MSTR Options Frenzy Ignites After Michael Saylor’s Latest Bitcoin Post

Michael Saylor posts. Markets move. It's the new normal.

The MicroStrategy chairman's latest social media activity—another bullish Bitcoin signal—has sent traders scrambling for exposure. Not to BTC directly, but to the company that's become its corporate proxy: MSTR.

Options Volume Spikes

Call option interest on MicroStrategy is surging. Traders are piling into leveraged bets that the stock will continue its volatile climb, directly tying their fortunes to Saylor's unwavering Bitcoin conviction. It's a pure-play on digital asset sentiment without touching a crypto exchange.

The Saylor Premium

The market has effectively priced in a 'Saylor Premium'—a volatility buffer fueled by his public statements. Every tweet or interview is parsed for clues, moving not just MSTR but casting a shadow over the broader crypto-equity complex. Some funds now treat the stock as a liquid futures contract on Bitcoin itself.

A Cynical Hedge

Let's be real—this is Wall Street's version of wanting Bitcoin exposure but needing a ticker their compliance department will approve. Why buy the asset when you can buy the narrative wrapped in a NASDAQ-listed security? It's financial engineering at its most pragmatic, or its most desperate, depending on your view of traditional finance's slow dance with disruption.

The takeaway? When Saylor talks, options desks listen. And right now, they're betting he's not done driving the conversation—or the price.

What Michael Saylor Highlighted In the Post?

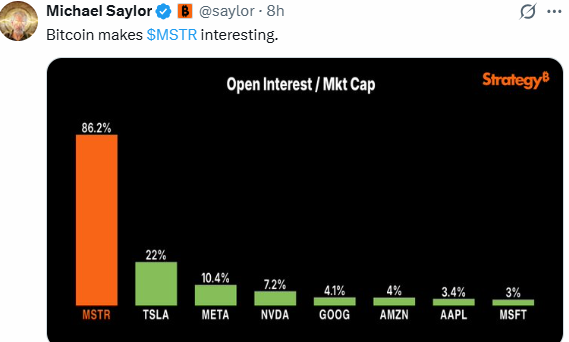

In his post, Saylor shared data showing that MSTR Options Interest stands NEAR $40–41 billion, making up roughly 86% of the company’s market value. This ratio is far higher than what is seen in most major technology stocks.

Source: X (formerly Twitter)

A comparison chart showed companies like Apple, Microsoft, Amazon, Meta, and Alphabet with single-digit open interest ratios. In contrast, Michael Saylor's firm stood out clearly. The message was simple: despite the fall, traders continue to treat this stock as a Leveraged Bitcoin play.

Why MSTR Stock Fell So Sharply in 2025?

The sharp drop was not driven by BTC price alone. One major reason was share dilution. The strategy just kept issuing new shares in order to raise funds for even more Bitcoin accumulation.

Fears of corporate risk. It was also alleged that some critics feared, in effect, holding the company rather than the BTC itself. Such a possibility led the microstrategy to be valued 20%–25% below its net asset value in relation to its holding of Bitcoin (MSTR nav).

Strategies’ Bitcoin Holdings Continue to Impress

In spite of Microstrategy’s poor stock performance, the balance sheet is largely secured by BTC. Currently, it possesses a total of 672,497 Bitcoins, valued approximately at $59 billion. It is observed that it is above its current market cap, which is approximately $46-47 billion.

The company also holds over $2 billion in cash and does not face major debt payments until 2028.

Why Traders Still Watch MSTR Options Closely?

The renewed focus on MSTR leveraged Bitcoin play suggests that many traders are not betting on slow recovery but on big price moves. It reflects expectations of volatility, not stability.

Saylor’s timing matters. His post came right after Strategy’s worst annual performance was questioned in the market. Instead of defending the stock price, he highlighted where trader interest still remains strong.

What Fred Krueger Is Saying About Bitcoin and Strategy Shares

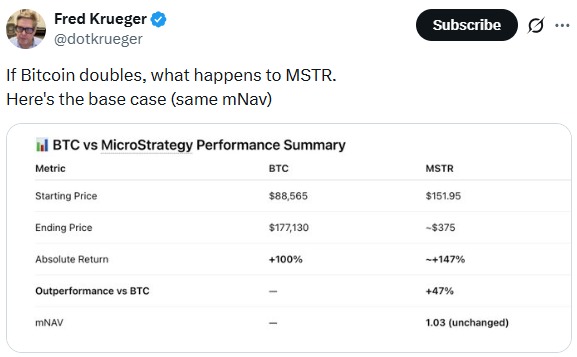

Fred Krueger also shared a simple scenario showing why traders are watching MSTR closely.

Source: X (formerly Twitter)

With BTC trading near $88,500, his chart shows that if BTC doubles to around $177,000, the stock could rise more than cryptocurrency.

In a base case, the stock moves toward $375, while a bullish case places it near $500. This outlook helps explain why MSTR open interest remains high, as traders are positioning for large Bitcoin-driven moves rather than small price changes.

Final Thoughts

The rise in attention around Strategy's Options Interest shows that, even after a tough year, Strategy remains a unique vehicle for bitcoin exposure. While investors debate dilution and risk, traders continue to see it as a high-beta way to play Bitcoin’s next move.

This article is for informational purposes only, kindly do your own research before investing.