Asia’s Stablecoin Revolution: Korea and Japan Lead the Charge Beyond USD Dominance

Forget Tether. The next wave of stablecoin adoption is surging from the East—and it's not pegged to the greenback.

The Local Currency Gambit

While Western crypto markets obsess over Bitcoin ETFs and Fed rate cuts, Asian financial hubs are quietly building parallel systems. Japan's Financial Services Agency (FSA) green-lighting yen-pegged stablecoins wasn't just regulatory compliance—it was a declaration of monetary independence. South Korea's major exchanges, flush with retail capital, are now listing won-anchored digital assets at a breakneck pace.

Why This Cuts Deeper

This isn't merely about convenience for local traders. It's a strategic bypass of the USD-dominated corridor system that has governed global finance for decades. Every KRW or JPY stablecoin transaction settled on-chain is a silent snub to correspondent banking fees and SWIFT delays. The infrastructure being built today allows capital to flow within Asia with a speed and transparency that legacy rails can't match—and Wall Street's old guard is barely watching.

The Ripple Effect

The momentum creates a self-fulfilling prophecy. More liquidity in local stablecoins attracts more developers, which builds more use cases, which demands more liquidity. We're witnessing the early formation of regional digital currency blocs, with decentralized protocols as the new settlement layer. Traditional finance always underestimated crypto as a speculative toy; now it's becoming the plumbing for intra-Asian commerce right under their noses.

So, while portfolio managers in New York fret over basis points, a foundational shift is underway. The future of digital assets may not be written in dollars after all—it might be minted in yen and won. A delightful irony for an industry born in the shadow of the 2008 crisis: the real disruption isn't just creating new money, it's circumventing the old guard's favorite weapon—currency dominance itself.

The question now is, can non-USD stable coins MOVE beyond strategy and achieve real adoption in 2026?

Non-USD stablecoins in Asia: Japan and Korea Lead the Shift

Japan and South Korea emerged as early leaders in Asia’s non-USD stablecoin push. While other majors named as India, also stated the introduction of its own Rupee-backed set to launch in Q1, 2026, but it is yet to come out.

On the other hand, in October 2025, Japanese fintech firm JPYC launched what it described as the country’s first legally recognised yen-backed stablecoin.

Simultaneously, Japan’s three megabanks, MUFG, SMBC, and Mizuho, began pilot programs focused on Digital stable assets and tokenised deposits for payments, interbank settlement, and institutional finance.

In December, Japan’s Financial Services Agency publicly backed these initiatives.

Financial groups also moved quickly. SBI Holdings announced plans to work with blockchain firm Startale on fixed value coin issuance and infrastructure, signaling growing private-sector confidence.

South Korea followed a similar path. Crypto custody firm BDACS launched KRW1, a won-pegged stablecoin on Avalanche, aimed at global payments and remittances.

Another native currency– Won, backed token, KRWQ, debuted on Coinbase’s Base network, while KakaoBank advanced its stablecoin project into the development stage.

Although South Korea lacks a regulated or formal stablecoin framework, law makers have signaled one is in progress.

Market Reality: Strategy First, Scale Later

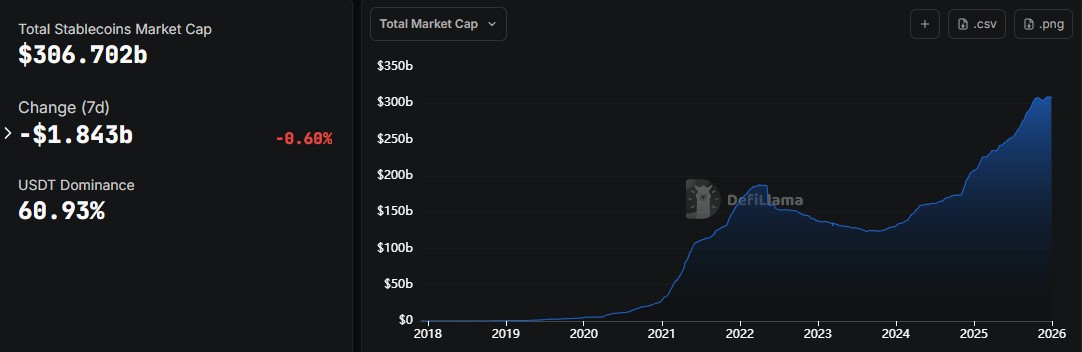

Although there is a lot of momentum, non-USD stablecoins still comprise a minute size. Where dollar-dominated stable digital coins still make up more than 60.9% of the total stable digital coins market capitalization worth, and yen-stablecoins comprise only $6.54 million. It is stated that projects revolve around diversifying and not replacing the dollar.

While it seems likely that 2025 will see a payments-first approach to use cases such as cross-border settlement payments, it is likely that Asia will be seen as a route between multiple stable currencies in the future, rather than a threat to dollar power, in 2026.