Liquidity Surge, Institutional Floodgates, and Regulatory Tailwinds Ignite Santa Rally 2025

The crypto market isn't just hoping for a holiday miracle—it's engineering one. A powerful trifecta of forces is converging to fuel what analysts are calling the most significant Santa Rally in years.

The Liquidity Engine Revs Up

Market depth is returning with a vengeance. Major exchanges report order books thickening, slashing slippage and creating a stable platform for the next leg up. This isn't just retail FOMO; it's the sound of high-frequency trading algos and deep-pocketed funds finding their footing.

Institutions Aren't Knocking—They're Kicking the Door Down

Access is everything. The launch of new, regulated investment vehicles—think spot ETFs for major altcoins and compliant staking products—has torn down the last barriers for traditional capital. Pension funds and asset managers, once sidelined, now have a clear on-ramp. They're not dipping a toe; they're diving in headfirst.

Regulation: From Headwind to Catalyst

Clarity breeds confidence. Key jurisdictions, from the EU with MiCA to Singapore's refined FSA guidelines, are moving from hostile ambiguity to structured frameworks. This shift tells Wall Street one thing: the asset class is maturing, not disappearing. It’s the kind of boring, procedural news that makes risk committees actually say ‘yes’—a Christmas gift wrapped in legal parchment.

The result? A rally built on steel rather than speculation. While the usual suspects will credit ‘market cycles’ or ‘technical breakouts,’ the real story is simpler: the infrastructure finally caught up with the ambition. Just in time for the holidays—and just in time for the annual bonus pool to seek outsized returns, as finance’s herd mentality finds a new pasture.

U.S. Liquidity Turns Friendly Again – and That’s Good for Risk Assets

The biggest boost for the Santa rally this month comes from the United States.

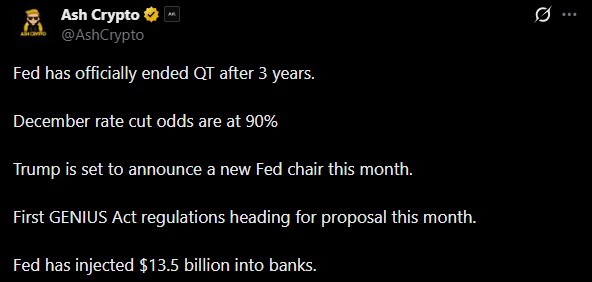

On December 1, 2025, the Federal Reserve (Fed) officially ended its long-running(QT) program, halting the reduction of its balance sheet. That MOVE freed up roughlyin liquidity, easing one of the largest drains on global market cash in recent years.

At the same time, markets are widely pricing in a rate cut – with aboutof a Fed rate reduction in mid-December. Lower rates and restored liquidity typically benefits Bitcoin, Ethereum, and altcoins.

For risk-asset investors, that’s an encouraging backdrop: less pressure on liquidity, lower borrowing costs, and renewed appetite for high-reward assets like digital tokens.

Adding to the momentum the country’s president, a pro-crypto supporter, is set to announce aearly 2026. Any shift in leadership brings fresh expectations for interest rates and financial policy – both heavily linked to crypto market performance.

Institutional Developments: ETFs, Taxes & Big Money

One of the biggest institutional signals for Santa Rally this December 2025 came from a traditionally cautious corner: Vanguard. As of December 2, Vanguard – managing roughly US$ 11 trillion, reversed its long crypto-averse stance, allowing clients to buyand(e.g., those tracking Bitcoin, Ethereum, and other major assets).

This move dramatically widens the investor base for cryptocurrency, lettingof Vanguard clients easier access digital-asset funds under a familiar regulatory framework.

Meanwhile, market fear tied to Strategy – Largest Bitcoin Holding Institution, selling pressure ended after the company confirmed a strong, easing concerns of forced liquidations.

These developments come against a backdrop of regulatory clarity improving in multiple jurisdictions – lowering institutional risk thresholds and opening the door to larger capital inflows.

Regulations on Track, Crypto Taxes on Ease: Santa Rally Stimulating

The most breakthrough digital coins act of the world’s largest economy (USA) – , is expected to present its first regulation proposals this month, offering more clarity for digital assets and crypto services.

In parallel, Japan also appears ready to overhaul itsand, and that’s being viewed as a major bullish signal for the 2025 Santa Rally. The government is reportedly preparing legislation under which the crypto asset tax rate will be fixed at 20%, much lower than the top rate of up to 55%.

Alongside the tax reform, Japan has approved a hugestimulus package, which boosts economic liquidity and indirectly supports inflows to speculative and growth assets.

Given that Japanese investors already hold tens of billions in crypto, with holdings surging in recent months, easier taxation and clearer regulation could reignite domestic demand and liquidity in Asian markets.

Only Threat to Santa Rally: The Bank of Japan Rate Decision

Despite the bullish setup, the biggest risk to the santa rally is policy from the Bank of Japan. A BoJ interest-rate hike is expected in its December 18–19 meeting, with a majority of economists forecasting a rise from.

A rate hike, and possible further tightening, could unravel global ‘yen-carry’ trades, draining liquidity in risk assets. Crypto, which often benefits from carry-trade flows, could face sharp sell-offs, like in August 2024, when bitcoin and altcoins fell after Japan’s monetary tightening pressured global markets.

For now, the upside face looks more potential with easing liquidity, institutional access, regulatory clarity, and renewed investor appetite. For bulls, the next few weeks could be promising. But with the BoJ’s December policy meeting looming, volatility remains a live threat.