Zcash Developer Exodus Triggers Market Panic: ZEC Price Plummets Amid Leadership Crisis

Core developers walk—markets tumble. The Zcash ecosystem faces its most severe internal crisis to date as key architects abandon ship, sending the privacy-focused cryptocurrency into a tailspin.

The Great Departure

Multiple founding engineers and protocol specialists have tendered resignations, leaving critical development roadmaps in limbo. The exodus wasn't a coordinated exit but a cascade—one resignation triggering another, exposing fragile governance structures. Internal memos suggest disagreements over treasury allocation and protocol direction reached a breaking point.

Market Reaction: Pure Capitulation

Trading floors lit up with sell orders the moment news hit encrypted channels. ZEC/USD charts show a classic panic dump—liquidity vanished, bid walls collapsed, and stop-losses triggered a cascade. The drop wasn't a correction; it was a repricing of risk based on fundamental project viability. Volume spiked to quarterly highs, almost entirely on the sell side.

Privacy Tech's Persistent Paradox

Zcash's signature shield pools and zk-SNARKs remain technically sound, but code doesn't build itself. The developer drain raises existential questions: who maintains the complex cryptographic machinery now? Competing privacy chains like Monero and emerging L2 solutions are already circling, marketing their 'stable teams' and 'predictable governance'—a direct jab at Zcash's turmoil.

The Road Ahead: Fork in the Codebase?

Community forums are buzzing with talk of emergency grants, governance overhauls, and even potential hard forks. Without core maintainers, network upgrades could stall. The Zcash Foundation faces a brutal triage: recruit expensive external talent, simplify the protocol roadmap, or risk technical debt snowballing into security vulnerabilities.

Investor Takeaway: Trust, Verify, Then Verify Again

This isn't just a 'buy the dip' moment. It's a stark reminder that in crypto, the smartest contracts can't fix human disagreements. The market is voting with its wallets—and right now, it's pricing Zcash like a project in intensive care, not one on the innovation frontier. Another case of brilliant technology meeting the messy reality of funded development—turns out, even privacy coins can't hide from boardroom drama.

Source: X (formerly Twitter)

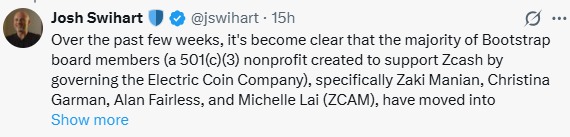

According to Swihart, several Bootstrap board members: Zaki Manian, Christina Garman, Alan Fairless, and Michelle Lai, pushed changes that no longer aligned with Zcash’s original privacy mission. Rather than compromise, the entire team chose to leave.

What Happened After the Zcash Developer Team Resigned?

The news spread quickly. Swihart confirmed that the developers are now planning to start a new company focused on building what he called “unstoppable private money.” Importantly, he also clarified that the protocol itself is not broken.

Source: X (formerly Twitter)

The co-founder Zooko Wilcox echoed this point, saying the network is open-source and will continue running. However, the sudden exit of the original builders raised serious concerns about Zcash’s future roadmap. This uncertainty is what scared the market.

ZEC Price Reacts as Confidence Takes a Hit

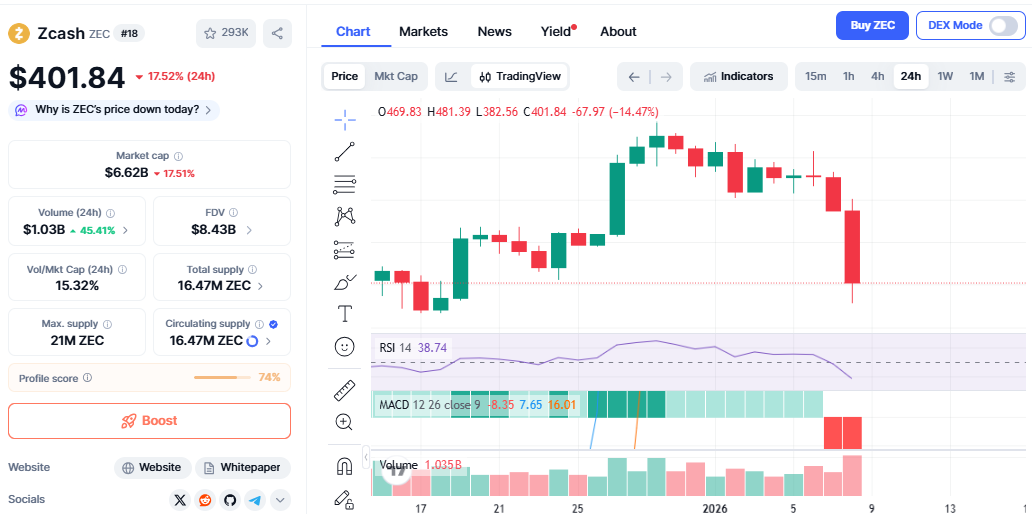

After the resignation, the ZEC price crashed. In the last 24 hours, ZEC has fallen more than 16%, sliding from above $480 to near $401.

Source: CoinMarketCap ZEC Chart

The trading volume surged more than 44% to about $1.03 billion, suggesting panic selling rather than a composed profit-taking. Many investors scrambled to exit positions as questions piled up on leadership and long-term development.

While Zcash had performed well earlier, governance risk quickly erased recent gains.

Technical Signals Turn Bearish After the Resignations

It broke below key moving averages near the $460–$470 zone, which had been acting as strong support.

The RSI is below 40, which indicates weak momentum as well as strong selling pressure.

Moreover, the MACD is bearish, which reaffirms the fact that the sellers are in control.

These signals emerged as the reason for the acceleration in the price decrease rather than it becoming stable.

Why Does This Governance Crisis Matters?

It is a privacy-focused blockchain, which derives a lot of value from having active, skilled developers working on maintaining and improving it. Then, when the Core development team stepped down, it raised concerns of who was going to provide upgrades, security, and long-term vision.

This is not a protocol failure; it's a leadership and governance crisis. History has shown that prices tend to stay under pressure until clarity returns after the sudden exit of CORE teams from the project.

ZEC Price Prediction: What Comes Next?

If selling pressure continues, it could test the $440 support level shown on the chart. A bounce is possible if buyers step in NEAR oversold levels.

If confidence does not return and volume stays high on red candles, ZEC could slip toward the $400 zone before stabilizing.

If Bootstrap quickly provides a clear development plan and leadership roadmap, ZEC may reclaim the $460–$480 range. However, this likely needs strong communication and time.

Final Thoughts

The Zcash development team has resigned. The market reacted accordingly. Although the Zcash network still operates normally, a lack of leadership has dented confidence. The extent to which ZEC prices will fare depends on how soon leadership stability returns.

This moment could very well set the tone for what comes next for the project, a comeback tale or a rebuilding process.

This article is for informational purposes only and does not constitute any financial advice, kindly do your own research before investing in crypto markets.