ZkPass Price Plunge: Altcoin’s RSI Hits Historic Lows – Is This The Ultimate $ZKP Buying Opportunity?

ZkPass just flashed a signal crypto traders haven't seen in years. Its Relative Strength Index—the market's universal fear gauge—has cratered to levels that scream 'oversold.' This isn't a dip; it's a full-blown capitulation event.

The Anatomy of a Washout

When an asset's RSI plunges this deep into the red, it typically signals one thing: panic selling has exhausted itself. The weak hands have been shaken out, leaving behind a market cleansed of speculative froth. For ZKP, this extreme reading suggests the selling pressure may have finally hit a wall.

What's Next for the Protocol?

Technical extremes like this often precede powerful reversals. The question isn't if the bleeding stops, but when the algorithmic traders and deep-pocketed accumulators start sniffing around for discounted assets. History shows that buying when others are fearful—especially at these RSI levels—pays off more often than not. Just ask anyone who bought Bitcoin during its own historic oversold moments.

The contrarian playbook is simple: extreme fear creates opportunity. While mainstream finance is busy chasing last quarter's earnings, crypto markets are pricing in tomorrow's infrastructure. ZkPass's current predicament looks less like a failure and more like a classic setup—the kind that separates tourists from investors. After all, what's a little volatility between revolutions?

Altcoin RSI Hits an All-Time Low: ZkPass Price Crash Reason

A popular market analyst Ash Crypto, shared an important chart on X. This chart tracks altcoin dominance and its monthly RSI (Relative Strength Index).

Now, according to the chart, the altcoin dominance RSI has dropped to an all-time low. This has never happened before. It clearly shows that altcoins are extremely weak right now.

Most money is moving into Bitcoin and large coins, while small assets are being sold heavily. This marketplace condition is one of the biggest reasons behind today’s ZkPass Price drop.

$ZKP Price Analysis: What Happened After 19 Dec Listing?

The official Zkpass airdrop listing made its multi-exchange debut on December 19. But soon after the launch, selling pressure increased.

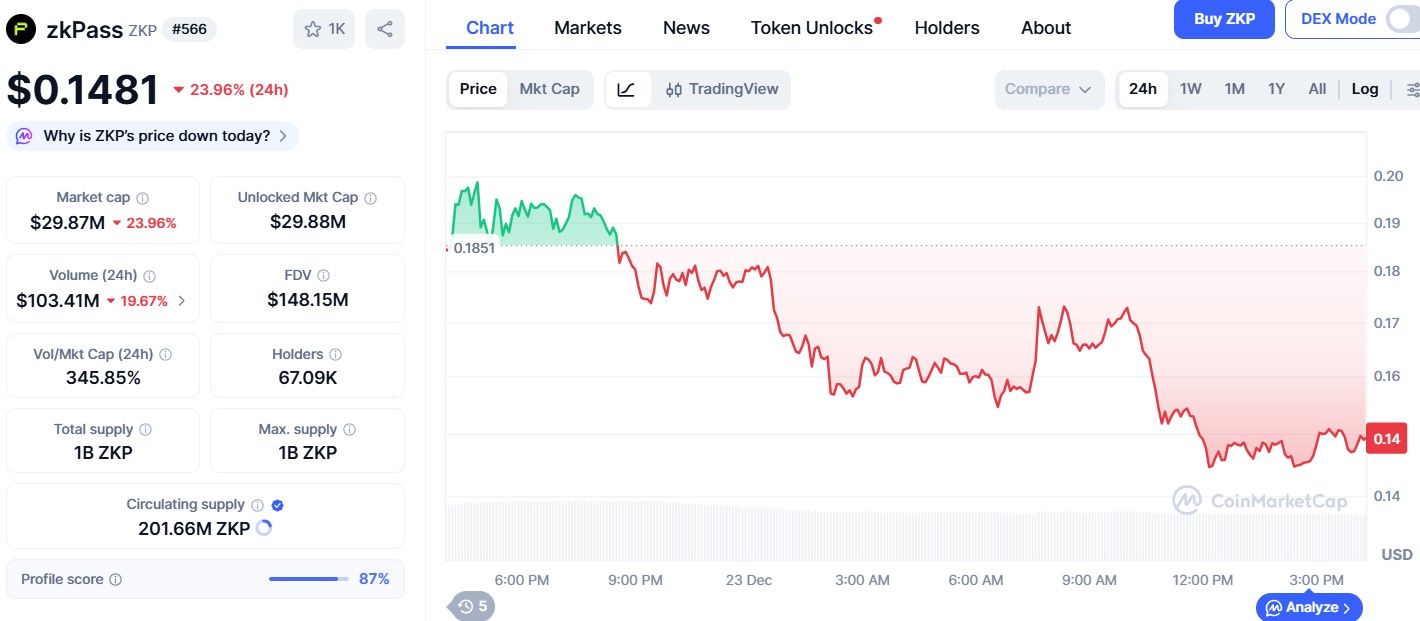

According to CoinMarketCap chart , the asset is trading NEAR $0.1490, down around 25% in just one day. The price fell from the $0.18 - $0.19 range to around $0.14, showing strong selling.

Important market data to watch:

-

Market Cap: $29.87M (down 23.96%)

-

24h Trading Volume: $103.41M

-

Crypto fear index sitting at extreme 24 fear zone

When the crypto fear index is this low, people panic and sell their coins even if the project is good.

Why Is ZkPass Price Crashing Today? Market Bloodbath

There are four main reasons why the ZKP crypto news is trending today after the major price fallout:

Airdrop Selling: Many people got free tokens through an airdrop on Dec 19. Most of them sold their tokens immediately to make a quick profit.

Weak Crypto Market : Total crypto market cap is down 2.12%, with $BTC and ETH both crashing down.

Crypto Fear Index is at 24, which means Extreme Fear

Weak Altcoin RSI: Bitcoin is taking all the attention, while Altcoin's RSI hit an all-time low today.

$ZKP Token Price Prediction: Is There Hope For $ZKP Crypto Coin?

Based on the ZKP/USDC 4 hour Tradingview chart, the situation is risky but not broken. The RSI is near 53, which indicates the token is not in the overbought zone yet.

-

Strong support nears $0.135, if it breaks then the $ZKP price target 2026 will turn bearish.

-

Resistance $0.18, if the asset breaks this level, a trend reversal will begin.

Experts believe that as long as it holds above $0.135, the ZkPass Price Crash is just a healthy correction and not the end of the project.

-

Zkpass token price prediction 2025 : If the market and altcoin dominance improves, it could return to the $0.20 – $0.25 range.

-

Long Term Target: With more people using privacy tech, some analysts at Coingabbar see the price reaching $0.50 or higher if the ecosystem grows.

What Other Analysts Are Saying

Another well-known analyst Satori , shared his view on X. He said that ZKP’s trend since listing has been clean and steady. The current dip into support is often where smart investors slowly build positions. This clearly shows that not all experts are worried about the ZkPass Price Crash.

When fear is high, new tokens usually fall faster, and this asset is facing the same pressure.

Final Thoughts

The ZkPass Price Crash is a result of a very weak altcoin market and extreme fear among investors. There is no sign of project failure or serious problems with its ecosystem.

Traders should note that as long as the $0.135 support stays strong, $ZKP token still has a chance to recover when the altcoin RSI improves.

Disclaimer: This article is for educational purposes only. Crypto prices are very risky and change quickly. Always do your own research before investing.