Will Rollblock’s Q1 2026 Launch Actually Happen? Experts Flag 3 Critical $RBLK Risks

Another day, another altcoin launch date on the horizon. Rollblock's team points to Q1 2026, but the crypto trenches are buzzing with skepticism. Three glaring risks shadow the $RBLK token, turning cautious optimism into a game of 'wait and see.'

The Regulatory Gauntlet

Forget moon missions—the first hurdle is earthbound regulation. New frameworks drop weekly, and a project's entire tokenomics can get shredded by a single regulatory body's memo. Launch timelines aren't just about code; they're about compliance chess.

The 'Vaporware' Specter

Promised features in a whitepaper are cheap. Delivering a live, scalable, and secure protocol is a different beast. The gap between roadmap rhetoric and on-chain reality has buried more than one hyped project, leaving bagholders with nothing but GitHub commits.

Market Sentiment: The Uncontrollable Variable

Timing is everything. Aiming for a Q1 2026 debut means rolling the dice on macroeconomic winds and crypto's infamous volatility. A bearish turn could starve a launch of essential liquidity and user attention, no matter how solid the tech.

So, will the date hold? It's a bet on the team's execution against a triad of classic crypto pitfalls. In an industry where 'soon' is a technical term, maybe the real investment is in the popcorn. After all, watching promises meet reality is the sector's favorite pastime—right behind losing money.

With the presale finished and staking active and the macro trend collapsing, the question now comes: Are market conditions forcing a strategic debut shift?

$RBLK Presale Is Over — So Why Is the Listing Date Still Missing?

Following the official closure of the presale, the steps according to the roadmap included three immediate actions:

-

Announcing the Q1 2026 listing date

-

CEX Top Listings Update

-

Staking platforms launching before token debut

So far, only staking has been launched. Later on, the group confirmed that the token launch will now occur in early 2026, with the final date still to be confirmed. This announcement came amid a slowdown in the overall market, and this connection is what investors are questioning now.

Why the Rollblock Launch Date Q1 2026 Timing Matters Now: Risk Ahead?

