Fed Forced to Slash Rates as US Jobs Plummet & National Debt Soars

The Federal Reserve is cornered. With employment numbers tumbling and the national debt ballooning, policymakers face a stark reality: cutting interest rates isn't a choice—it's an imperative.

The Jobs Dilemma

A cooling labor market strips the Fed of its hawkish armor. When payrolls shrink, the central bank's primary tool for fighting inflation becomes a liability, threatening to stall the entire economic engine.

The Debt Trap

Servicing the towering national debt gets brutally expensive with high rates. Each uptick adds billions to the government's interest bill—a fiscal time bomb that makes maintaining a restrictive policy politically and economically untenable. It's the ultimate 'kick the can' finance strategy, where tomorrow's crisis always justifies today's easy money.

This pivot from inflation-fighter to stability-guardian signals a profound shift. The era of tough talk is over. The era of managed decline has begun. Get ready for cheaper money, whether the textbooks like it or not.

Are Fed Rate Cuts Coming?

The latest economic data has revived strong expectations that the Federal Reserve will cut rates again at the upcoming December 10 FOMC meeting. Hassett has a pro-growth, low-tax, pro-liquidity position that generally supports more accommodative monetary policy.

Should he be appointed, the markets anticipate a more vigorous rate-cutting cycle, possibly to stimulate the employment rate and to hold the high asset prices.

The reaction of investors is already taking shape, with optimistic forecasts like the S&P 500 reaching 8000 already circulating online.

Many analysts argue that the Fed can no longer rely on tight monetary policy when signs of economic softness—especially in labor markets—are becoming unavoidable.

Source: The Kobeissi Letter X

Why US Have to Cut Rates in December?

Despite inflation sitting slightly above the Fed’s 2% target, the real pressure comes from the weakening foundation of the economy. Consumers are squeezed by high borrowing costs, falling real wages, and rising defaults.

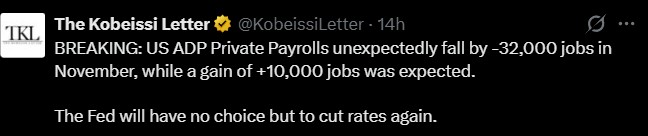

The latest ADP private payrolls data showed a shocking decline of 32,000 jobs, instead of the expected +10,000. This is the largest contraction since early 2023 and signals a cooling job market. Under the Fed’s dual mandate—price stability AND maximum employment—rate cuts become almost necessary.

Moreover, if consumer spending slows further, overall economic growth may stall. Many economists now believe the Fed is approaching a point where cutting rates is less about boosting markets and more about preventing a recession.

Source: X

Could Kevin Hassett’s Entry as Fed Chair Spark Rate Cuts?

A major political development adds even more weight to this scenario. Reports suggest that President TRUMP is considering Kevin Hassett as the next Federal Reserve Chair, while also elevating Treasury Secretary Scott Bessent to top economic adviser.

U.S. CPI has already been confirmed to be 3% in November 2025, and already the markets are pricing in 87% probability of a 25 bps cut.

The social sentiment is no different. According to online debates, a growing K-shaped economy is becoming evident, with big tech items skyrocketing and ordinary consumers unable to afford them.

Source: X

What Problems Arise Due to Delay?

Delayed Fed rate cuts may aggravate:

Loss of jobs as companies withdraw from recruitment.

High loan and credit card interest stress on the consumer.

Declining small business activity.

More recession risk in case spending remains weak.

A long wait can also cause liquidity problems, particularly to those households that are already living paycheck-to-paycheck.

US Debt Pressure Rising

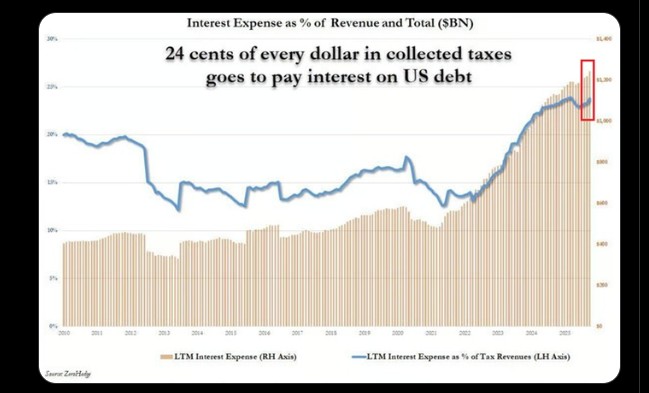

One of the biggest reasons behind rising pressure for rate cuts is the state of U.S. federal debt. Interest payments have surged to $1.24 trillion over the past year—now eating up 24% of every tax dollar collected.

This cost has doubled since 2021 and now surpasses defense and healthcare spending. With federal debt at $38 trillion and rising, the government itself needs lower rates more than anyone. Without cuts, interest expenses could exceed $1.6 trillion by 2030.

Source:

Impact of Fed Rate: Before and After

When rates were high, mortgages, credit cards, and business loans became more expensive, slowing consumption and hiring. Markets grew nervous, and job growth flattened.

After the recent cuts earlier in 2025, borrowing eased slightly, markets soared, and liquidity improved. Another cut could bring temporary relief to consumers, support businesses, and calm debt pressures.

Conclusion

Federal reserve news now appears less like an option and more like an economic necessity. With weakening jobs, rising debt costs, and consumer strain, another cut could stabilize growth—at least for now.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.