Bitcoin Price Alert: Risk of Dropping Below $90K as Whales Trigger Sell-Off

- Why Bitcoin’s Short-Term Holders Are Losing Faith

- RSI Suggests More Pain Before Gain

- The $86.2K Liquidation Bomb

- Critical Support Levels to Watch

- Q&A: Your Bitcoin Concerns Addressed

Bitcoin’s recent struggle to hold above key support levels has traders on edge. With the cryptocurrency hovering near $90,000, analysts warn of a potential cascade if liquidation triggers hit. This article dives into the STH cost basis, RSI signals, and liquidation heatmaps—plus why the next 48 hours could decide BTC’s short-term fate. Spoiler: It’s not just about the charts; macro uncertainty and weak hands are playing their part.

Why Bitcoin’s Short-Term Holders Are Losing Faith

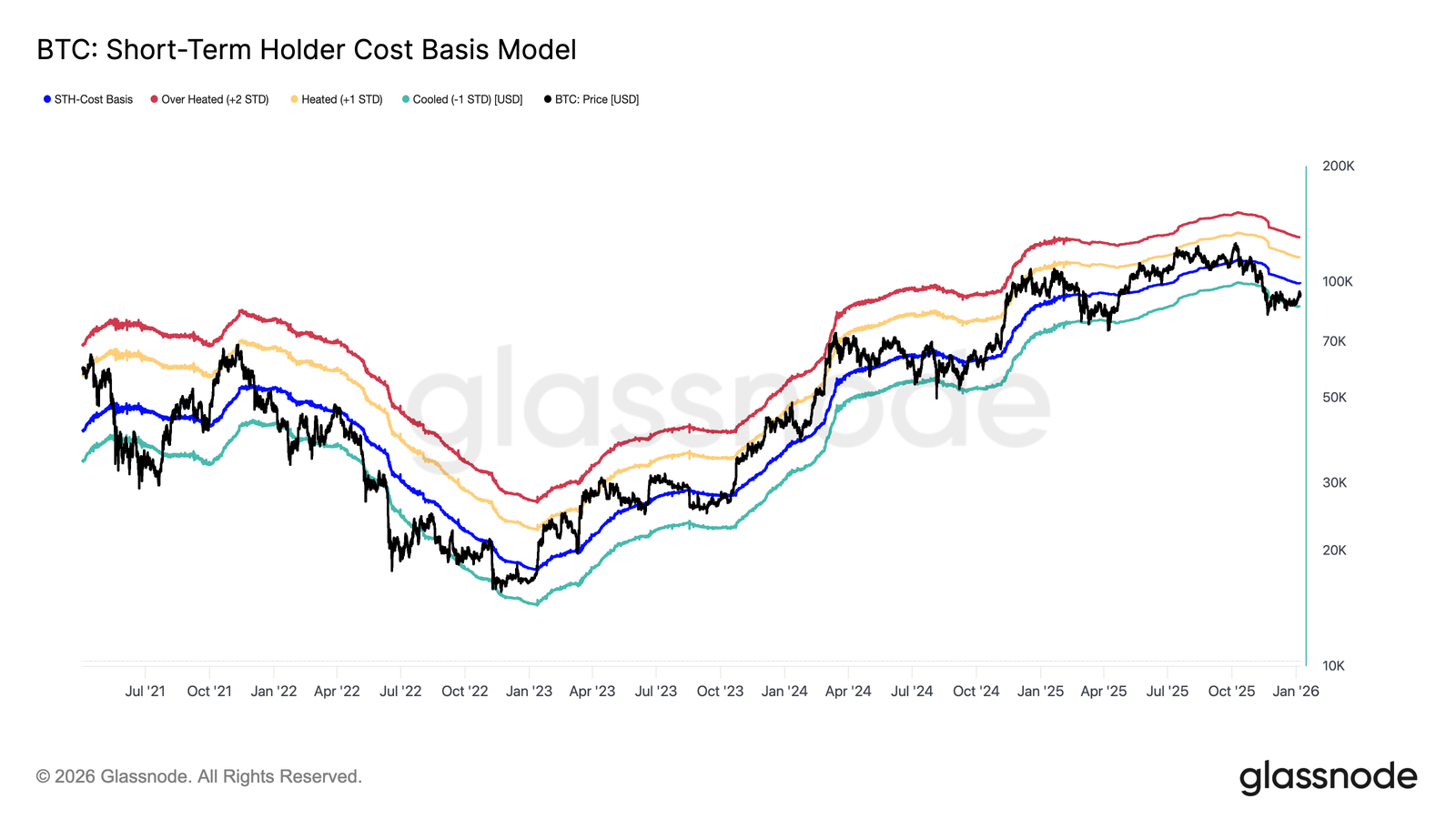

The bitcoin market is flashing amber alerts as short-term holders (STH) show dwindling conviction. Glassnode’s STH cost basis model—a critical benchmark during trend transitions—reveals BTC briefly stabilized near the -1 standard deviation band in December, reflecting fragile equilibrium. The rebound to the model’s mean at $99,100 typically signals renewed confidence, but Bitcoin remains stuck below this level. Historically, failure to reclaim this zone precedes defensive market positioning rather than accumulation phases. As one BTCC analyst noted, "Until BTC closes above $99.1K, recovery signals remain half-baked."

