Fear Returns: Why Are Crypto Prices Crashing Today? BTC, ETH, XRP in Freefall

Crypto markets just got a brutal reality check. The digital asset space is awash in red as a wave of fear sweeps through portfolios, sending major tokens like Bitcoin, Ethereum, and XRP tumbling. This isn't a minor correction—it's a full-blown sentiment shift that's got traders scrambling.

The Fear & Greed Index Plummets

Remember the euphoria from last week? Gone. Market sentiment has flipped from greedy to fearful in a matter of hours. That collective confidence that was pushing prices toward new highs has evaporated, replaced by a classic 'sell first, ask questions later' mentality. It's a stark reminder that in crypto, sentiment is the ultimate catalyst.

Liquidity Gets a Stress Test

Watch the order books thin out. As prices drop, buy-side liquidity often vanishes, accelerating the downward move. It's a self-fulfilling prophecy of panic—large sell orders hit a market with few willing buyers, creating gaps that spook even the most hardened HODLers. This is where paper hands get separated from diamond hands, and not everyone passes the test.

A Healthy Pullback or Something More?

Every bull market needs a breather. Sharp corrections shake out leverage and reset overbought conditions, theoretically creating a healthier foundation for the next leg up. But this feels different. The speed of the decline suggests something beyond simple profit-taking—perhaps a macro tremor or a sector-specific shock that hasn't fully surfaced yet. Traders are now parsing every piece of news, looking for the culprit.

Traditional Finance Watches and Waits

From the sidelines, your average Wall Street portfolio manager is probably sipping coffee, muttering something about 'speculative excess' and 'unproven asset classes.' It's the same cynical jab they've used for a decade, conveniently ignoring their own history of bubbles and bailouts. Their hesitation, however, means less institutional buy-in to cushion the fall.

What's Next for BTC, ETH, and XRP?

The path forward hinges on where support forms. Do major levels hold, or do they crack under pressure? The next 24-48 hours will be critical. This crash isn't just about price—it's a test of the market's underlying structure and conviction. Strap in; volatility is back on the menu.

Why Is Crypto Down Today? Key Reasons Behind the Fall

Why is crypto Down Today when no major negative headline hit overnight? Price action itself tells part of the story.

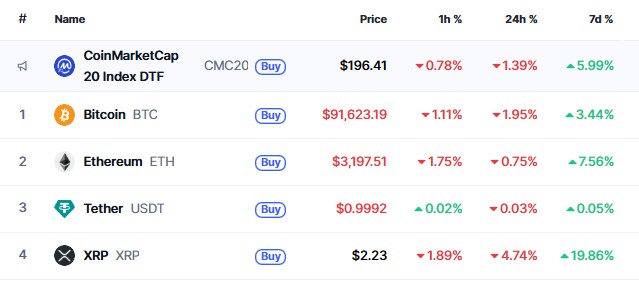

According to CoinMarketCap data:

Bitcoin Price Today is $91,631.44, down over 2%

Ethereum price today is $3,199.07, down 0.66%

XRP dropped sharply by 4.75% and is trading near $2.23

When large assets fall together, it usually points to traders reducing risk rather than reacting to a single coin issue. This is often the first sign of a short-term pullback, not panic selling.

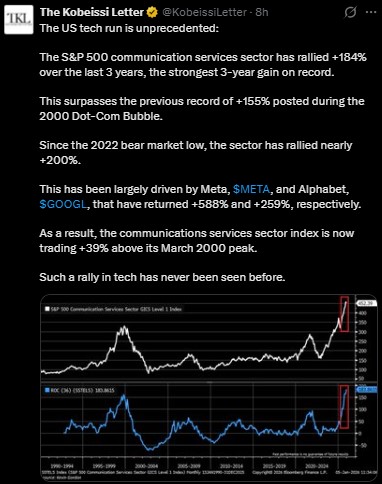

Another major reason behind why the market is down today is happening outside digital assets. According to The Kobeissi Letter, the S&P 500 communication services sector is up 184% over the last three years. That beats the 2000 dot-com peak. Since the 2022 low, the sector is up nearly 200%, led by Meta (+588%) and Alphabet (+259%).

