Crypto’s December Dive: 4 Reasons Behind the Crash and What’s Next for the Market

Crypto markets tumble as the year winds down—here’s what’s rattling the cage.

Reason 1: The Macro Squeeze

Traditional finance isn't playing nice. Hawkish whispers from central banks send shivers through risk assets. When the old guard tightens the belt, crypto often feels the pinch first—a classic case of Wall Street's hangover hitting the digital party.

Reason 2: Liquidity Lock-Up

Market depth evaporates. Thin order books turn minor sell-offs into cliff dives. It’s the December curse: capital heads for the sidelines, leaving the remaining traders to swing at air.

Reason 3: Leverage Unwinds

Overextended positions get liquidated. A cascade of margin calls feeds on itself, turning a correction into a crash. The market cuts the weak hands out—brutally and efficiently.

Reason 4: Narrative Fatigue

The ‘next big thing’ cycle stalls. Without a fresh story to buy, momentum fizzles. Even the most ardent believers pause, waiting for a new catalyst to spark the next run.

So, what’s next? History suggests these shakeouts lay the groundwork for the next leg up. They flush out excess, reset expectations, and—for those with dry powder—create generational buying opportunities. The market doesn't crash; it just takes a breath, often right before it proves the skeptics wrong yet again. Just ask any finance professional who’s still waiting for Bitcoin to go to zero.

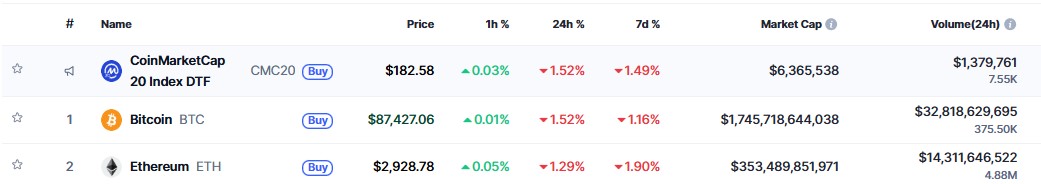

In the same period, 59,155 traders were liquidated, with total liquidations reaching $125.75 million. The largest single order was a BTC-USD position worth $7.02 million on Hyperliquid.

Why Is Crypto Crashing Today? Top 4 Reasons

One of the main reasons why the crypto market is down is fresh concern around a US government shutdown 2026. Congress adjourned for Christmas without an agreement on a budget and a framework on how to pass a vote, thus heightening the possibility of a new shutdown on the next deadline on January 31. The previous long shutdown in 2025 did serious damage to risk assets, as it lasted for more than 36 days.

Another crucial aspect that is adding to the reason why crypto is falling is that capital is flowing to traditional instruments. Notably, as per The Kobeissi Letter’s observations, the prices of silver ROSE by more than 10% in a single day by breaching the $79 per ounce mark for the first time in history.

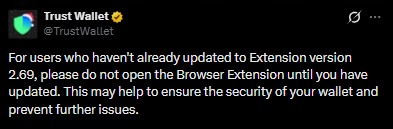

Simultaneously, there was damage to trust caused by the Trust Wallet hack that occurred on December 26. Official reports have it that more than $6.77 million was stolen, with exchanges such as ChangeNOW, FixedFloat, KuCoin, and HTX being used to channel the money. Of course, CZ was assuring that Trust Wallet WOULD cover all losses.

There are also political headlines involved. News surrounding the releasing of the Epstein files, due to President Trump’s call for the DOJ to reveal those involved, added to the global uncertainty. Such major headlines are always likely to influence market participants to cut their exposure, hence the question of why is crypto crashing today.

What’s Next for the Market: Bull Run in 2026?

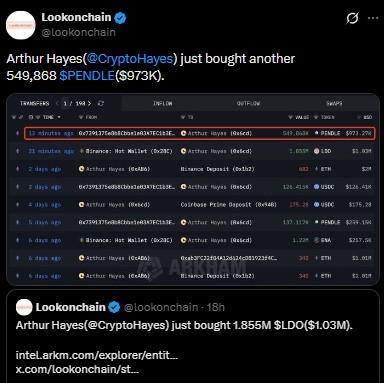

Despite the current crypto crash, smart money activity tells a different story. Lookonchain data shows Arthur Hayes bought 1.855 million LDO worth $1.03 million and 549,868 PENDLE worth $973,000.

Fundstrat’s Tom Lee-linked Bitmine staked 74,880 ETH worth $219.2 million, while SharpLink Gaming redeemed 35,627 ETH worth $104.4 million. These moves suggest long-term confidence and support the classic “buy the dip” strategy and hints for a bull run in 2026.

Conclusion

Why is crypto crashing today comes down to fear, not fundamentals. US shutdown risks, silver’s surge, security concerns, and political noise triggered selling. Yet whale buying shows confidence. For investors, this phase looks more like consolidation than collapse.

This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.