RSI Suggests More Pain Before Gain

Momentum indicators echo the caution. Bitcoin’s RSI (Relative Strength Index) hasn’t yet plunged to the 38.1 threshold that historically marks capitulation—a sign selling pressure isn’t exhausted. TradingView data shows the RSI hovering at 42, a no-man’s-land where bounce attempts often fizzle. "We’ve seen this movie before," says a veteran trader. "Without a deeper momentum reset, rallies get sold into."

The $86.2K Liquidation Bomb

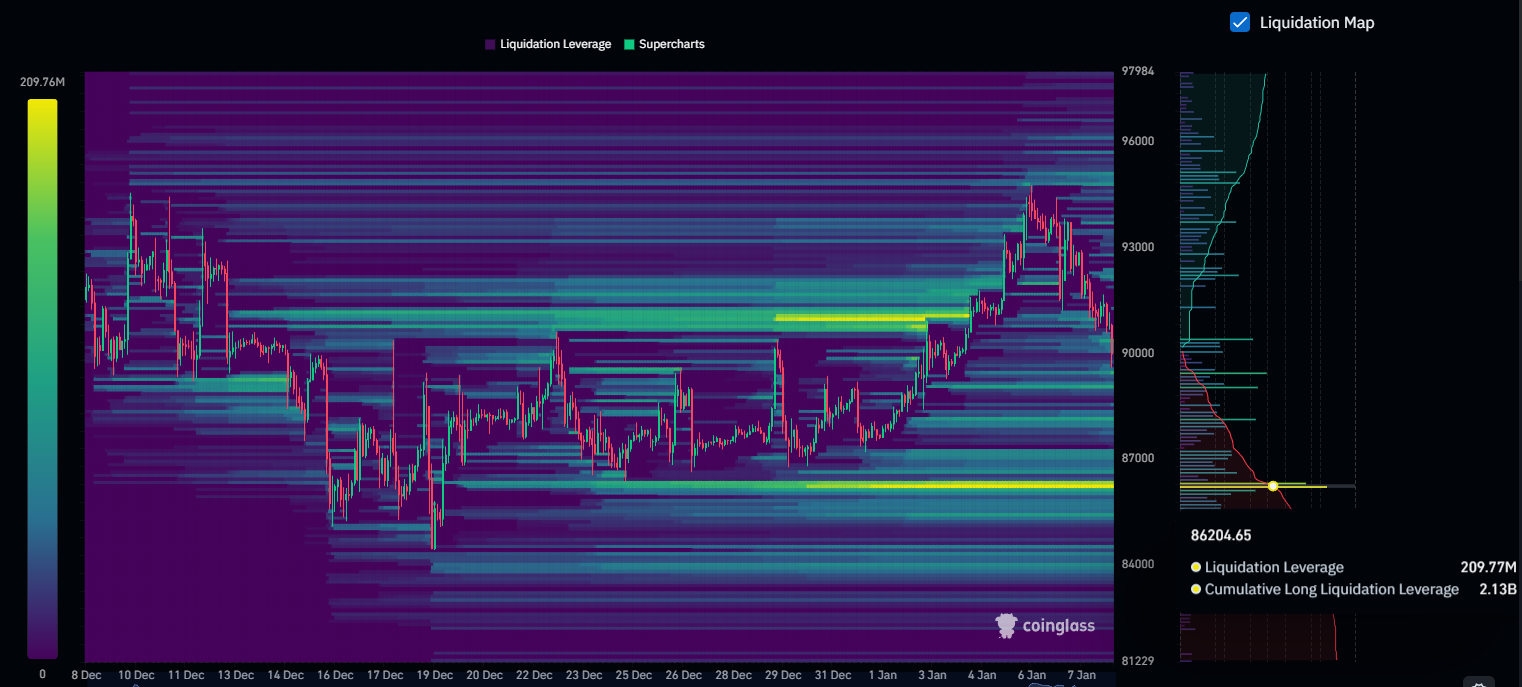

Derivatives markets reveal a lurking danger: $2.13 billion in Leveraged long positions cluster near $86,200 (Coinglass data). A dip into this zone could trigger automated sell-offs, accelerating declines. While liquidation zones sometimes act as magnets, they’re also volatility hotspots. "It’s like walking past a sleeping bear," quips a BTCC strategist. "You hope it doesn’t wake up hungry."

