BTC and ETH Options Expiry: Is This the Recovery Spark for Bitcoin and Ethereum?

Options expiry day hits crypto markets—again. Billions in BTC and ETH contracts mature, setting the stage for a volatility showdown. Will this be the catalyst that finally flips the script?

Max Pain Theory Meets Market Reality

Traders watch the 'max pain' price—the strike where most options expire worthless. It's the invisible hand that often pulls spot prices toward it in the final hours. For Bitcoin and Ethereum, that magnetic point now becomes ground zero. Will bulls or bears feel the most pain when the clock runs out?

Liquidity Squeeze or Launchpad?

Major expiries don't just settle bets; they unlock or destroy massive collateral. That capital either floods back into the market or vanishes from the order books. The resulting liquidity shock can fuel a violent rebound—or trigger the next leg down. Market makers hedge their exposure right up to the wire, often amplifying price swings.

The Post-Expiry Playbook

History shows a pattern: volatility spikes, then consolidates. The real move often comes 24-48 hours after settlement, once dealer gamma hedging unwinds. Smart money watches for that window—when technicals clear and the market's true direction emerges. Forget the expiry noise; the follow-through tells the tale.

Broader Signals in the Chaos

Options markets are sentiment gauges. A skewed put/call ratio reveals whether fear or greed dominates. This expiry's structure hints at positioning: are institutions building for a rebound or bracing for more pain? The answer often leaks into spot prices before the headlines catch up.

So, recovery or dead cat bounce? The options flush clears leveraged overhang—a necessary purge for any sustainable rally. But in crypto, 'fundamentals' sometimes just mean whose leverage gets liquidated last. One trader's expiry pain is another's portfolio gain—welcome to decentralized finance, where the house always wins, even when there isn't one.

BTC and ETH Options Expiry Data Shows Strong Price Pinning

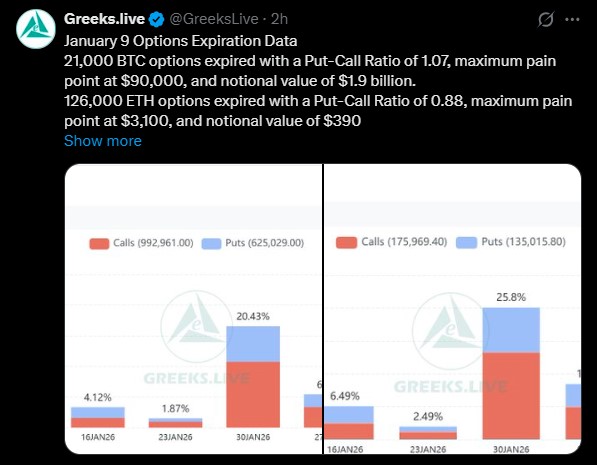

According to Greeks.live on-chain data, bitcoin options expiry today hit around 21,000 ground with a Put-Call Ratio of 1.07, indicating a bit of bearish sentiment. The max pain point for $BTC is $90,000, with a total value of $1.9 billion.

On the other hand, 126,000 ethereum options expired, showing a Put-Call Ratio of 0.88 and a max pain of $3,100, with $390 million in value.

Even though this expiry was small, making up only 7% of total open interest, it helps explain why BTC and ETH news feels calm despite recent ups and downs.

Market makers usually prefer prices to stay around these levels until expiry is over.

What’s $BTC Price Impact? Holding $90K as Derivatives Pressure Eases

Right now, it is trading at $90,005, with 24-hour trading volume down nearly 9% to $39.3 billion as per TradingView price chart technical analysis.

Data signals weak momentum but not panic. The Relative Strength Index (RSI) on the 2-hour chart is NEAR 40, close to oversold, while the Moving Average Convergence Divergence (MACD) is bearish but flattening.

The impact of BTC and ETH Options Expiry is clear: prices are drawn toward $90,000. If it drops below this level, the next support levels are $88,800 and $87,500. If buyers can defend this level, Bitcoin 2026 price prediction for coming days might bounce back to $91,800–$92,500, and later on towards $95,000,.

Traders should note that, for now, it seems neutral to slightly bearish until trading volume picks up again.

$ETH Price Impact: What Happened and What Next?

The altcoin is currently trading at $3,093, with volume down 11% to $21.23 billion. After the expiry event, the altcoin is holding up better than 'Crypto King', staying between $3,050 and $3,150 levels.

Its RSI is higher, and the MACD shows selling pressure is fading. The max pain is still at $3,100, acting like a pull for the long-term Ethereum price prediction for 2026.

If it stays above $3,100, it could go up to $3,180–$3,250. But if it drops below $3,050, it might fall to $3,000. In the short term, ETH price looks neutral-to-bullish compared to the “Crypto King”.

Expert View: Will Bitcoin and Ethereum Recover?

A crypto expert named Crypto Tice pointed out on its official X account that the $2.22 billion in BTC and ETH options expiring today can create volatility.

Big expiries often keep prices pinned near max pain levels. But after this event, the pressure from hedging decreases, allowing for clearer price trends to form.

This expert’s analysis clearly shows that the assets have the potential to recover soon as long as their key support level holds.

Traders should note that Market insights are based on on-chain options data, technical indicators, and derivatives market behavior observed during January 9.

Conclusion

The BTC and ETH Options Expiry suggests that we are in a phase of consolidation, not collapse. The direction of the market now depends on trading volume, their support levels, and follow-through. Volatility may rise in the short-run, but crypto market watchers are bullish on long-term price estimates.

YMYL Disclaimer: This content is for informational purposes only and does not count as financial advice. Cryptocurrency markets can be volatile. Readers should do their own research before making any investment decisions.