Sharplink’s Ethereum Staking on Linea Just Made Institutional Adoption Inevitable

Institutional confidence in crypto just got a major, tangible upgrade—and it's not coming from a legacy bank.

The Infrastructure Play That Changes Everything

Sharplink's deployment of Ethereum staking directly on the Linea network bypasses the clunky, multi-step processes that have kept traditional finance on the sidelines. It cuts settlement times from days to minutes and slashes the operational overhead that makes CFOs wince. This isn't just another protocol update; it's the rails for serious capital.

Why Linea? Why Now?

The move targets scalability and cost—the twin demons of institutional entry. By leveraging Linea's zk-rollup architecture, Sharplink delivers Ethereum's security with a transaction fee structure that doesn't look like a predatory late fee from a credit card company. It turns staking from a niche technical play into a streamlined treasury management tool.

The Confidence Metric

The real signal isn't in the code—it's in the capital flows. This kind of infrastructure build-out acts as a magnet for institutional liquidity, providing the compliant, auditable, and efficient pathway that fund managers have been waiting for. It effectively answers the 'how' for billions waiting on the sidelines.

A New Era for Digital Asset Strategy

Forget speculative trading. This is about core portfolio allocation. Sharplink's framework treats staked ETH as a yield-generating digital asset, fitting neatly into existing risk models and investment mandates. It's the bridge between crypto-native tech and institutional-grade finance.

The launch proves that the biggest barrier to institutional crypto wasn't skepticism—it was shoddy infrastructure. Now that it's being fixed, the old guard's reluctance is starting to look less like prudent caution and more like a failure to adapt. The smart money is building the future, not just debating it.

SharpLink Deploys $170 Million in ETH on Linea

SharpLink Gaming has deployed and staked around $170m worth of ETH on Linea, a layer-2 network. With this move, SharpLink now holds close to 864,800 ETH, worth nearly $2.7 billion.

Source: X (formerly Twitter)

That makes SharpLink the second-largest public Ethereum treasury firm, just behind Bitmine.

A key detail here is leadership. SharpLink’s chairman is Joseph Lubin, who is also the founder and CEO of Consensys. Consensys is the company that incubated Linea.

This shows the decision was not random. It was planned, strategic, and clearly long-term.

Why Does Linea Matters Even After TVL Fell?

Linea’s Total Value Locked has dropped sharply since its token launch.

• Peak TVL: $1.64 billion

• Current TVL: around $186m

• Decline: nearly 89%

Normally, such a drop scares investors away. But this staking news suggests the opposite. Big players are willing to move in when activity is low, not when HYPE is high.

Staking ETH on Linea helps the network stay secure and boosts activity, sending a strong signal that the insiders still believe in its future.

The ETH Staking Strategy Adds More Confidence to Bitmine.

Bitmine has recently invested another $105 million into this cryptocurrency, bringing the total balance to over 4.07 million tokens-about 3.36% of the total supply. The company aims to get to 5% of this crypto’s supply by 2026.

Bitmine’s ETH staking reaches 1.032m tokens, with more than $2.87 billion locked. With $915 million still available in reserves, Bitmine clearly sees this digital currency as a long-term asset.

Together, Sharplink and Bitmine Ethereum Staking show that institutions are accumulating, not exiting.

Why Is the Ethereum Price Down Today?

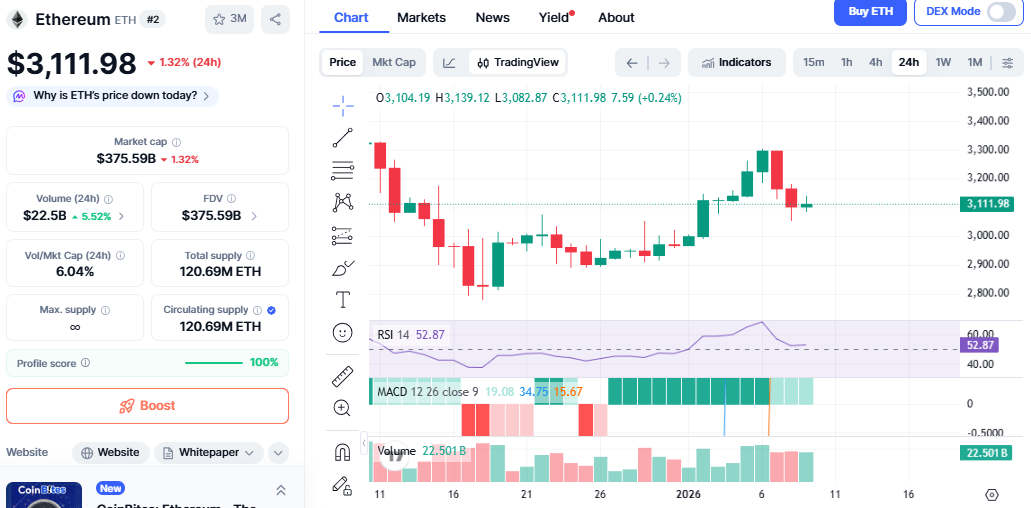

The price slipped around 1.32% in the last 24 hours, trading NEAR $3,112. This drop is not random.

• $159.9 million in outflows from U.S. spot ETH ETFs as per Sosovalue data.

• $116 million in this crypto's long liquidations after Bitcoin fell below $90,000

• A $26.4 million exploit linked to Truebit, hurting short-term sentiment

Still, it remains up over 3% this week, showing buyers are not gone.

Ethereum Price Prediction

It is holding a key support zone between $3,080 and $3,120. RSI is near 52, which means the market is balanced, not over-sold. MACD is positive but slowing, suggesting consolidation.

Source: CoinMarketCap Chart

If it stays above $3,080, a MOVE toward $3,280–$3,350 is possible. If support breaks, it could dip toward $2,950 before buyers step back in.

Final Thoughts

Sharplink Ethereum Staking is not a short-term trade. It is a clear message from institutions that it is becoming a productive treasury asset. While prices may stay volatile, smart money appears to be positioning early, not running away.

YMYL Disclaimer: This article is for informational purposes only, kindly do your own research before investing.