Ethereum Surges Toward $390 Billion Market Cap as Bulls Charge Forward

Ethereum isn't just climbing—it's rewriting the rulebook on digital asset valuation.

The $390 Billion Horizon

Watch that market cap ticker. Each upward move toward the $390 billion mark isn't just a number—it's a direct challenge to traditional finance's skepticism. While Wall Street analysts debate hypothetical valuations, Ethereum's network effect is doing the talking. It's building the infrastructure, while they're still drawing the blueprints.

Beyond the Price Pump

This isn't mere speculation. Real utility—DeFi, NFTs, layer-2 scaling—fuels this ascent. The network's activity creates its own gravity, pulling in capital and developers in a self-reinforcing cycle. Old-guard financiers might dismiss it as a bubble, but they're missing the tectonic shift underneath: code is eating their lunch, one smart contract at a time.

The New Math of Money

Forget price-to-earnings ratios. In crypto, value is measured in network security, developer mindshare, and protocol revenue. Ethereum's march toward a $390 billion valuation proves that digital scarcity and programmable money have their own calculus—one that leaves traditional metrics looking about as useful as a paper map in a space race.

So, is it sustainable? Only time tells. But one thing's clear: while the suits are busy forecasting, the network is busy building. And right now, building is winning.

This development shows its recent rally in 2026, which gained 8.34% in weekly surpassing the 6.3% up in monthly structure. With the ethereum market cap almost touching $390 billion ($389.21B), it shows strong buying interest.

With the current scenario, is ether price preparing for a sustained breakout in 2026?

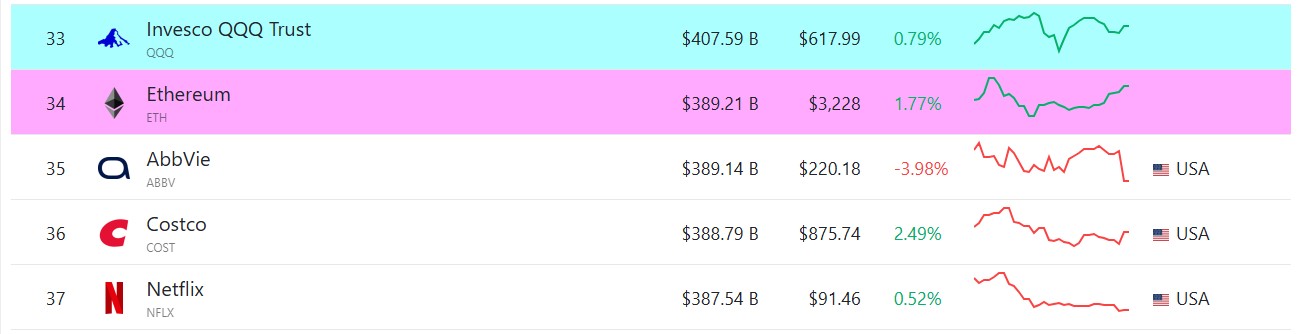

Ethereum Market Cap Jumps Past Netflix and Costco in One Day

Data from CoinGecko, supported by real-time pricing from Companies market cap, confirms that ETH market cap has moved above both Netflix, Costco, and AbbVie in quick succession.

This MOVE places Ether firmly at 34th place among global assets, a level it last approached during the 2021 bull marketplace. Unlike previous rallies, today’s growth is supported by stronger fundamentals and broader adoption.

Why Ethereum Price Is Rising in 2026

Ether price moved above important short-term levels:

7-day average: $3,079

30-day average: $3,034

This move usually attracts more buyers. Momentum indicators also look positive. The RSI is at 65, which shows strength but not overheating yet.

Ether completed major upgrades in 2025, i.e., Pectra and Fusaka, that improved scalability and reduced transaction costs. Layer-2 networks now handle most activity, making ETH faster and more affordable for users and developers.

More upgrades – Glamsterdam and Hegota, planned for 2026 which aims to increase efficiency further, with 10,000+ TPS target on L1, strengthening its role as a global blockchain platform.

Ethereum ETFs attracted strong inflows of around 10 billion in 2025, and early 2026 shows fresh interest from institutional investors. Many institutions are also staking ETH, earning yield while holding for the long term, for example: Grayscale's ETHE distributing rewards from January 2026

This behavior reduces selling pressure and supports steady market cap growth.

$ETH remains the leading network for stablecoins, decentralized finance, and tokenized real-world assets. Businesses and financial institutions increasingly rely on Ether for payments, settlement, and asset issuance.

This shift from speculation to real usage is helping its market cap grow on stronger foundations.

After Ethereum, What’s Next Coin on the Line Of Breakthrough

After Ether, solana is widely seen as the next altcoin to break the narratives. Ethereum’s rise is driven by strong buying, institutional interest, and its role in stablecoins and DeFi, which supports its growing marketplace value.

At the same time, Solana continues to attract users with faster transactions and very low fees, making it popular for trading and consumer apps. The asset also gained fast with up 11.78% in weekly, and 4.85% in yearly with current value at $138.84. U.S. Solana ETFs also showed a significant inflow of $16.8M, hinting at strong institutional interest.

This shows that Ethereum’s current rally is powered by deeper fundamentals, positioning it as the backbone for major crypto and financial activities, whereas Solana captures speed-oriented, consumer-driven demand.

Final Thought

Ethereum price is rising because of strong buying, improving market mood, and high trading volume. The move looks healthier than short-lived rallies seen in the past.

While risks remain, the current data suggests ethereum price has momentum on its side right now.

Market data is based on publicly available sources and may change rapidly.