,000, analysts are closely watching for signals of a breakout. The combination of strong technical support, institutional accumulation, and potential market reversals points to a possible rally toward the $5,700 level in the NEAR term.

Ethereum (ETH) was trading at around $4,133, up 7.81% in the last 24 hours at press time. Source: ethereum price via Brave New Coin

Investors are advised to monitor ETH wallets, gas fees, and market trends closely, as fluctuations in network activity and institutional flows may influence price dynamics. With Ethereum’s continued adoption by corporate treasuries and steady market support, the cryptocurrency appears poised for renewed growth.