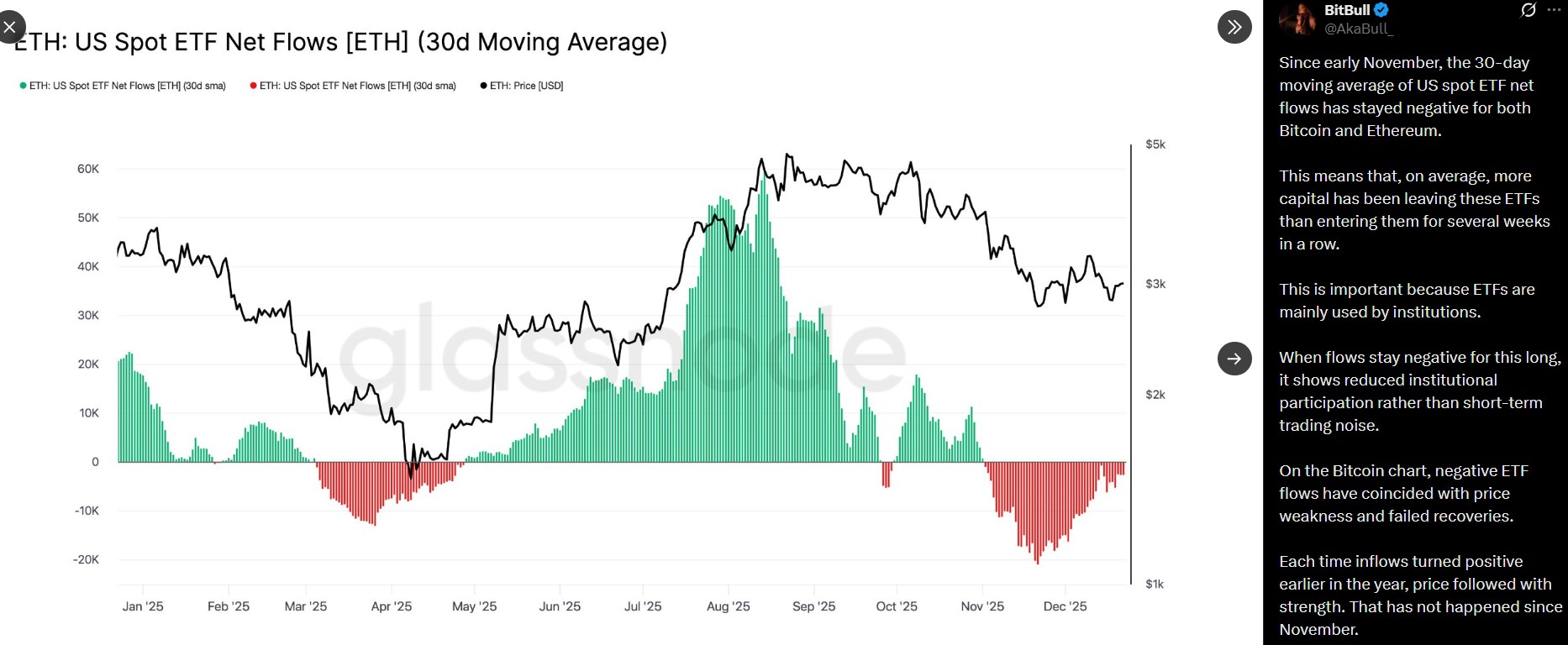

According to data cited by analyst BitBull, the 30-day moving average of US Spot ETF net flows for both Bitcoin and ethereum have been negative since early November.

This implies that institutions are withdrawing their money from the market rather than investing. In the past, a continuous pattern of BTC ETH ETF outflows have weakened the:

BTC Price recovery signs

Lower altcoin liquidity

Disappointing debut performance for newly-listed coins

Notably, these ETF outflows started roughly around the time that Rollblock announced the presale closure and shifted its focus towards early 2026.

