Bitcoin RSI Screams for 2026 Breakout: Explosive Start or Catastrophic Breakdown Ahead?

Bitcoin's Relative Strength Index is flashing a signal traders haven't seen in years—and it's pointing straight at 2026's opening bell.

The Technical Tug-of-War

Forget the Wall Street analysts with their polished spreadsheets. The real action is on the charts, where Bitcoin's RSI is coiled tighter than a spring. This momentum indicator, which measures the speed and change of price movements, is screaming for resolution. It's a classic setup: extreme compression typically precedes explosive movement. The only question is direction.

Bull Case: The Launch Sequence

History favors the bold. Similar RSI patterns in Bitcoin's past have often acted as a prelude to parabolic rallies. The mechanism is simple—prolonged consolidation shakes out weak hands and builds a foundation of stronger support. When that energy releases, it bypasses traditional resistance levels with brutal efficiency. The 2026 narrative, ripe with institutional adoption whispers and regulatory clarity hopes, provides the perfect fundamental kindling for a technical spark.

Bear Case: The Trap Door

Not every coiled spring launches upward. Sometimes it snaps. The same technical setup that signals a potential breakout can also foreshadow a breakdown if key support levels fail. A rejection at current levels would confirm distribution, not accumulation, turning the RSI signal from a bullish harbinger into a warning siren for a deeper correction. In crypto, the line between 'oversold bounce' and 'dead cat bounce' is notoriously thin.

The 2026 Verdict: Bang or Whimper?

The market holds its breath. All the classic ingredients are here: a key technical indicator at an inflection point, a macro calendar reset, and the relentless, sentiment-driven engine of crypto speculation. Whether this translates into a bang that echoes through the financial sector or a breakdown that sends portfolio managers reaching for the antacid depends on which side of the RSI the market chooses to respect. One cynical truth remains—whether it rockets or craters, someone on Wall Street will claim they predicted it all along.

Polymarket: Why Traders Are Hesitant to Predict a Quick $150K Bitcoin Price Surge

Bitcoin is kickstarting 2026 with a mixed bag of Optimism and realism. While analysts are still tossing around six-figure targets, Polymarket traders are still being cautious about how high they think BTC can go before 2027.

Looking at the market odds, you see that the most likely outcome is $120,000, with a 45% probability, even though that level is below its 2025 all-time high.

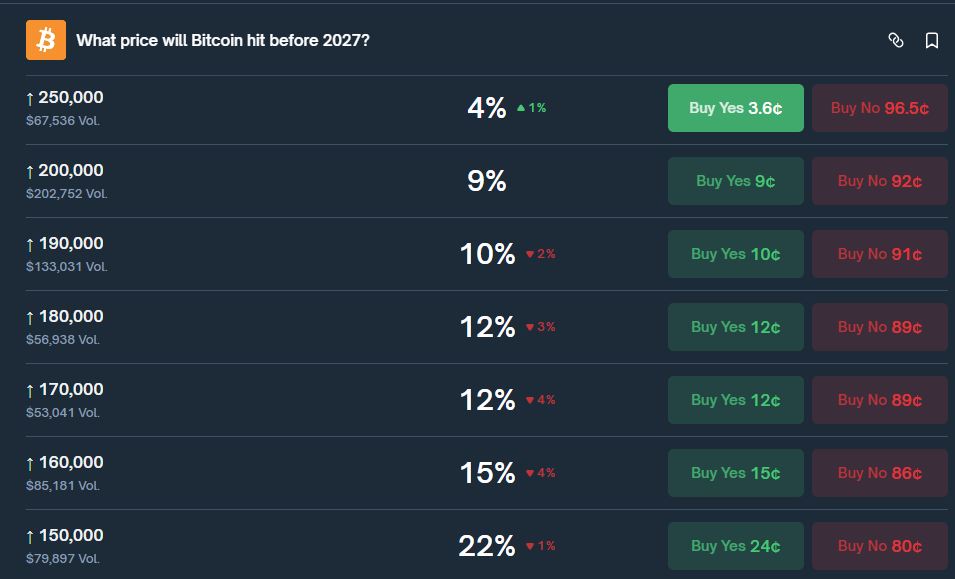

But the confidence in higher targets is starting to wane. Polymarket is saying:

- 35% of traders think $130,000 is a possibility

- 28% of traders think $140,000 is a possibility

- 21% of traders think $150,000 is a possibility

Source: Polymarket

By contrast, the market is saying there’s probably an 80% chance bitcoin either holds or recovers the $100,000 zone, suggesting traders think it will hold firm but don’t expect a rags-to-riches surge right away.

