XRP Plunges to $2.40 - But Exploding Trading Volume Hints at Major Accumulation Phase

XRP takes a sharp dive as sellers overwhelm the market, pushing prices down to $2.40 territory.

SURGING VOLUME TELLS A DIFFERENT STORY

While the price action looks bearish on the surface, trading volume is exploding through the roof. This classic divergence pattern often signals smart money accumulation - when institutional players quietly build positions while retail investors panic sell.

WHISPERS OF INSTITUTIONAL INTEREST

Massive volume spikes during price pullbacks typically indicate something bigger brewing behind the scenes. Either someone knows something the market doesn't, or we're witnessing the calm before the next major move. Because nothing says 'financial sophistication' like billion-dollar funds chasing the same volatility that terrifies Main Street investors.

The stage appears set for XRP's next major move - will this accumulation phase fuel the next leg up, or is this just another false dawn in crypto's endless cycle of hope and disappointment?

Market participants are closely watching the token, suggesting that recent activity could signal accumulation by larger holders ahead of the next major price move.

XRP Price Declines Amid Rising Trading Volume

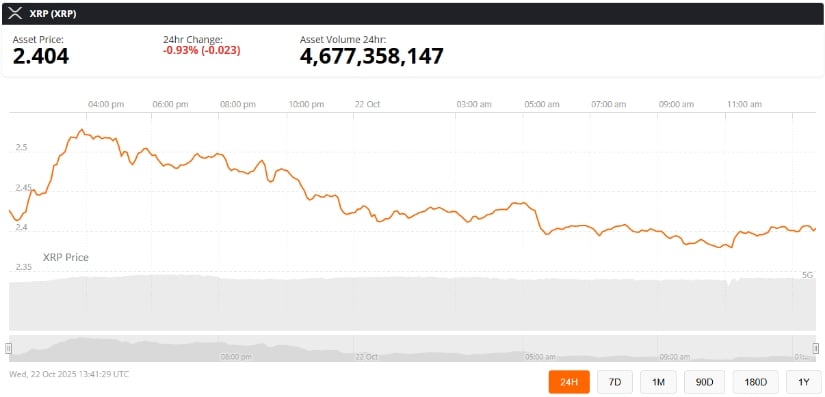

At the time of writing on Wednesday, XRP’s current price stands at $2.40, down from $2.44, marking a 0.93% drop over the last 24 hours. Daily trading volume, however, climbed around 6% to nearly $4.67 billion. This divergence between price decline and volume surge often points to profit-taking or strategic repositioning by traders ahead of a potential rebound.

XRP was trading at around $2.404, down 0.93% in the last 24 hours at press time. Source: xrp price via Brave New Coin

Over the past week, XRP has gained around 4%, with a market capitalization reaching approximately $144.1 billion, maintaining its position as a leading cryptocurrency in terms of overall market value. Analysts note that the interplay between falling prices and rising volume could indicate an ongoing shakeout phase, where weaker hands are exiting while institutional or long-term investors accumulate.

Technical Indicators Suggest Consolidation

From a technical standpoint, XRP has dipped below its 200-day exponential moving average (EMA), raising short-term bearish concerns. The RSI (Relative Strength Index) shows room for further upside, reflecting potential momentum if buyers step in. Analysts emphasize that a breakout above $2.50, accompanied by sustained volume, WOULD be a positive signal for a reversal from the current pullback.

XRPUSD is trading within a descending triangle, with bearish RSI divergence suggesting a potential 5% drop toward $2.08–$1.77, while a breakout above $2.82 could target $3.10. Source: BeInCrypto on TradingView

The XRP price today is also supported by multi-year trendlines, suggesting that the current dip may represent a buying opportunity rather than a prolonged downtrend. Historical fractals, including patterns observed during the 2017 bull run, indicate that periods of consolidation can precede significant upward moves in XRP’s long-term trajectory.

Chart Analysis: Eyes on Long-Term Targets

Recent chart analyses overlaying XRP’s price action on 2017 bull run fractals project a potential logarithmic breakout to $26 by late 2026, with intermediate targets at $8, $13, and $27. These projections use Fibonacci extensions and multi-year ascending support lines to anticipate future gains while considering historical parabolic moves.

ChartNerdTA projects XRP targets of $8, $13, and $27 using Fibonacci extensions based on 2017 bull run patterns extended through 2025–2029. Source: @ChartNerdTA via X

At $2.40, XRP sits above key monthly EMA support, indicating that the current pullback remains within healthy technical levels. Analysts suggest that the absence of overbought divergence on the RSI leaves room for further upward movement in line with historical patterns.

Final Thoughts

XRP’s current market behavior reflects a delicate balance between short-term selling pressure and long-term accumulation. Rising volume amidst a price dip often signals strategic buying by larger investors, suggesting that the cryptocurrency may be consolidating before a potential rebound.

Traders and investors are advised to monitor key levels around $2.40 and $2.50, alongside regulatory updates and whale activity, to gauge the next phase of XRP’s market trajectory. While short-term volatility persists, the underlying technical and on-chain trends point toward a potential accumulation phase, laying the groundwork for future growth.