Is a January 2026 $RBLK Crypto Listing Too Risky? Facts Here

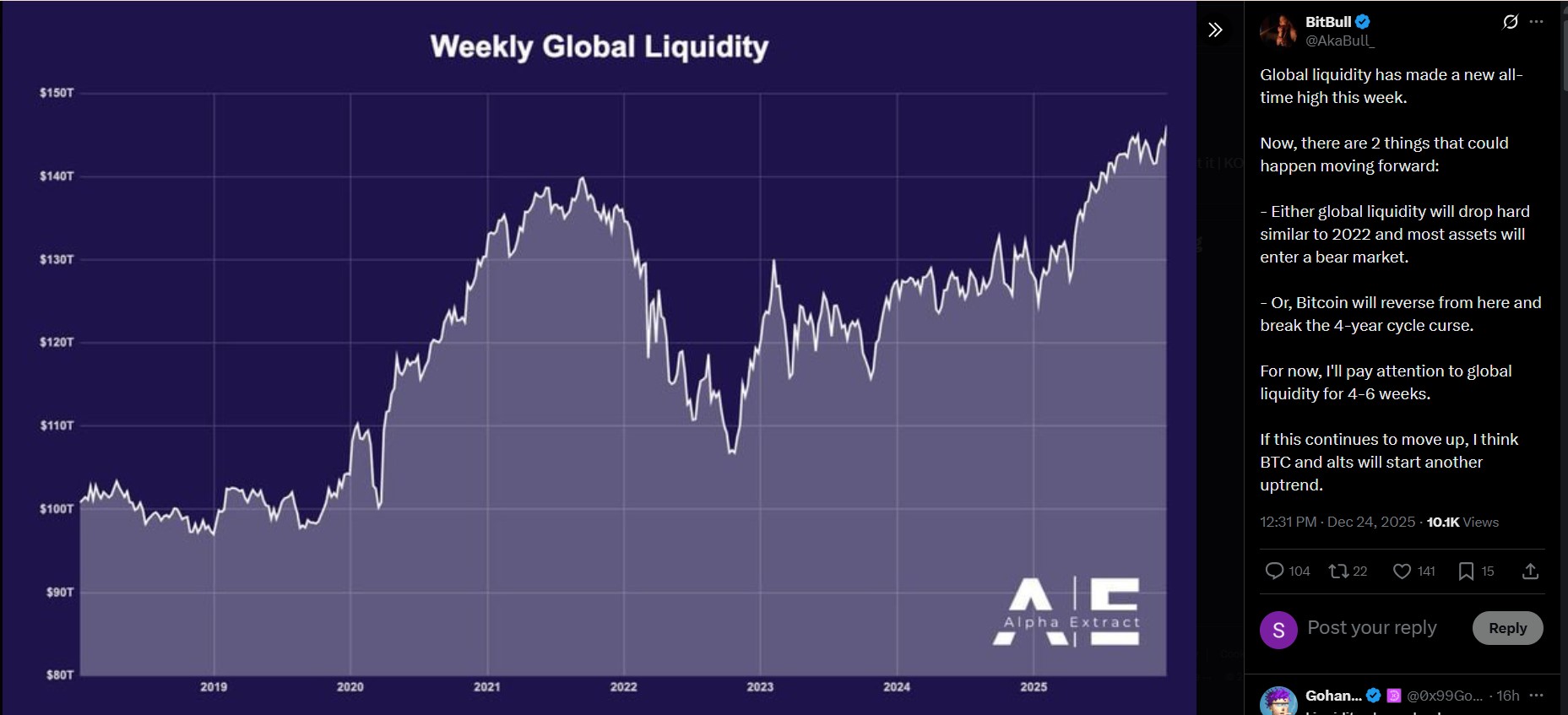

The global crypto market liquidity stood at a new historic high this week. Though it may seem to be a positive trend, instances where liquidity hit ATH during past cycles have been associated with sharp reversals or funding shocks, including the one seen in 2022.

What will happen towards the end of 2025 will make a difference between whether a Rollblock Launch Date Q1 2026 is an advantage or a disadvantage.

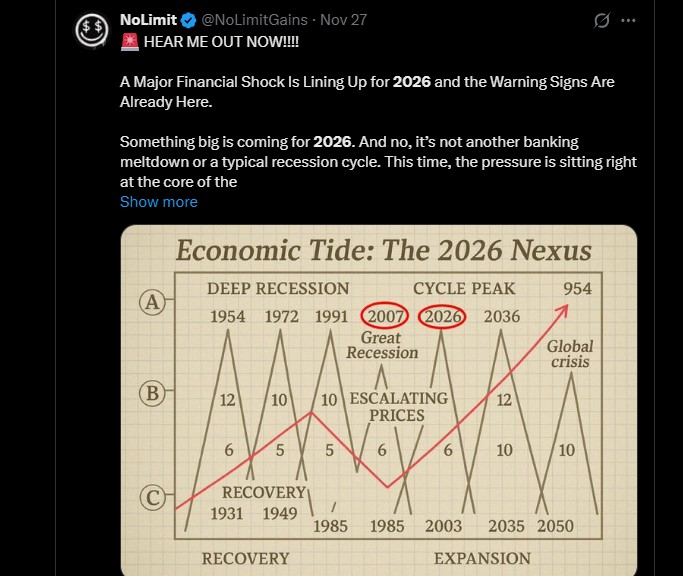

Top Macro analyst NoLimit has pointed out that 2026 may see the onset of a global sovereign bond stress event due to the following reasons:

-

Bond Market Volatility (MOVE Index)

-

Record US Treasury issuance

-

Even Japan’s fragile yen carry trade may not avoid

-

China’s local government debt pressure

If there’s weakness during the US 10-year or 30-year Treasury auction, it could spark temporary stress within the markets fueling the new token listing downwards.

Does $RBLK’s Fundamentals Still Support a New Year Q1 Launch?

Despite macro uncertainty, project’s fundamentals remain intact:

Amount raised through Presale: $12,321,629.44

Tokens sold: 541,886,

Total supply: 1,000,000,000

Exchange allocation: 11%

Holder incentives: 11%

Chain: Ethereum

Over 8,000 casino/sportsbook games in play

This puts the token into an operational GambleFi platform, rather than a speculative one. However, As per Coingabbars analyst’s marker research, the current Rollblock listing date risk indicators suggest that the multi-exchange debut might shift to Q2 if industry sentiment doesn't improve

Price Prediction 2026 Based on Market Scenarios: 3 Cases

If BTC and ETH Outflows continue, no institutional demand enters the industry, the price of $RBLK may range within $0.03 to $0.06.

Considering the potential listings on top exchanges like Binance, ByBit, KuCoin, MEXC, might support a price range of $0.08.

The price may go up to $0.25-$0.40 if Rollblock launch date Q1 2026 lands under bullish market conditions.

Conclusion

A lack of a fixed listing date does not imply delay but rather the discipline of timing. Aligning the Rollblock Launch Date Q1 2026 with improving liquidity and institutional re-entry might lower launch-related risks.

Traders should note that the strategic debut shift remains speculation until the team confirms the same.

Investors are presently paying more attention to macro data than announcements

Disclaimer: This article is for informational purposes only and does not constitute financial advice. cryptocurrency markets are highly volatile and influenced by macroeconomic conditions. Always DYOR before making any investment decisions.