Bitcoin Holds Strong Above $104K: Next Target $111K as Bulls Regroup

Bitcoin's price action defies gravity—again. After consolidating above $104K, the king of crypto eyes a decisive breakout toward the $111K recovery zone. Here's why traders aren't blinking.

The Setup: Stability Breeds Confidence

No wild swings, no panic—just steady accumulation. That $104K floor? Now a springboard for the next leg up.

The Target: $111K or Bust

Technical charts whisper what hodlers already know: every dip gets bought. The path to six figures? Cleared of weak hands and paper profits.

The Punchline: Wall Street Still Doesn't Get It

While traditional finance debates 'store of value,' Bitcoin's quietly doing what it always does—making early believers rich and bankers nervous. Tick-tock, next block.

After a brief pullback from $106,000, Bitcoin’s price action highlights strong technical support and growing interest from long-term holders. Analysts emphasize that sustaining this level is critical for confirming bullish momentum in the coming days.

BTC Price Stabilizes Amid Short-Term Pullback

Bitcoin (BTC) recently experienced a modest pullback from $106,000 to $104,500, according to a 15-minute BTC/USD chart shared by analyst CryptoBheem. The chart highlights an upward trendline suggesting a potential resumption of bullish momentum.

BTC pulls back from $106K to $104.5 with a bullish trendline; intraday closes at $106,033 on a 4% surge amid U.S. shutdown optimism. Source: Ahmed via X

“Signs point toward a higher move, but confirmation is still pending,” CryptoBheem noted in response to market queries. Bitcoin’s intraday close at $106,033 reflects a 4% gain amid growing Optimism for a rebound, bolstered by market expectations surrounding the anticipated U.S. government shutdown resolution.

With BTC trading at $106,050, the short-term outlook suggests a delicate balance between support levels and potential upside targets, making it crucial for traders to watch intraday movements closely.

Key Support Levels and Holder Dynamics

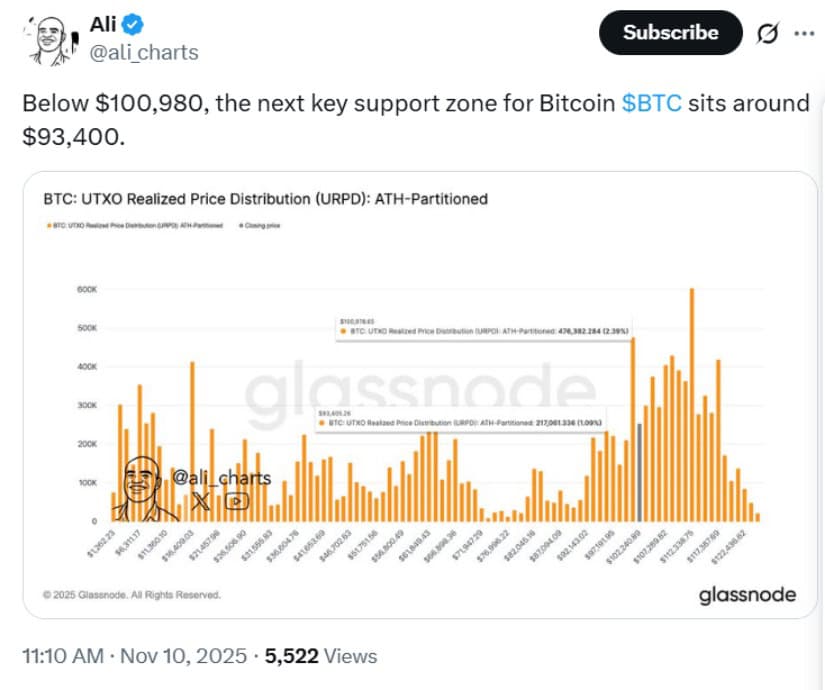

On-chain data from Glassnode provides further insight into Bitcoin’s current technical position. According to analyst Ali Charts, the next major support zone sits at $93,400, just below the $100,980 cluster, which contains 2.9% of Bitcoin’s supply.

Bitcoin’s next key support below $100,980 is around $93,400. Source: Ali Martinez via X

Historically, these UTXO clusters of long-term holder cost bases act as significant buying interest zones when prices approach their respective break-even points. For example, if the $104,000 support holds, it WOULD help investors feel confident. If this support fails to hold, then the BTC would be exposed to downward moves toward $93,400, just as in discussions that continue to trend on liquidity resets and order blocks between $96,000 and $111,000:

Market Context: Altcoin Rotation and Bitcoin Dominance

Analysts suggest broader market dynamics could influence BTC’s short-term trajectory. Bitcoin Dominance (BTC.D), currently around 59.94%, has shown bearish signals, potentially indicating capital rotation toward altcoins.

Matthew Hyland, a market analyst, commented, “The BTC dominance has looked bearish for weeks, and this relief rally could be a temporary bounce in a larger downtrend.” Similarly, Michaël van de Poppe compared current conditions to late 2019 and early 2020 cycles, highlighting parallels where bitcoin Dominance briefly recovered before a secondary drop.

A bearish head-and-shoulders formation on the BTC.D chart also suggests a potential decrease in Bitcoin’s share of the market, which could shift liquidity toward altcoins in the NEAR term.

Bitcoin Price Forecast: Eyes on $111K Resistance

Despite these short-term fluctuations, Bitcoin is still in a position to resume its upward trend. According to technical analysts, a retest of higher levels near $111,000 is possible if $104,000 support remains intact.

Early indicators remain promising, though confirmation from technical patterns is still needed before a clear bullish reversal can be established. Strong support levels, along with on-chain insights and macroeconomic factors such as U.S. liquidity events, could drive Bitcoin toward its near-term target around $111,000.

Final Thoughts

Bitcoin remains above the critical support of $104,000 as it approaches the break-even levels that reflect long-term holder sentiment.

Bitcoin was trading at around 106,051.59, up 4.08% in the last 24 hours at press time. Source: Brave New Coin

Traders are closely monitoring the $111,000 resistance zone, which may serve as a key target if bullish momentum resumes. Cautious optimism abounds on both on-chain data and from a technical perspective; however, confirmation from price action has to be seen before any decisive moves.