Gnosis Chain Moves to Recover $9.4M from Balancer Hack—Here’s How

Another day, another crypto exploit—but this time, the chain is fighting back.

The $9.4 Million Recovery Play

Gnosis Chain isn't waiting around. After the Balancer hack drained millions, the network is executing a coordinated recovery effort. Think of it as a decentralized asset-repossession squad—bypassing traditional legal gridlock and moving funds directly.

How Chain-Level Recovery Works

This isn't a simple transaction reversal. The process involves validator consensus and on-chain governance mechanisms to isolate and reclaim stolen assets. It sets a precedent: chains can act as their own enforcement layer when protocols get drained.

Why This Matters Beyond $9.4M

The move signals a maturation in DeFi's security posture. Instead of writing off losses as 'code is law' casualties, networks are building tools for remediation. It's a stark contrast to traditional finance, where recovery often involves years of litigation and a fleet of lawyers—who probably take half anyway.

One cynical take? In TradFi, the middlemen profit from the crime and the recovery. In DeFi, at least the code tries to claw it back.

What Happened?

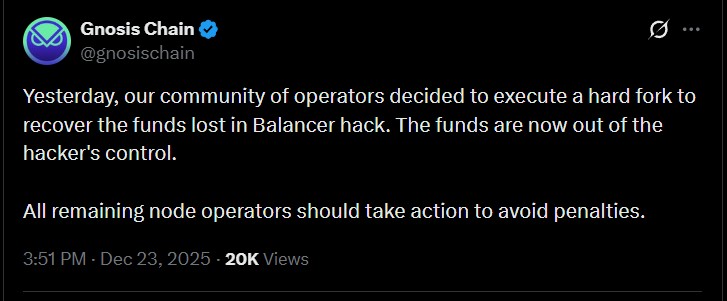

In December 2025, Gnosis Chain was able to do a hard fork approved by governance to recapture stolen funds due to the November 2025 Balancer V2 exploit.

The security flaw in the stable pools enabled hackers to steal $128 million in various blockchains, with $9.4 million stolen on Gnosis.

The first step was the freezing of funds by Gnosis with the help of a soft fork. The migration enabled the recovery of funds

Source: Official X

Reviewing The Balancer Hack 2025

In November 2025, the Balancer hack emptied approximately $128 million because of a rounding error in stable pools.

Several chains (Ethereum, Gnosis, and others) were compromised. The vulnerability was not detected until it was exploited by hackers despite the fact that it was audited several times.

What Problems Occurred due to the Hack?

The hack brought about several issues for users and the network:

It resulted in the theft of millions of dollars that impacted the liquidity and trust of Balancer and the DeFi ecosystem in crypto Scams.

On Gnosis, correctors had to organize updates to freeze and subsequently redeem funds, or face fines.

The event triggered the controversies between blockchain immutability and user protection.

The communities were in a state of panic and confusion because they were not sure of how the funds would be refunded.

The incident also demonstrated technical weaknesses in smart contracts and the necessity of enhanced auditing, monitoring, and proactive security in DeFi protocols.

How is Gnosis Hard Fork Treated as a Solution?

The hard fork of Gnosis Chain served as a decisive measure to ensure the stolen funds and safeguard the users who were affected.

The rules of the blockchain were temporarily modified, which allowed the transfer of the frozen funds of $9.4 million in the form of a soft fork to a DAO custodial wallet, which was effectively out of the control of hackers.

This strategy provided the society with an opportunity to make decisions concerning equitable compensation and allocation.

Accountability was also a priority of the hard fork, with validators being penalized unless they upgraded their nodes, keeping the network secure.

Some argued that it was a violation of the code is law, but Gnios said that changes were minimal and did not alter the history of blockchain.

The action is in line with other chains that have similarly reacted to big exploits, and it will set a precedent of being proactive in recovering in the DeFi arena.

It exhibits a decentralization equilibrium and user asset security.

Community Reaction

It is a divisive issue within the community, with some commending Gnosis on how it secures the users, and some claiming that it compromises the immutability of blockchains. Analysts warn that regular hard forks may provide dangerous precedents to DeFi governance and protocol anticipations.

Advice to Users

The user is advised to keep up to date, not to play with vulnerable pools, and to adhere to official updates on Gnosis. The validators are required to update nodes to remain in the network and prevent staking fines.

Other Fund Recoveries

Other recoveries followed a similar pattern, with Sui, Berachain, and Sonic networks recovering the stolen funds following major DeFi hacks, indicating a tendency for blockchain interventions to restore stolen money and protect users on the ecosystems.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. crypto assets are highly volatile and you can lose your entire investment.