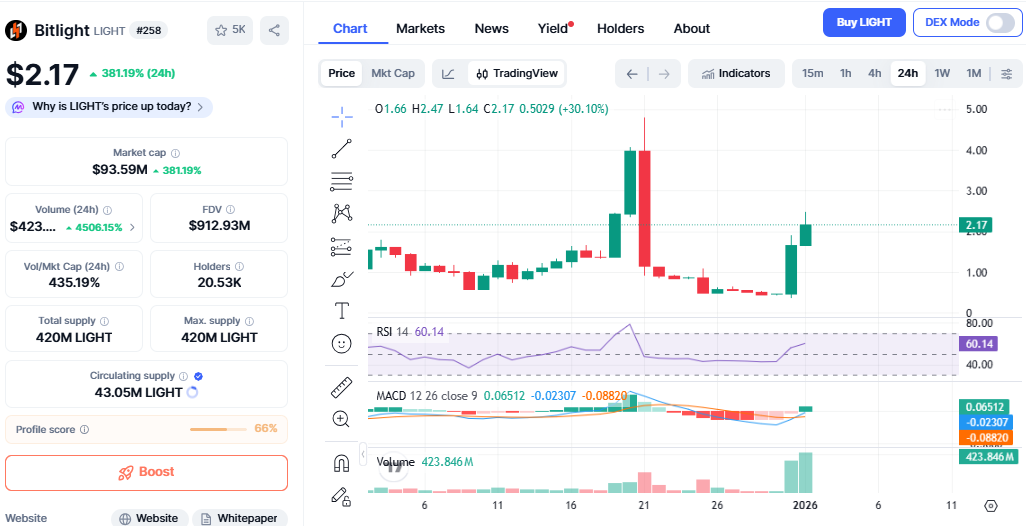

Bitlight Price Surge: Will $LIGHT Hold the Rally or Face a Sharp Crash in 2026?

Bitlight's $LIGHT token rockets upward—again. The charts scream momentum, but seasoned traders hear a different sound: the faint ticking of a potential correction.

Anatomy of a Rally

This isn't its first parabolic move. The token carved a path through resistance levels that once looked solid, now just historical footnotes on its climb. Each pullback has been shallower, each recovery sharper, painting a classic bullish structure on the daily timeframe. The crowd's chanting 'new ATH,' but the smart money is watching volume and derivatives data for the first sign of exhaustion.

The Support Question

Every rally needs a floor. For $LIGHT, the critical test isn't the peak—it's what happens after the inevitable profit-taking wave hits. Key moving averages and previous resistance-turned-support zones now form the battleground. A clean hold there signals institutional accumulation; a breakdown opens the trapdoor to a much deeper flush. It's the difference between a healthy consolidation and a full-blown trend reversal.

Macro Shadows & Crypto Realities

Never forget the context. Broader market sentiment acts like gravity on all altcoins. A shift in risk appetite from the traditional finance herd—often slower and more predictable than crypto-native whales—can drain liquidity in a heartbeat. $LIGHT trades in a crypto ecosystem, not a vacuum. A few hawkish whispers from central bankers could do more damage than any project-specific news.

The Verdict: Momentum vs. Mean Reversion

The trend is intact until it isn't. The current price action favors the bulls, with higher highs and higher lows locked in. But crypto has a nasty habit of reminding everyone that what goes up must come down—usually at the most inconvenient time, naturally. The coming weeks will reveal if this is a sustainable leg up or just another pump destined for the 'rug pull' section of crypto Twitter lore. Trade the chart, not the hype. And maybe keep some dry powder for the dip that always seems to arrive right after you go all-in—a classic maneuver in the beautifully irrational theater of digital asset finance.

Source: X (formerly Twitter)

Bitcoin DeFi Buzz Behind the $Light Price Surge

One big reason for the Bitlight Price Surge is growing interest in Bitcoin-based DeFi.

Bitlight Labs recently shared updates about how it plans to use RGB technology with the Lightning Network. In simple words, this allows more advanced features, like assets and smart-style payments, to run on Bitcoin.

Many investors see this crypto as a way to bet on Bitcoin’s future growth beyond just being digital money. Because only a small part of it’s total supply is available to trade, even small demand can push prices up fast. This also means prices can fall quickly if sentiment changes.

Price Breakout Triggered Fast Buying

The Bitlight Price Surge also happened because the price broke past important resistance levels. LIGHT moved above $1.48, a level where sellers had earlier stopped rallies. It also crossed around $2.06, which traders watch closely.

But once this occurred, many short-term traders got involved. Data indicated good levels of buying interest, but not to the extreme. Nevertheless, some indicators suggest that the momentum of the rally could ease, which can lead to volatile price movements.

Listings on the Exchange Stoked the Rally

The other important factor contributing to the price surge is the rising number of exchange listings. LIGHT has been listed on exchange platforms such as KuCoin, Bitget, and WEEX. This makes it easier to trade the token.

The trading volumes saw a huge spike, surging over 4,500% on one day. Although this contributed to the price increase, volume escalation at this rate can also lead to higher risks of price drops. Historically, coins with an issue of limited supply, like this one, have dived sharply when early investors capitalized on profits.

What’s Next for the Bitlight Price?

Bitlight Price Prediction: Can LIGHT Hold This Rally?

Bullish Case: If buying interest stays strong and LIGHT holds above $2.06, prices could move higher toward the $2.80 to $3.20 range.

Base Case: The price may range between $1.80 and $2.40 as traders wait for new updates.

Bearish Case: If selling pressure increases and LIGHT drops below $1.48, a deeper pullback toward $1.00 to $1.20 could happen.

Conclusion

The Bitlight Price Surge demonstrates just how quickly things can shift within the crypto space. The excitement surrounding Bitcoin DeFi, technical breakouts, and the availability of exchanges are causing the run-up in the project. The issue, however, is the limited supply causing the volatility within the price.

Whether this crypto's price continue to climb higher or cool off will be determined by actual developments, market demand, and market performance. Until now, the market has definitely brought $Light to the attention of the public.

This article is for informational purposes only and not a financial advice, kindly do your own research before making any investment decision.