Crypto Experts Brace for Market Volatility: What’s Next for Digital Assets?

Hold onto your wallets—crypto's rollercoaster is gearing up for another wild ride.

Market analysts are flashing warning signs, pointing to a perfect storm of regulatory uncertainty, macroeconomic headwinds, and classic crypto sentiment swings. The usual suspects—Bitcoin and Ethereum—are expected to lead the charge, dragging altcoins along for better or worse.

Why the turbulence now?

Institutional money is getting twitchy. After a period of relative calm, traditional finance players are re-evaluating their crypto exposure. Combine that with the ever-present specter of regulatory crackdowns—because nothing says 'stable market' like a surprise announcement from a three-letter agency—and you've got a recipe for volatility.

The technical picture isn't much prettier.

Key support levels are being tested across major charts. Trading volumes are spiking in the derivatives market, a classic tell that big moves are brewing. It's the kind of environment where fortunes are made and lost before your morning coffee gets cold.

But here's the twist for long-term bulls.

This isn't 2022. The ecosystem is more resilient, with real-world adoption acting as a shock absorber. Major protocols aren't just surviving—they're building through the noise. Volatility isn't a bug in crypto; it's a feature that separates diamond hands from the tourists.

So, is this the big crash or just another dip?

Smart money watches the charts but bets on the technology. The underlying blockchain revolution hasn't slowed—if anything, it's accelerating behind the scenes while traders panic over daily candles. Just remember: in crypto, 'expert predictions' are about as reliable as a meme coin's whitepaper. The real signal always comes from the code, not the commentary.

Bitcoin Projections

BTC hovers around the $90,000 mark while investors await signals either for uncertainty to continue or for its resolution, following the already priced tariff decision. A negative verdict might trigger rapid movements in both directions. According to Altcoin Sherpa, the fluctuating trend will remain painful until $94,000 is surpassed.

The White House suggests implementing alternative measures immediately if tariff cancellations occur. Despite uncertainty about these backup plans, their potential to balance the situation is critical. A rapid response is anticipated once the decision is made. Sherpa advises maintaining short-term Optimism for BTC, as 4-hour EMAs remain healthy.

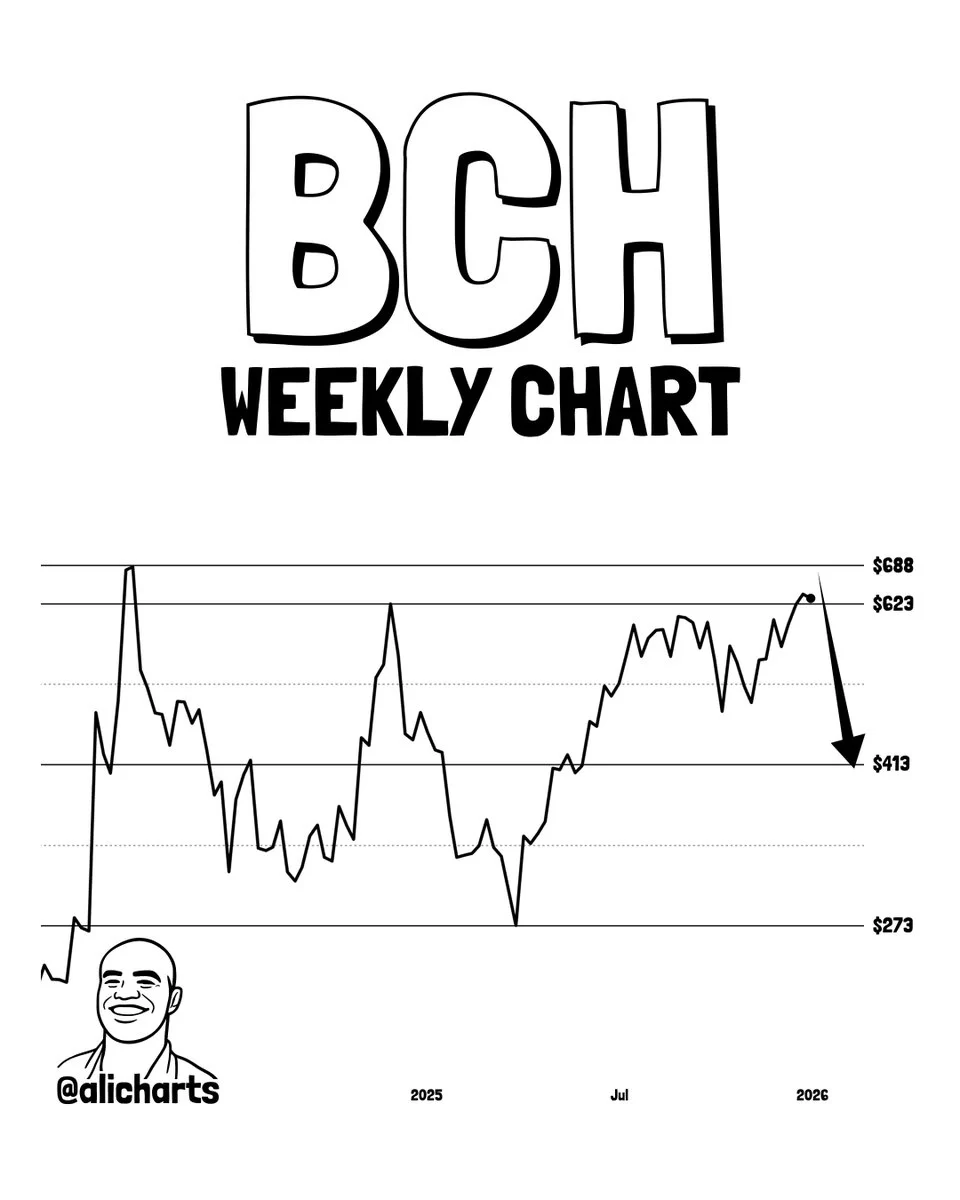

Bitcoin Cash (BCH) Outlook

Focusing on altcoins, Ali Martinez shares a setup for BCH amidst potential volatility. If tariffs are revoked, a strong uncertainty may lead Martinez to predict a rapid BCH drop to $413, targeting a dip at $273.

In a contrary scenario, with fears already priced in and if TRUMP chooses a non-escalation policy, BCH could break upwards to $623-$688, aiming ultimately for a four-figure valuation.

Though Treasury officials and the WHITE House mention contingency measures for a potential adverse decision, formidable players like China might turn these developments to their advantage. Should China impose fresh export restrictions on rare earth elements following tariff nullifications, tensions are likely to rise.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.