Crypto Market Dips 0.6%: BTC & ETH Slightly Drop - What’s Next for Digital Assets?

Crypto markets catch a breath—0.6% dip signals a pause, not a panic.

Bitcoin and Ethereum lead the slight retreat, showing resilience amid typical volatility. The move feels more like a market recalibration than a fundamental shift. Traders are watching key support levels, while long-term holders barely flinch.

Behind the Numbers

That tiny 0.6% slip? Barely a blip in crypto's wild ride. It's the kind of movement that gets traditional finance analysts sweating over their spreadsheets—meanwhile, decentralized networks keep humming along, indifferent to daily price gyrations. The dip reflects minor profit-taking, not a loss of faith in the underlying tech.

Big Players Hold Steady

BTC and ETH's modest drops suggest institutional positioning remains intact. No mass exodus, just routine portfolio adjustments. The real story isn't the slight decline—it's the absence of panic selling. Volatility is crypto's native language, and today's whisper-quiet movement speaks volumes about maturing market psychology.

Finance's favorite pastime: overanalyzing microscopic market moves while missing the revolution happening right under their polished desks. Crypto doesn't need their approval—it just needs their outdated infrastructure to get out of the way.

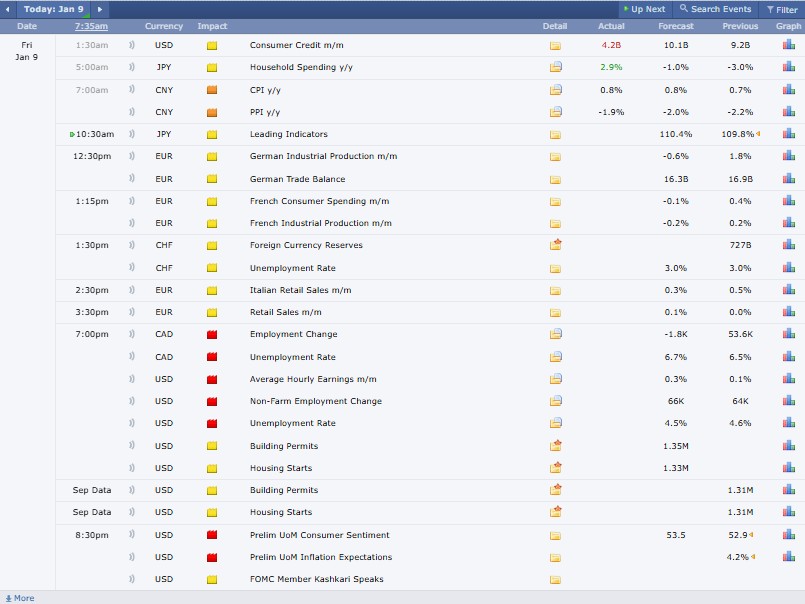

Major Crypto Events Today

Source: Forex Factory

24-Hour Crypto Market Update: Prices, Volume & Trends

The global cryptocurrency market today recorded a capitalization of $3.19 trillion, reflecting 0.6% downward trend in the last 24 hours. Total trading volume noted $122 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 56.9%, while ethereum (ETH) carries 11.7%. As of now, 18988 cryptocurrencies are being tracked. The largest gainers of the industry are Polkadot and XRP Ledger Ecosystem in the last 24 hours.

Note: BTC and ETH are often viewed as less volatile historically, but still risky.

Bitcoin (BTC) price today reached $91309.09, slipping 0.15% in the last 24 hours, with a trading volume of $42.49 billion and a market cap of $1.82 trillion.

Ethereum (ETH) is priced $3125.51, slightly dipping 1.52% in 24 hours with a trading volume of $21.68 billion and a market cap of $377.23 billion.

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

Bitcoin (BTC) is trading at $91,297.63, down 0.05%, with a strong trading volume (TV) of $42.45 billion.

Zcash (ZEC) is priced at $433.53, falling sharply by 9.84%, while recording a TV of $1.51 billion.

$XRP price today valued at $2.13, declining 2.09%, and posting a TV of $4.53 billion.

