Ethereum Stablecoin Transfers Shatter Records: $8 Trillion in Q4 2025 Alone

Ethereum's stablecoin ecosystem just posted a quarter for the history books—moving more value than some national economies.

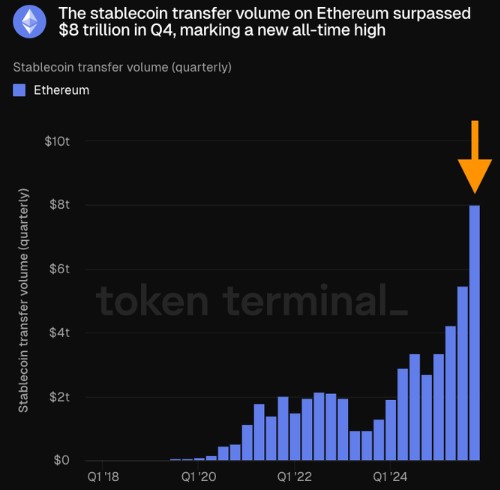

The $8 Trillion Quarter

Forget whispers of 'crypto winter.' The final three months of 2025 saw a staggering $8 trillion in stablecoin value change hands on the Ethereum network. That figure isn't just big; it's a seismic shift, highlighting how dollar-pegged digital assets have become the undisputed workhorses of blockchain-based finance. They're not just for trading anymore—they're settling invoices, powering payroll, and facilitating cross-border commerce at a scale that traditional rails can only dream of matching.

What's Fueling the Fire?

Several engines are driving this explosion. Institutional adoption is no longer a promise—it's a reality, with treasury departments and payment processors integrating stablecoin rails to bypass sluggish correspondent banking. The rise of decentralized finance (DeFi) continues to create insatiable demand for stable liquidity across lending protocols and automated market makers. Meanwhile, developers are building faster, cheaper layer-2 networks on top of Ethereum, making micro-transactions and frequent transfers economically viable for the first time.

The New Financial Plumbing

This isn't speculation; it's utility. Stablecoins are becoming the fundamental plumbing for a new global financial system—operating 24/7, cutting out middlemen, and providing transparency that legacy systems struggle to offer. While Wall Street debates basis points, Ethereum's network settles trillions in the background, proving that the real revolution isn't in the price of ether, but in the unstoppable flow of capital on its blockchain.

A final thought: that $8 trillion figure likely gave more than a few traditional bankers heartburn—after all, it's hard to charge a fat wire fee when the competition settles for pennies in seconds.

The number nearly doubled from around $4.2 trillion in Q3, showing how fast on-chain dollar activity is growing. So why is the network pulling so far ahead?

Ethereum Overtakes Traditional Finance Benchmarks

To put the scale in perspective, its Q4 stablecoins volume surpassed the SPDR S&P 500 ETF (SPY), which sees an estimated $3.4 trillion in quarterly trading value.

This comparison highlights how blockchain settlement rails are now handling value at a level once dominated by traditional financial markets.

Despite less hype than some newer chains, the network has become the main settlement LAYER for digital dollars, especially for large and institutional transactions.

What Drives the Record Surge?

Several factors pushed Ethereum’s stablecoin activity to new highs:

The Fusaka upgrade, which improved efficiency, throughput, and coordination between Ether and its Layer-2 networks

Rising institutional use, including DeFi collateral, trading, and treasury settlements

Growth in real-world asset (RWA) tokenization, where Ether hosts about 65% of on-chain RWA value

Stablecoins supply growth, with Ether ending 2025 at roughly $181 billion, up about 43% year over year

Network usage also climbed sharply. In December, the network recorded 10.4 million monthly active addresses, while daily unique senders and receivers crossed 1 million.

Ethereum vs. Solana: Different Strengths

Solana also grew rapidly in 2025, especially for low-cost, high-speed retail payments. Its stablecoin supply jumped to around $14.5 billion, up more than 170% year over year.

However, no available data shows solana approaching Ethereum’s $8 trillion quarterly transfer volume.

In simple terms:

Ethereum-dominates high-value and institutional flows

Solana excels at fast, low-fee retail transactions

Why This Matters Going Into 2026

Ether’s record quarter shows that stablecoins are no longer just a crypto trading tool. They are now used for payments, settlements, remittances, and institutional finance at global scale.

As more institutions MOVE on-chain and upgrades continue, its role as the backbone of the stablecoin economy looks stronger heading into 2026, even if it often goes unnoticed.