Crypto Plunge on Dec 24: Unpacking the Crash and Spotting the Recovery Signals

Crypto markets tumble on Christmas Eve—here’s what’s rattling the digital cages and where the bounce might begin.

The Liquidity Squeeze Hits Hard

Thin holiday trading volumes are amplifying every sell order. Major exchanges report order books drying up faster than holiday cheer—a classic recipe for exaggerated price swings when large holders decide to cash out.

Regulatory Ghosts of Christmas Past

Year-end regulatory uncertainty is back like an unwelcome guest. Traders are spooked by potential policy shifts in key markets, prompting defensive portfolio moves. Some traditional finance players are pulling the classic ‘sell first, ask questions later’ routine—because why let due diligence ruin a good panic?

Technical Breakdown Triggers Algorithmic Avalanche

Key support levels shattered in early trading, triggering automated sell-offs across leveraged positions. The cascade effect hit major tokens hardest, with derivatives markets seeing forced liquidations that pushed spot prices even lower.

Where’s the Recovery Taking Root?

Look for accumulation patterns beneath the noise. On-chain data shows savvy addresses increasing holdings during the dip—a classic contrarian signal. Infrastructure tokens with clear utility are showing relative strength, suggesting the market is already separating wheat from chaff.

The Bounce Back Blueprint

Recovery typically starts with stablecoin buying power accumulation, followed by selective re-entry into oversold assets with strong fundamentals. Watch for decreasing sell pressure on lower timeframes—that’s your early warning system.

Markets have short memories but long grudges. Today’s panic creates tomorrow’s opportunity, while Wall Street analysts will inevitably claim they predicted it all along—after the fact, of course.

Why is Crypto Crashing Today: Gold or Fed Behind?

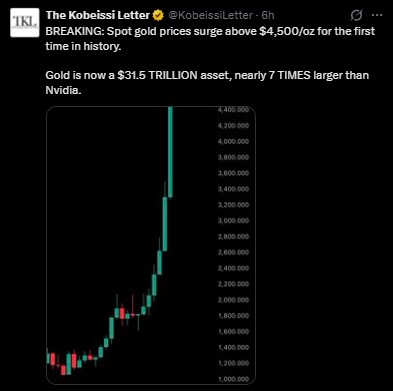

One major reason why is crypto crashing is the unstoppable rise of gold. Spot Gold surged past $4,500 per ounce, making it a $31.5 trillion asset, according to The Kobeissi Letter. That is nearly seven times larger than Nvidia.

Silver also crossed $70, reinforcing the MOVE toward traditional safe havens. With the strengthening of gold, the digital assets markets lose steam, which is why it is down even though there haven’t been any failures in protocols.

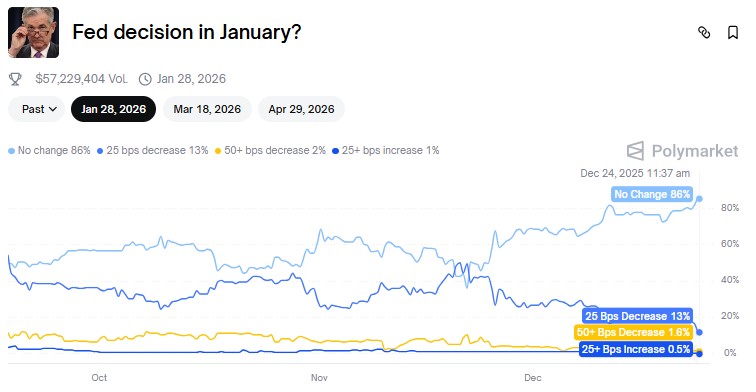

Another reason for which crypto is crashing today is because of increasing fears over US monetary policies. The Fed meeting slated for January 28, 2026, is making everyone nervous. The odds from Polymarket for no rate cut are 86%.

Adding further uncertainty was TRUMP announcement of Fed chair. Trump said that he wants leaders of the Fed who share his opinions, making many fearful of their policy independence. This is why is market down today.

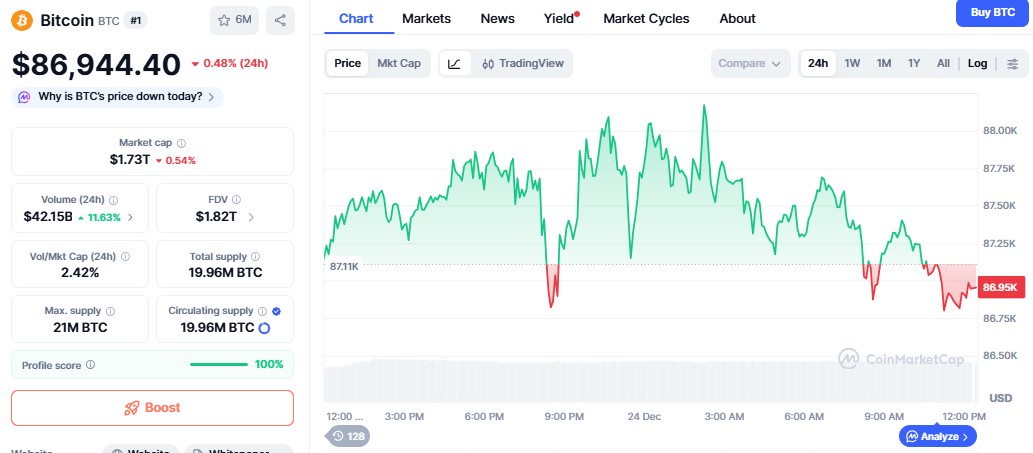

The sell-off escalates after Bitcoin price dips below $87000 having breached the psychological level. Bitcoin currently trades close to $86,815, while ethereum price crash sees ETH fall below $2,900 and now trades at $2,924.

In the past, when Bitcoin loses strength, altcoins usually follow. This has been responsible for why there is a crashing across the board yet there has been no panic-selling.

Can the Crypto Market Recover Again?

Whales move despite the fear. A whale has accumulated 40,975ETH ($121M) in only five hours. Starting from November 4, there has been a whale accumulating 569,247ETH ($1.69B) using borrowed money from Aave, according to Lookonchain.

However, Bitmine, spearheaded by Tom Lee, acquires 67,886 ETH worth approximately 201M USD, while further weakening rivals in Leveraged bets from Fasanara Capital. This reflects market confidence beyond market chatter.

Conclusion

Thus, the question remains, Why is crypto crashing today? The rising prices of gold, uncertainty of the Fed, political pressures, and sharp drops in bitcoin prices all contribute to the fear. However, institutional purchases imply that there is hope for the future.

This article is intended to be informative in nature and should not be considered investment advice. The cryptocurrency market is highly volatile. Readers should do their own due diligence and consult appropriately qualified investment professionals.