Robert Kiyosaki’s Silver Prediction: $70 Barrier Shattered, $200 Looms as Fiat Crisis Deepens

Silver just punched through a critical resistance level—and one prominent financial voice says the real surge hasn't even started.

The $70 Breakout: More Than Just a Number

For months, analysts watched the $70 mark. Its breach isn't just a technical win; it's a signal flare. It suggests a fundamental shift in how investors view traditional safe havens versus the creeping instability of government-issued money. The move hints at capital searching for a tangible exit.

From $70 to $200: The Fiat Fuel for the Fire

Kiyosaki's projected leap to $200 isn't based on mining supply alone. The catalyst, as framed, is a growing crisis of confidence. When central banks print to solve problems created by printing, it creates a self-feeding loop—a classic case of fighting fire with gasoline, then wondering why the blaze spreads. Savvy investors aren't just buying silver; they're selling a narrative of fiat decay.

The New Safe Haven Playbook

This isn't your grandfather's commodity trade. The thesis positions physical silver not merely as an industrial metal, but as a direct hedge against monetary policy missteps. It bypasses complex ETFs and goes straight for the tangible asset—a move that screams distrust in financial intermediaries as much as in the currency itself.

The path to $200 will be volatile, littered with dismissals from mainstream pundits who'll call it fear-mongering right up until their digital bank balances buy a cup of coffee. Sometimes, the oldest money in the book becomes the most radical play on the future.

This has issued a fresh warning to investors: the era of "fake money" is failing, and the white metal is stepping into the spotlight. Let’s understand what it means, and how the Silver surge will impact BTC price going forward.

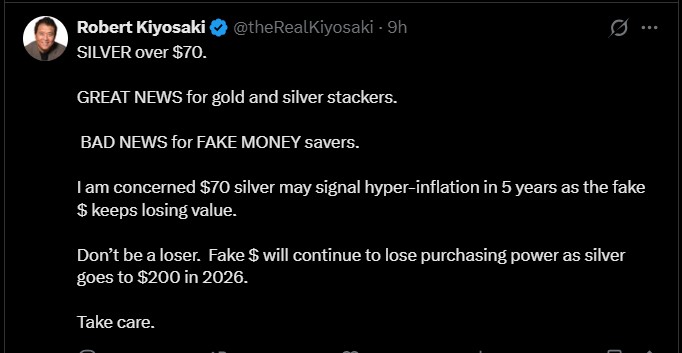

Kiyosaki on Silver: Why $70 is a "Wake-Up Call” For Investors

In the context of Robert Kiyosaki Silver prediction, a break above the $70 per ounce mark acts as a historic shift in how the world views wealth. He argues that rising metal prices reflect weakening trust in fiat currencies, especially the U.S. dollar.

This continuous precious metal rally will lead to hyper-inflation within the next five years, and the Kiyosaki silver price target $200 by 2026 will turn real.

-

The "Fake Money" Argument: He often calls the U.S. Dollar "fake" because it is not backed by precious metals.

-

The Move to "Real Assets": His advice is simple: protect your hard-earned savings by moving away from fiat currency and into "real" assets like Golden and white metal.

This warning aligns closely with broader inflation hedge assets narratives surging in 2025.

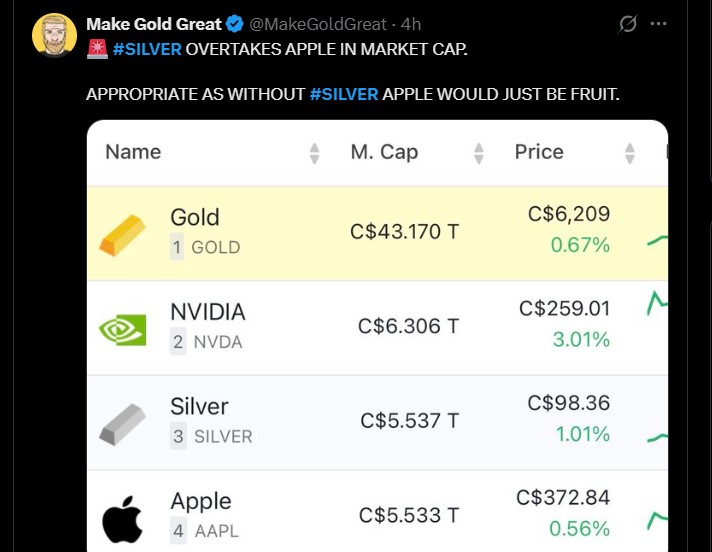

Silver Overtakes Apple Market Cap: The "Dhurandar" of 2025

A chart shared by crypto analyst Make Gold Great on X claims that white metal’s total market value has recently climbed around $4.07 trillion, surpassing Apple market cap to become the world’s third-largest asset.

At present, it is trading NEAR $72.30 per ounce, climbing steadily from the $58–$60 range. The price structure shows higher highs and higher lows, confirming a strong bullish trend.

On the other hand, it isn't just one commodity making headlines. Spot Gold prices have surged past $4,500 per ounce, a historic milestone. Expert Kashif Raza, founder of Bitning, has labeled gold and another commodity as the true "Dhurandar" (Champions) of 2025.

“His comment reflects a growing expert view that traditional hard assets are outperforming in an environment shaped by inflation fears, currency debasement, and declining confidence in fiat systems.”

Technical Chart Analysis: What RSI and MACD Indicators Say

The RSI MACD indicators currently show a very "bullish" trend.

-

RSI is currently high, which means buyers are active and demand is strong.

-

MACD is moving upward, showing that buyers are controlling the market right now.

-

The price is moving up very fast in a curved pattern. In the past, such moves usually slowed down near the 4.23 Fibonacci level.

-

The $70 level, which was earlier hard to break, is now acting as a strong support. Buyers are stepping in around this level.

This TradingView price chart confirms strong upward momentum, setting the narrative of rising prices amid weakening fiat value.

Silver Price Prediction 2026: The Road to $200 and Beyond

While Robert Kiyosaki Silver prediction of $200 by 2026 is bold, many top crypto analysts are now updating their outlook.

Looking at the bullish trend, technical indicators, and the Rich Dad Poor Dad author’s warning, these are the more realistic price targets ahead:

-

Base Case:If inflation continues and trust in fiat currencies weakens, it could realistically move toward $120 – $150 in the coming period.

-

Bull Case ($200): If a major "currency crash" occurs, as Kiyosaki predicts, it could reach $200 by 2026 as people panic-buy hard assets.

-

Bearish Case: Likely, but trend remains bullish above $65–70.

Bitcoin Price Prediction: Will $BTC Follow White Metal’s Gain?

Kiyosaki’s warning also impacts crypto markets. With $BTC trading near $87,000, he believes that as commodities rise, Bitcoin price will also follow.

Currently, according to the TradingView price chart, Bitcoin is moving sideways between the $85,000 – $90,000 range. The RSI is around 47, showing neutral momentum, while the MACD is slightly negative, suggesting short-term consolidation.

If hard assets continue to rise as inflation hedges, and top analysts’ views prove correct, Bitcoin price prediction could target the $180,000 – $250,000 range by 2026.

Conclusion

The Robert Kiyosaki silver prediction is a reminder that the global economy is changing. Whether it hits $200 or stays in the $100 range, the message is to look for "scarcity."

Assets that cannot be printed—like gold, silver, and Bitcoin—are becoming the preferred choice for those worried about the future of the dollar.

Disclaimer: This article is for informational purposes only. It is not financial advice. Investing in precious metals and cryptocurrencies involves high risk. Always DYOR before investing.