Bitcoin (BTC) Price Prediction: Golden Cross Retest Sparks Analyst Frenzy for Explosive $160K Rally

Bitcoin's technical setup flashes its most bullish signal in years as the king cryptocurrency retests the golden cross formation.

The Golden Cross Awakens

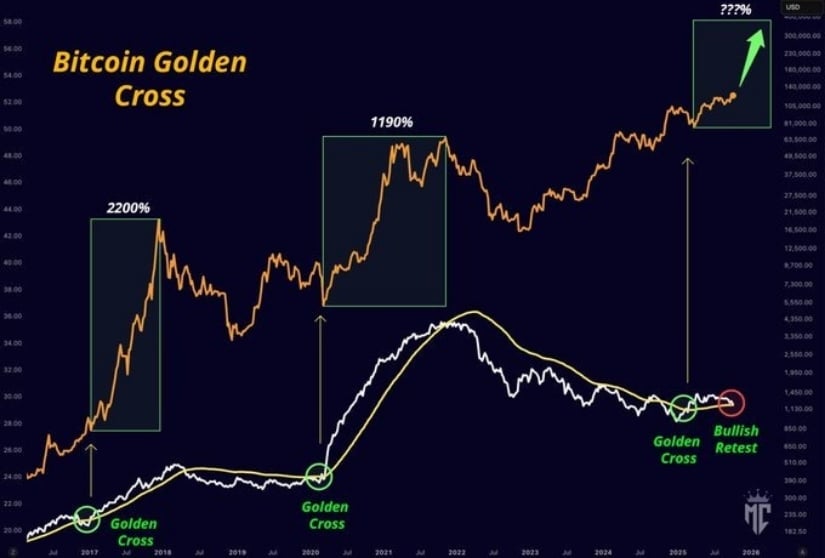

BTC completes its third golden cross retest this cycle—a technical pattern that historically precedes massive upward momentum. The 50-day moving average slices through the 200-day, creating the perfect storm for breakout conditions.

$160K Target in Play

Analysts point to the symmetrical triangle formation breaking to the upside, with the measured move projecting toward the $160,000 region. The last time these conditions aligned, Bitcoin delivered a 400% run in under six months.

Institutional FOMO Returns

Spot ETF volumes surge 40% week-over-week as traditional finance finally understands what crypto natives knew all along—though they'll probably still call it a bubble until their quarterly bonuses clear.

History suggests when Bitcoin's technical stars align like this, the only direction is up—and the charts agree.

Analysts suggest that holding above the crossover could confirm a major breakout, potentially pushing Bitcoin toward $160,000 as institutional inflows and bullish technical indicators align to reinforce long-term optimism.

Bitcoin Tests Key Technical Signal

Bitcoin (BTC) is once again at a crucial technical crossroads as it retests the golden cross—a bullish formation where the 50-day moving average crosses above the 200-day average. Historically, this signal has preceded major rallies in the bitcoin price, often marking the start of extended uptrends in previous cycles.

Bitcoin retests the golden cross—holding above could spark an explosive rally toward $160K. Source: @misterrcrypto via X

“The market is retesting the golden cross right now,” said crypto analyst Mister Crypto in a post on X. “If we can hold above, BTC price will absolutely explode.” He added that holding the crossover level could propel Bitcoin toward $160,000 by late October 2025, citing bullish MACD signals and strong ETF inflows as key catalysts.

Golden Cross Has a History of Power Moves

Historically, Bitcoin’s golden cross formations have been followed by sharp gains. Past occurrences triggered rallies of 1,190% to 2,200%, with short-term pullbacks often preceding the breakout. Analysts note that similar setups in 2019 and 2021 were initially met with mild corrections before Bitcoin surged to new all-time highs.

Bitcoin retests its 50-week SMA, reinforcing the golden cross setup and signaling potential for a major bullish continuation. Source: HexaTrades on TradingView

Technical strategist Cas Abbé observed that after each golden cross, Bitcoin tends to dip around 10% to 15% before resuming its uptrend. “The golden cross is often misunderstood—it’s not an immediate buy signal but a confirmation of trend strength,” Abbé said.

However, some traders remain cautious. FX_Professor, a market analyst on TradingView, cautioned that the golden cross “often lags price movement” and may serve as a trend confirmation rather than a leading indicator.

Altseason Rotation and Market Dynamics

The recent market downturn has affected both Bitcoin and altcoins, with Bitcoin’s price falling to $104,782. This suggests that the anticipated altseason may not materialize as expected, and market participants should exercise caution. Influencer Philanthrop recently announced on X that he sold his entire Bitcoin and ethereum holdings to focus on altcoins, referencing patterns observed in the 2017 and 2021 cycles.

The trader sells all BTC & ETH, betting on altcoins—predicting the right picks could make millionaires by the end of 2025. Source: @0xPhilanthrop via X

Data from 21Shares supports the correlation, showing that during past bull markets, large-cap altcoins outperformed Bitcoin by an average of 174%. However, reports from Cointelegraph suggest that altcoins remain far more volatile and heavily dependent on global monetary policy trends, meaning many fail to maintain long-term gains after short-lived rallies.

Macro Factors and Market Risks

While Bitcoin’s technical picture looks strong, several macro risks linger. Trade tensions between the U.S. and China, fluctuating interest rate expectations, and geopolitical instability could create short-term volatility.

Recent geopolitical events, such as the U.S.-China trade tensions, have introduced significant macroeconomic risks that could impact Bitcoin’s price more immediately than anticipated ETF outflows, especially if Bitcoin fails to sustain momentum above key support zones.

Looking Ahead: $160K Target Gains Credibility

Despite short-term risks, sentiment across major crypto analytics platforms remains broadly optimistic. Bitcoin’s long-term on-chain metrics and institutional accumulation patterns support the thesis of a renewed uptrend heading into 2025.

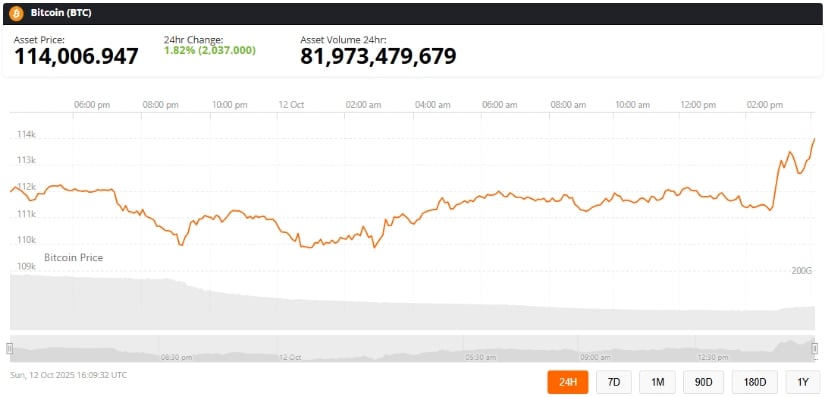

Bitcoin (BTC) was trading at around $114,006, up 1.82% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

If Bitcoin can maintain support above its golden cross and continue attracting ETF-driven inflows, analysts believe a MOVE toward $160,000 could materialize before the end of the year.

Still, as past cycles have shown, even powerful technical formations like the golden cross do not guarantee a smooth ride. Investors and traders are advised to monitor key indicators—including ETF inflows, RSI levels, and macro developments—to navigate the evolving Bitcoin market with precision.