Bitcoin Defies Gravity at $90,000: The Altcoin Domino Effect Begins

Bitcoin's fortress holds at ninety grand—now watch the rest of the crypto castle tremble.

The King's Unshakable Throne

Forget dips and corrections. The flagship cryptocurrency isn't just holding; it's setting a new high-water mark that's redrawing the map for every digital asset in its wake. This isn't stability—it's a statement.

Altcoins: Riding the Wave or Drowning in the Wake?

When Bitcoin moves, the entire market holds its breath. A sustained price at this level acts like a rising tide, but it's a selective one. Liquidity gets pulled, investor attention narrows, and capital starts playing musical chairs. Some altcoins will surf this wave to new heights, while others get left gasping on the shore—their narratives suddenly looking very thin.

The Liquidity Ladder

Money flows where it's treated best, and right now, Bitcoin is the five-star resort. Major players and institutional funds anchoring themselves here creates a gravitational pull. The real test begins for mid and small-cap tokens: prove your utility fast, or watch your trading volume evaporate to feed the king. It's the ultimate market efficiency test—or as traditional finance folks might call it, Monday.

Narrative is Currency

In a market hypnotized by a $90,000 BTC, an altcoin's story needs to be bulletproof. Projects with clear use-cases, robust ecosystems, and real-world adoption will separate from the pack of 'vaporware with a whitepaper.' The hype cycle gets a brutal reality check when cold, hard Bitcoin dominance is the backdrop.

So, buckle up. Bitcoin's stand isn't an endpoint—it's the starting gun. The coming weeks will reveal which altcoins built something real and which were just building castles in the air, funded by cheap money and cheaper promises. The tide is high, but it only lifts the boats that aren't full of holes.

Avalanche (AVAX)

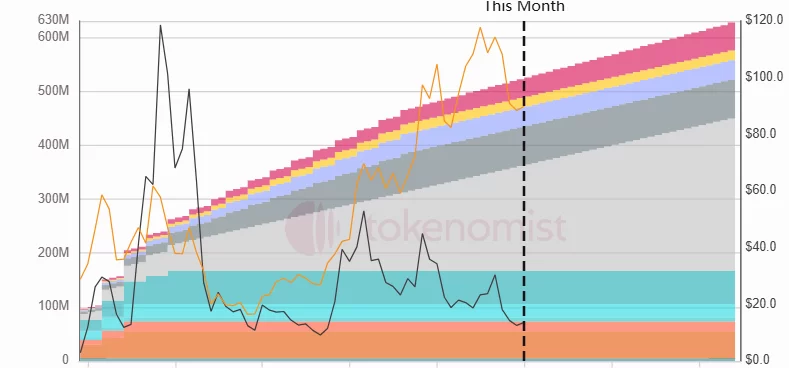

The surge in altcoins was led by AVAX, a rare occurrence that began yesterday. Robust performance from fundamental layer-1 solutions is anticipated in 2026. For AVAX, 2025 represented bear market conditions, but its performance is expected to improve in 2026. Notably, the token‘s unlock rate has slowed in the new year, transitioning to a more balanced supply growth compared to the rapid expansion between 2022 and 2025, with nearly 75% of the supply already in circulation.

The rapid surge yesterday returned prices to their December 11 levels, with the possibility of testing $14.75 again over the weekend. If the rise continues, the $15.94 level is targeted as the next support, while $13 serves as a critical level in the event of a pullback.

XRP Coin and LINK Coin

XRP Coin, after a series of lower lows and horizontal movements, is finally poised to return to $2. Reclaiming $1.98 as support before the weekend reflects an ambition to advance to $2.08, with $2.28 anticipated as a potential peak during aggressive gains.

XRP ETF inflows have exceeded $1.24 billion, with steady inflows persisting. Should today’s surge pave the way for an entry record through the ETF channel, XRP prices could ascend more swiftly over the weekend.

While LINK Coin has observed favorable ETF inflows, interest has waned considerably. Today’s ETF inflows might accelerate due to a 6% price surge. Upon maintaining the $12 floor, LINK Coin enthusiasts are targeting $13.6, with ambitions to exceed this threshold and venture toward the $14.8 resistance level over the weekend.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.