Sei Price Bounces Off Critical Support – Is This the Launchpad for the Next Crypto Bull Run?

Sei’s price action just flashed a bullish signal that has traders buzzing. After testing a key support level, the token staged a sharp rebound—fueling speculation that the next leg up is just getting started.

The Setup: Why This Reversal Matters

Markets don’t scream ‘accumulation phase’ louder than this. The bounce wasn’t just technical—it was a psychological win, shaking out weak hands while smart money piled in. No fancy indicators needed; price carved its own narrative.

The Bigger Picture: Cycles Don’t Lie

History rhymes, especially in crypto. If this support holds, the 2025 rally could mirror 2023’s explosive moves. Traders are already positioning for a potential liquidity grab—because nothing pumps bags like FOMO and leverage (ask your local degen).

Bottom Line: Confirmation or Trap?

Watch the follow-through. A close above resistance turns this bounce into a breakout. Fail? Well, even ‘institutional-grade’ projects aren’t immune to crypto’s favorite pastime—liquidating overleveraged longs. Stay sharp.

Sei shows renewed bullish momentum as analysts iWantCoinNews and RedDog highlight a long-term accumulation breakout and bullish divergence NEAR $0.15.

The Altcoin Establishes Accumulation Zone Near $0.10–$0.12

Sei Network’s native token has displayed a steady recovery after forming a long-term accumulation base around the $0.10–$0.12 zone. This region, visible on the daily chart, has acted as a consistent area of buyer activity since early 2024.

The zone has served as a launching point for renewed upward momentum each time the token revisited this price range. Analysts note that its repeated respect for this support suggests an established foundation that continues to attract long-term investors.

According to data from Binance, SEI’s structure shows multiple accumulation phases followed by rising higher lows, pointing to sustained market confidence. The chart shared by analyst iWantCoinNews illustrates this pattern as part of what he described as “The Path to Retirement.” The setup indicates that the recent price behavior could mirror the early stages of previous bullish cycles in other layer-one blockchain tokens.

Market Activity Reflects Strengthening Price Momentum

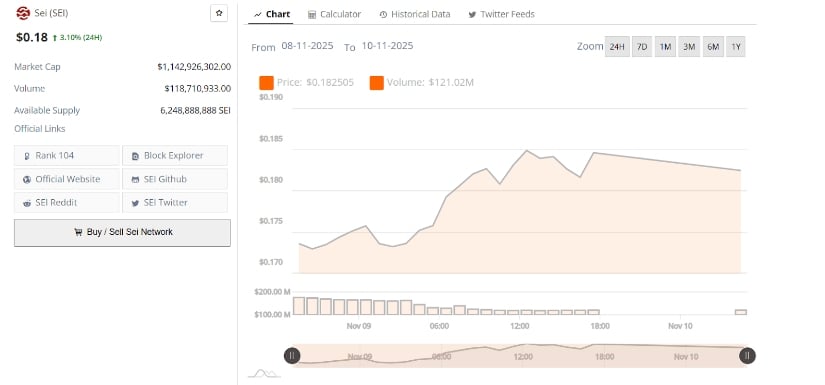

In the past 24 hours, the asset recorded a gain of approximately 3.10%, trading near $0.18. The token’s market capitalization stands at around $1.14 billion, with trading volume over $118 million. These figures show growing market activity and steady liquidity across exchanges.

SEIUSD 24-Hr Chart | Source: BraveNewCoin

During the period between November 8 and 10, the top altcoin price climbed from $0.171 to $0.186 amid volume levels surpassing $121 million. This movement indicates that investor activity has increased within the current trading range.

The rise in trading volume coincided with stronger buy-side participation, suggesting that investors may be accumulating within the $0.17–$0.18 area. The support in this range has become a short-term base, helping stabilize price movement as market participants position for potential continuation above the $0.19 resistance zone. While the gains remain moderate, its ability to maintain this upward trajectory reinforces its recovery momentum following weeks of consolidation.

Analysts Observe Technical Structure Supporting Bullish Reversal

Market analyst RedDog shared an outlook indicating a developing reversal structure on the altcoin daily chart. The token recently rebounded from the $0.15 support after forming a bullish divergence with the Relative Strength Index (RSI).

Source:x

This signal typically suggests weakening selling pressure even as prices record lower lows. Alongside the divergence, an increase in trading volume supports the view of renewed accumulation.

At the time of the analysis, the crypto traded near $0.183, just below the short-term resistance at $0.20. RedDog’s technical projection suggests that clearing this resistance could open a move toward $0.286, aligning with the descending trendline and the 200-day moving average. A further advance toward $0.39 would confirm a “Break of Structure,” indicating the beginning of a new bullish phase. The RSI level near 43.7 shows improving momentum from oversold territory, consistent with recovery signals observed on other indicators.

Short-Term Price Levels Define Next Directional Move

The current chart structure shows the altcoin consolidating above $0.175, suggesting that the token is stabilizing before a possible upward continuation. Maintaining this level could help build the base required to retest the $0.19 and $0.20 resistance areas. A confirmed breakout above $0.20 WOULD signal the potential start of a broader uptrend, supported by renewed demand from traders and investors.

However, a drop below $0.17 may result in temporary corrections as the market tests lower support areas before resuming its upward path. For now, the rebound from $0.15–$0.17 support zone indicates that the token is in an early-stage recovery cycle. With trading volume remaining healthy and momentum improving, the Network’s price action suggests a foundation for continued growth if current support levels hold.