Ethereum (ETH) is trading at $3,124.43, down 1.48%, with $20.34 billion in TV.

Solana (SOL) price is at $139.01, gaining 1.44%, with a TV of $4.81 billion.

(Ranked by 24-hour percentage gain)

JasmyCoin (JASMY) is trading at $0.009562, rising 12.98%, with strong trading activity of about $143.51 million.

Polygon (POL), previously known as MATIC, is priced at $0.1393, gaining 7.43%, and recording a trading activity of nearly $143.47 million.

Monero (XMR) is trading at $455.01, up 5.01%, with trading activity of around $133.38 million.

(Ranked by 24-hour percentage loss)

Zcash (ZEC) price is at $433.55, down 9.83%, with heavy selling pressure reflected in a trading volume of about $1.5 billion.

Pump.fun (PUMP) is priced at $0.002172, slipping 8.25%, while recording a trading volume of roughly $148.2 million.

Pepe (PEPE) is trading at $0.056073, down 7.89%, with strong activity seen in a trading volume of nearly $744.9 million.

Stablecoins noted no changes over the past 24 hours, with a market capitalization of $311.8 billion and trading volume of $100 billion.

The Decentralized Finance (DeFi) market declined 1.6% over the last 24 hours, recording a market cap of $110.6 billion and trading volume at $4.26 billion. Defi dominance globally marked 3.5%.

Fear and Greed Index Today

Source: Alternative Me

Source: Alternative Me

Today’s Fear and Greed Index stands at 27 (Fear), down from 28 yesterday and last week, but above 26 last month. The slight drop reflects continued market caution, driven by falling prices, profit-taking, and uncertainty from regulatory and security-related crypto developments.

Latest Crypto Market News Today, 9 January

(Note: All of these updates affect traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

Arkham announced it will end support for the Blast and Manta blockchains on January 11, citing low user demand and regular reviews of chain relevance within the crypto ecosystem overall.

Cyvers Alerts traced a suspicious Truebit Protocol transaction, potentially losing $26 million and 8,535 ETH. Truebit has confirmed a breach and warned its users, reported the incident to the authorities and stopped communicating with the affected contract.

The tax authority of Colombia, DIAN, will compel crypto platforms to declare Bitcoin, Ethereum, and stablecoin transactions as of 2026, which is in accordance with OECD standards, and non-compliance with which will be punishable, and large transactions will automatically be reported.

SharpLink Gaming staked $170M worth of ETH on Ethereum Layer 2 Linea, aiming for higher returns. The firm holds 864,800 ETH, even as Linea’s TVL has dropped sharply since the token launch

CFTC issued a no-action letter to Bitnomial Exchange, allowing it to launch fully collateralized event contracts in the U.S., covering crypto, economic indicators, and financial outcomes under reporting conditions rules.

President TRUMP said there are no plans to pardon ex-FTX CEO Sam Bankman-Fried, jailed for fraud, noting slim chances, while defending his crypto support and saying it helped win votes.

Comparative Insight

The crypto update January 8, as compared to January 9, is slightly weaker than it was yesterday, with the overall cap falling (from $3.2T and $3.19T). Key assets like Bitcoin and Ethereum show mild losses from yesterday. Trading volumes remained strong, but losses widened among select altcoins, indicating rising short-term caution and profit-taking behavior.

What This Means for Crypto Users

Users of crypto are advised to be on high alert as the mixed price action, falling DeFi metrics, and regulatory developments could affect the liquidity and volatility. The short-term movements are still sentiment-based and thus close monitoring of news, volumes, and trends is crucial.

Risk Context: This commentary is only informational and not for long-term conditions. It does not indicate the direction of the price or indicate an action to be taken on the investment.

CoinGabbar’s Opinion

Based on the 24-hour crypto update, investments remain high-risk but selectively beneficial. Volatility persists, favoring informed traders over long-term speculation. Cautious positioning, risk management, and research are crucial in current conditions.

Disclaimer: This is not financial advice. Do Your Own Research before investing. CoinGabbar is not liable for any financial loss. The crypto assets are risky, and you may lose all your investments. Not all regions can offer some of the services or assets discussed.