Trump’s Fed Chair Clash: How Disagreement Torpedoed His Chance to Lead the Central Bank

Disagreement with Trump ends Fed Chair hopes—here's what it means for markets.

The Political Pivot That Backfired

Forget backroom deals and political favors. In the high-stakes world of central banking, one fundamental disagreement was all it took to derail a potential chairmanship. The candidate's vision for monetary policy clashed directly with the administration's public stance, creating an irreconcilable rift. No amount of political capital could bridge that gap.

Why the Fed's Independence Still Matters (For Now)

This episode underscores the fragile, often theatrical, independence of the Federal Reserve. Markets crave predictability, and nothing spooks institutional investors faster than the scent of political meddling in interest rate decisions. It's a reminder that while politicians love to take credit for bull markets, they're the first to look for a scapegoat when the music stops—preferably one in a suit at the Marriner S. Eccles Building.

Market Implications: Stability Over Sycophancy

The immediate reaction? A collective, if muted, sigh of relief from traditional finance. A perceived maintenance of the status quo means fewer short-term volatility triggers from monetary policy uncertainty. For crypto, it's a neutral-to-positive signal. A politicized Fed would have been a wildcard, potentially destabilizing the very dollar regimes that digital assets often seek to hedge against. This outcome, ironically, provides the stable macroeconomic backdrop that allows speculative assets to thrive—proving once again that crypto feeds on the complacency of traditional finance.

The takeaway? In the quest to lead the world's most powerful financial institution, sometimes agreeing to disagree isn't an option. And for traders watching from the sidelines, that's probably a good thing. After all, the only thing worse than a rigid central bank is a malleable one—unless you're trading the chaos, of course.

Source: X (formerly Twitter)

According to the president, markets should not fall when the economy is doing well. He believes that strong growth does not automatically cause inflation and that interest rates should be lowered when conditions are positive.

What Trump Said About the Fed Chairman Role?

The Trump Fed Chairman remark was very direct. He said that policy agreement matters and that anyone who openly disagrees with his views on interest rates should not expect to lead the Federal Reserve.

He also said that he wants his next chairman to lower interest rates if markets are performing well. He argued that high rates hurt growth, investments, and asset prices, while inflation can “take care of itself” over time.

These comments reflect the president's long-held belief that the Federal Reserve should support economic expansion and market confidence rather than slow things down with tight monetary policy.

How This Relates to Jerome Powell and the Fed?

Jerome Powell’s term as Chair is set to end in May 2026. While the president did not directly say he WOULD remove Powell early, his statement has raised questions about whether pressure on the chair could increase before that date.

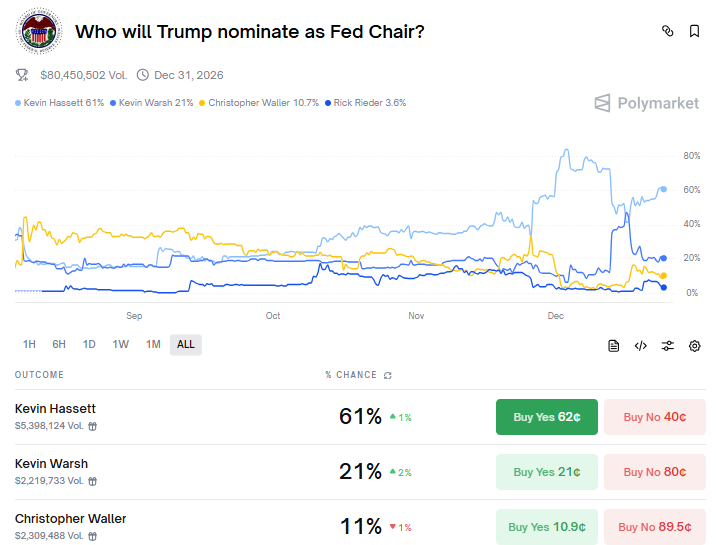

This has once again brought attention to the balance between political power and central bank independence. The Trump Fed Chairman discussion is also visible in prediction markets.

Source: Polymarket

Polymarket odds currently show Kevin Hassett as the leading candidate, followed by Kevin Warsh and Christopher Waller.

These candidates are seen as more aligned with Trump’s preference for lower interest rates and stronger asset prices.

Fed Rate Cuts in 2025 and Pause Expectations for 2026

The Federal Reserve reduced interest rate thrice in 2025. The target range was lowered to 3.50% - 3.75%. The MOVE was geared towards helping the economy as the inflation slowed.

However, markets currently expect that any further rate cuts may be paused. Forecasting platforms indicate that there is currently an 86% probability that the central bank will not reduce rates in the upcoming FOMC meeting in January 2026. This follows robust GDP growth and inflation remaining around 2.9%, still above 2% that the central bank targets.

Apparently, Jerome Powell has also stated that “the Federal Reserve is well-positioned to wait and see” how the market performs.

What Markets Are Watching Now?

This depicts an element of politics to an already complex market environment. Market players are now following three things very closely: the economic numbers, future central bank decisions, and Trump’s role in selecting the next Fed Chairman.

Bitcoin is steady at around $87000, which kind of indicates that while the markets are uncertain, they're not exactly in a state of panic.

Final Thoughts

Trump's remarks are more than an insight into leadership qualities. Trump's declarations have brought into focus an underlying controversy associated with the function of the Federal Reserve in the country and who should control it in the nation.

This article is for informational purposes only, kindly do your own research before making any investment decision.