The index is now trading 39% above its March 2000 peak. Such strength in stocks often pulls large capital toward traditional assets. This supports the view that some large holders are temporarily shifting funds, increasing pressure on digital assets.

Security concerns also played a role in why crypto market is falling today. On January 6, 2026, a suspicious transaction hit the USDC Fusion Optimizer Vault on Arbitrum. A legacy vault lost $336,000 USDC. While this is a small fraction of total funds, it reminded traders how smart contract risks still exist.

The concern was first raised by cybersecurity firms Hexagate and Blockaid, but SEAL is assisting with remediation. However, occurrences like this can produce a degree of short-term fear among parties, which leads to a degree of circumspect trading activity.

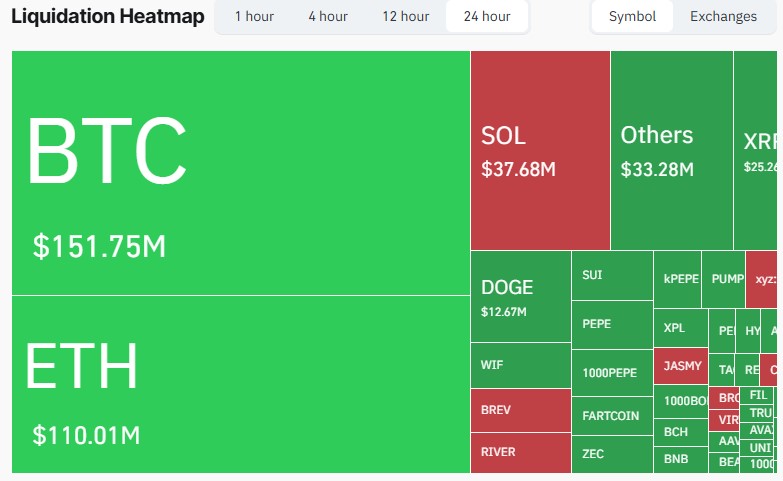

Another factor contributing to the current downturn in cryptocurrency markets is forced selling. According to data by Coinglass, in the last 24 hours, the following activities were recorded:

125,307 traders were liquidated

Overall liquidations reached $465.07 million

The biggest order in a single execution related to a BTC-USD liquidation worth $11.27 million on the Hyperliquid platform

As leverage grows through the rally, sometimes even a slight pullback starts a Ripple effect. This selling further feeds into overcorrection.

Crypto remains in fear territory; the sentiment charts are also responsible for the drop in the crypto market on this day. Current reading of the Fear and Greed Index for crypto is 42, which is still in the fear zone. While it did manage to recover from the fear levels of around 20 last month, it is still holding on to that level.

Will Market Recover or Crash Further?

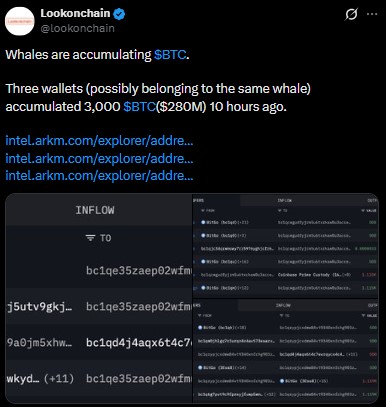

Despite today’s drop, this looks more like a correction than a full crypto market crash. Importantly, on-chain data shows confidence from large holders. According to Lookonchain, three linked wallets accumulated 3,000 BTC worth roughly $280 million just 10 hours ago. Accumulation during dips often signals long-term conviction.

In addition, Tom Lee Ethereum prediction remains extremely bullish. He has estimated Ethereum could rise toward $250,000 long term, valuing the network near $30 trillion. He also sees Bitcoin reaching $250,000 by 2026. Some interpret this as a sign that the market could recover.

Conclusion

Why is Crypto Down Today comes down to profit-taking, stock market strength, liquidations, and short-term fear. With whales buying and long-term forecasts like Tom Lee Ethereum prediction staying bullish, this dip looks corrective, not destructive. Traders now watch for stabilization before the next move.

This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.