XRP Defies Bears: Holds Critical $2 Support as Bulls Target All-Time High Breakout

XRP traders are holding their breath as the digital asset battles bearish pressure while maintaining its crucial $2 foundation.

The Support Standoff

Despite market headwinds, XRP's $2 support zone remains intact—proving more resilient than most traditional finance investments during volatility. The level has become a psychological battleground between bulls and bears, with neither side willing to concede ground.

Bullish Ambitions

Traders are eyeing a return to all-time highs as accumulation patterns emerge. The current consolidation suggests either a massive breakout or breakdown awaits—typical crypto drama that keeps Wall Street analysts scrambling for explanations.

Market Mechanics

Active buying pressure continues to defend the $2 threshold while short positions accumulate overhead. This creates a coiled-spring scenario where resolution could trigger significant momentum in either direction.

Meanwhile, traditional finance continues to debate whether digital assets belong in portfolios—right after missing another generational wealth transfer opportunity.

Analysts and traders are watching whether XRP coin can defend $2, with movements potentially signaling a rebound toward its XRP all-time high.

XRP Maintains Critical Support at $2

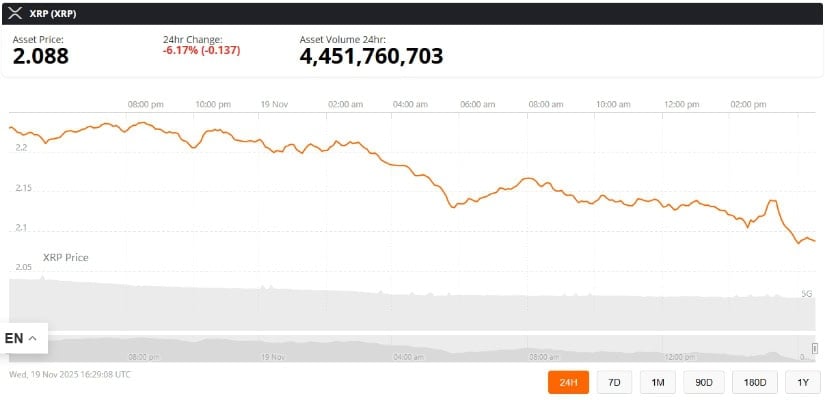

XRP (XRP) is trading at $2.09 as of November 19, 2025, down 6.17% over the past 24 hours, with a daily trading volume exceeding $4.45 billion. The token remains NEAR a pivotal support zone between $2.05 and $2.15, often referred to by traders as a “line in the sand” due to its role in historically preventing deeper declines. According to ChartNerd (@ChartNerdTA), “$XRP: $2 support awaits below… Hold it, we rocket back to ATHs. Limbo now until a decision is made.”

XRP hovers at $2 support, with $1.90 as the next key POC; holding it could spark a rebound toward all-time highs. Source: @ChartNerdTA via X

This range is significant because it has acted as a Point of Control (POC) in volume profile analysis over the last 11 months, meaning it historically represents the price level where the highest trading activity occurred. Traders often monitor such zones to gauge short-term buying interest and potential reversals.

Technical Structure and Key Levels

XRP is currently contained within a descending channel, according to TradingView analyst Quant_Trading_Pro. He notes, “Price is drifting lower within the channel, but volatility is contracting, indicating that sellers are losing strength while buyers are selectively accumulating at the bottom boundary.”

XRP tests a key support zone with buyers fatigued; a rebound could target the FVG, while a breakdown may draw price toward lower liquidity levels. Source: Quant_Trading_Pro on TradingView

Resistance overhead remains at $2.30–$2.45, limiting near-term upside. A confirmed breach below the $2 support zone could expose the next meaningful floor near $1.90, a level that previously triggered aggressive buying reactions.

Why it matters: Contraction in volatility often signals indecision, giving traders insight into whether buyers or sellers may dominate the next move. Historical data show that XRP often experiences short-term rebounds near major POCs, though this is scenario-based and not a guaranteed outcome.

On-Chain Metrics and Market Sentiment

Recent on-chain metrics provide further insight into market behavior:

-

Funding rates: Aggregated futures data from major derivatives exchanges show a sharp uptick in leveraged long positions near $2. Historically, similar spikes can precede short-term volatility rather than a guaranteed rebound.

-

Wallet losses: Data from Glassnode indicate that about 42% of XRP wallets are currently holding losses up to 40%, reflecting pressure on recent buyers and potential for liquidation if support fails.

-

Exchange reserves: XRP accumulation off exchanges suggests long-term holders are retaining positions, reducing immediate sell pressure.

These metrics show that XRP’s trajectory will heavily depend on the ability to defend the $2 support while traders weigh both technical and behavioral signals.

Scenario-Based Outlook: Recovery vs. Breakdown

If the $2 zone holds, XRP could attempt to retest $2.30 resistance, with further upside contingent on sustained buying and channel breakout confirmation.

The U.S. Treasury buys back $3.4B in debt, a move seen as bullish for crypto markets and XRP. Source: @Steph_iscrypto via X

Conversely, a breakdown below $2 could trigger a sharper correction toward $1.90, and in extreme conditions, toward $1.25. It’s important to note that these projections are conditional scenarios based on technical structures and past price behavior, not definitive price forecasts.

Final Thoughts

XRP sits at a critical juncture, with the $2 support zone determining whether near-term buyers or sellers dominate the market. Holding this level preserves the potential for a technical recovery toward prior highs, while a failure could trigger deeper losses.

Traders and investors should monitor support and resistance closely, integrating both technical and on-chain signals for informed decisions.