This caution might be due to cycle dynamics – Bitcoin ended last year in the red, and with the 4-year halving cycle coming to a close, traders are probably being a bit more picky about where they put their bets.

Institutional Bitcoin Buying Signals Long-Term Commitment

On the other hand, despite softer sentiment among individual traders, the institutions are still putting their money where their mouth is. In the last quarter of 2025, Japan-based Metaplanet added 4,279 BTC, bringing its stash to 35,102 BTC, which is worth a cool $3.1 billion at today’s prices.

Even though their stock price has been a bit of a dud, they’re still treating Bitcoin as a long-term store of value.

Tether has done the same thing. As BTC dipped below $88,000, the stablecoin issuer added 8,889 BTC, which cost them about $778.7 million. These purchases don’t guarantee a quick price spike, but they do show that the big players are using the dips to get a bit more exposure.

Bitcoin Technical Analysis: Triangle Breakout Or Triangle Breakdown?

Technically, Bitcoin price prediction continues to be neutral, as BTC is trading around $89,400, stuck inside a symmetrical triangle on the 4-hour chart. This pattern is more about tightening volatility than any weakness. The price is still forming higher lows, and the resistance line is sloping down from $92,800 to $93,000.

BTC is oscillating around a pivot zone NEAR $88,200-$89,000, where the 50-day and 100-day EMA100-day EMAs are converging. This compression of the EMAs is a sign of balance, not a sign that things are approaching a breaking point. As long as the price stays above the rising trendline from $84,400 and the 200-day EMA near $87,000, the overall structure remains constructive.

The candlestick action is backing that up as well. Recent sessions are showing spinning tops and small-bodied candles, which are more a sign of indecision than of selling off. The RSI has broken its short-term downtrend and is now above 55, suggesting momentum is strengthening.

If Bitcoin can close above $90,500, that WOULD resolve the triangle to the upside and open a path towards $92,800 and then $95,000. If it breaks below $87,000, though, that would be a blow to the setup and open the possibility of a move down to $85,800; at the moment, the structure is more likely to be on the upside.

What Could Trigger Bitcoin’s Next Major Move in 2026

With institutions soaking up supply and price compressing to a technical apex, the setup suggests preparation is underway, not exhaustion. Whether the next MOVE is a measured breakout or just another range expansion will define how quickly those $150,000 targets start looking realistic. For now, traders are betting on patience, and history suggests Bitcoin tends to reward it.

Maxi Doge: A Meme Coin Built Around Community and Competition

Maxi Doge is gaining traction as one of the more active meme coin presales this year, combining bold branding with community-driven incentives. The project has already raised more than $4.39 million, placing it among the stronger early performers in the meme token category.

Unlike typical dog-themed tokens that rely purely on social buzz, Maxi DOGE leans into engagement. The project runs regular ROI competitions, community challenges, and events designed to keep participation high throughout the presale phase. Its leverage-inspired mascot and fitness-themed branding have helped it stand out in a crowded meme market.

The $MAXI token also includes a staking mechanism that allows holders to earn daily smart-contract rewards. Stakers gain access to exclusive competitions and partner events, adding a passive earning component while encouraging long-term participation rather than short-term speculation.

Currently priced at $0.000276, $MAXI is approaching its next scheduled presale increase. With momentum building and community activity remaining strong, Maxi Doge is positioning itself as a meme coin focused on sustained engagement rather than one-off hype.

Click Here to Participate in the Presale