Critical Support Levels to Watch

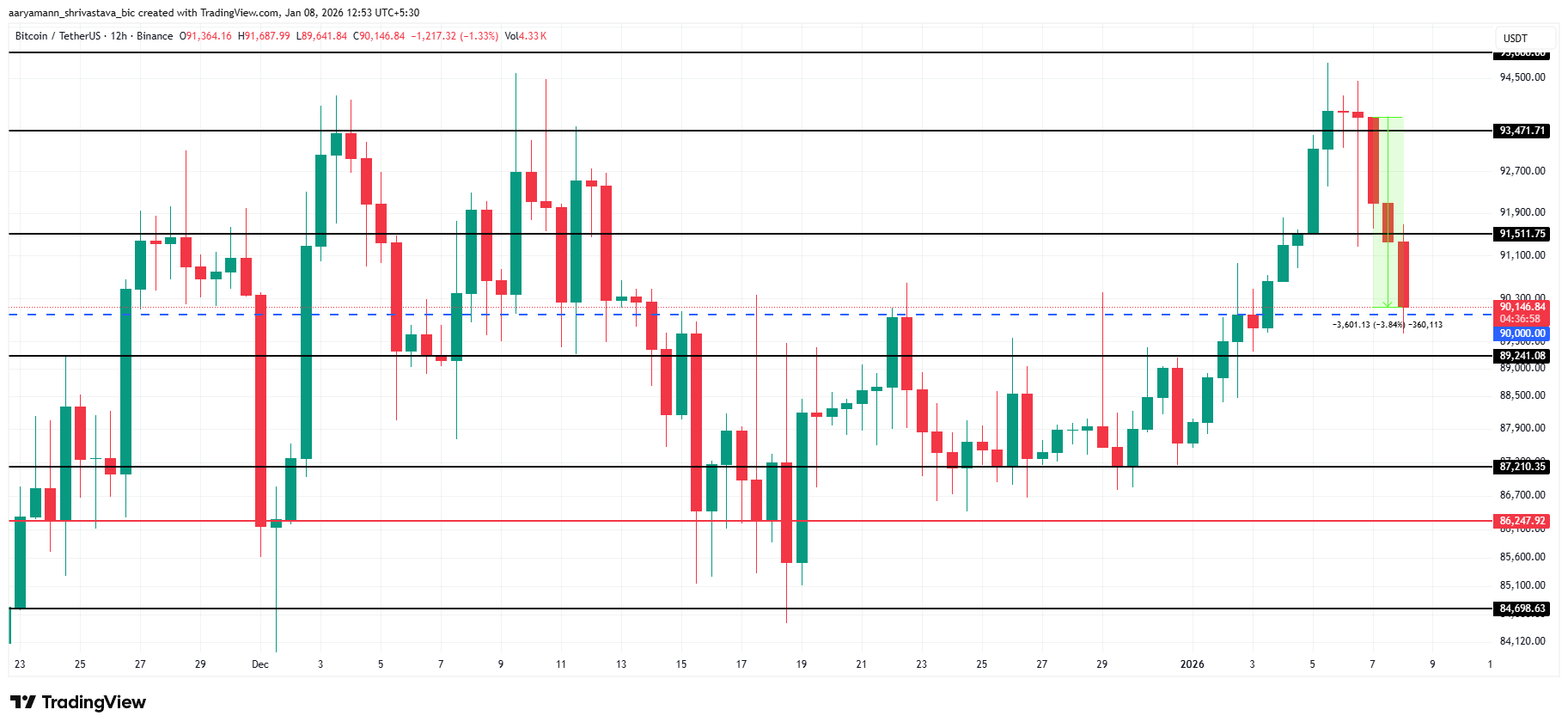

At press time, Bitcoin claws at $90,146—barely above psychological support. Key levels in focus:

- $89,241: Breach could accelerate selling

- $87,210: Previous reaction zone

- $86,247: Make-or-break level where prior sell-offs stalled

The bull case? A rebound past $91,511 could invalidate the bearish thesis and target $93,471. But with macro headwinds and tepid demand, the path of least resistance looks… well, resistant.

Q&A: Your Bitcoin Concerns Addressed

Why is $90K so important for Bitcoin?

Psychologically, round numbers like $90K act as mental anchors for traders. Technically, it’s defended by stop-loss orders and algorithmic trading levels—break it, and automated selling amplifies.

Could Bitcoin really drop to $86K?

Absolutely. The liquidation cluster at $86.2K creates a "gravity well." If BTC loses $89K, the cascade risk grows. That said, markets love to punish the obvious trade—watch for fakeouts.

What would signal a trend reversal?

Three green lights: 1) STH cost basis reclaim ($99.1K), 2) RSI reset below 38, and 3) derivatives open interest flushing out. Until then, assume we’re in a wrestlemania.