Crypto Markets on Edge: Key Developments Set to Unleash Major Volatility

Brace for impact. The digital asset landscape is primed for a seismic shift as multiple catalysts converge—regulatory whispers, protocol upgrades, and institutional maneuvers are all flashing warning signs for turbulent price action ahead.

The Perfect Storm

Forget sideways trading. Analysts point to a cocktail of pending decisions from global watchdogs and critical network forks as the primary volatility drivers. Market makers are already adjusting their books, anticipating whipsaw movements that could liquidate over-leveraged positions in minutes. It’s the kind of environment where fortunes are made and lost before your morning coffee gets cold.

Institutional Chess Moves

Meanwhile, the so-called ‘smart money’ isn’t sitting idle. Hedge funds and corporate treasuries are quietly building strategic hedges, using derivatives to bet on—or protect against—the coming storm. Their activity often serves as a leading indicator, a fact retail traders typically realize about three days too late, just in time for the classic ‘buy high, sell low’ ritual.

Technical Fault Lines

On-chain metrics reveal mounting pressure. Exchange reserves are draining, signaling a potential supply squeeze, while funding rates across major perpetual swap markets are turning erratic. The technical setup suggests a breakout is imminent; the only question is direction. History shows these compression phases rarely resolve calmly.

Navigating the Chaos

Seasoned traders are doubling down on risk management—tightening stop-losses and diversifying across asset classes. The coming weeks will separate the disciplined from the reckless. In crypto, volatility isn't just a market feature; it's the entire point. Just remember, the finance sector’s definition of ‘innovation’ is often just old speculation in a new digital wrapper.

Analyzing Bitcoin’s Prospects

As the dominant force in the cryptocurrency market, Bitcoin’s movements often dictate the direction of other digital currencies. Some analysts predict that Bitcoin’s price needs to surge past six-figure levels to reinvigorate investor interest in altcoins for 2026. Despite starting the year strong, Bitcoin currently faces fluctuating dynamics, rekindling discussions about its volatile nature in response to unfolding events.

The fluctuating conditions were highlighted by Altcoin Sherpa, who shared a graphic underlining the expectation of continued volatility until a definitive market breakout occurs. This period of consolidation offers prospects for short-term investors at resistance points, potentially signaling upcoming gains if major resistances are surpassed.

USDT‘s market dominance is showing signs of retreating from its resistance level. Analyst Mister Crypto, observing indicators like the Stochastic RSI, suggests that a relief rally might be on the horizon, offering potential short-term Optimism in the market.

In contrast, analyst Poppe highlights the severity of Bitcoin’s recent MACD collapse, paralleling it with historic downturns such as the Luna collapse and previous bear markets, urging caution while underscoring that significant opportunities often arise during such downturns.

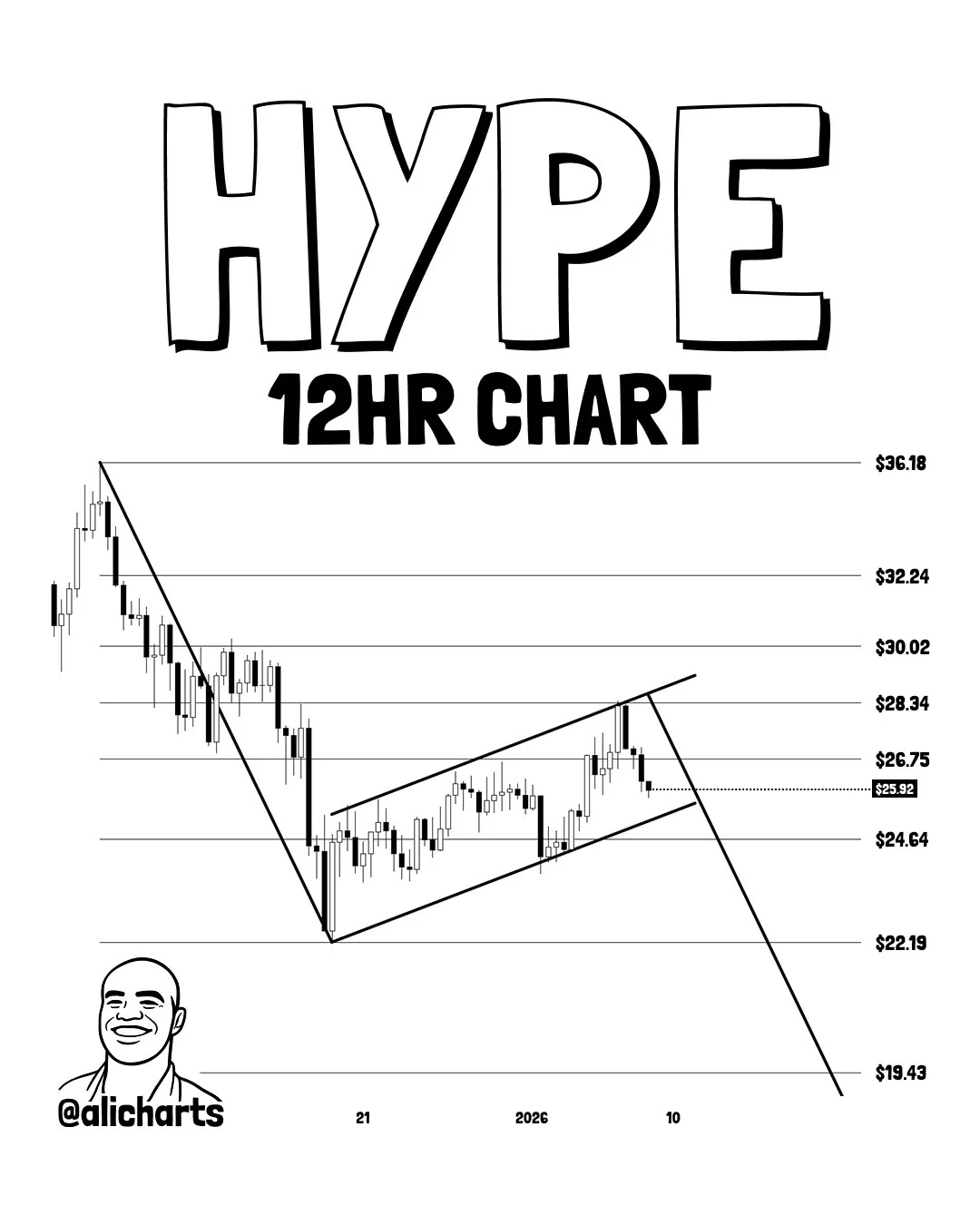

Navigating HYPE Coin’s Trajectory

As another focal point of market speculation, HYPE Coin’s outlook has incited substantial debate. Analyst Martinez marks a potential support target at $19 on the 12-hour chart, representing a conceivable entry point for long-term investors. However, it’s important to note the increasing inflationary trends within HYPE Coin, which may influence its future valuation.

Despite these uncertainties, HYPE Coin remains financially promising if it can avoid the fate of similar assets. Its substantial income streams could mitigate some risks, offering a robust buffer against market shifts if managed effectively.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.