Colombia Crypto Tax Reporting: DIAN Launches Mandatory 2026 Rules - What You Need to Know

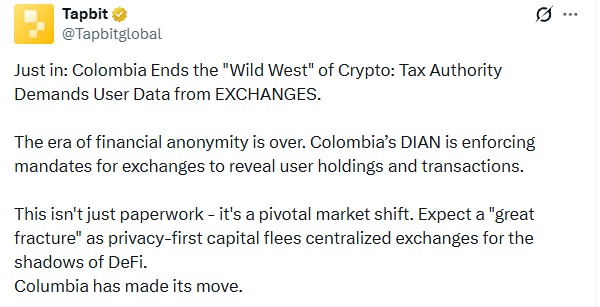

Colombia's tax authority just flipped the script on crypto traders. DIAN's new mandatory reporting rules for 2026 are live—and they're not messing around.

The Paper Trail Just Got Real

Forget flying under the radar. Every transaction, every swap, every yield farming move now leaves a digital footprint straight to the taxman. Colombian crypto holders are scrambling to connect the dots between their wallets and national IDs.

Exchanges Become Tax Collectors

Local platforms got drafted into enforcement overnight. They're now required to hand over user data, trading volumes, and withdrawal patterns. The 'off-ramp' just became a checkpoint.

The Global Squeeze Tightens

Colombia joins the growing list of nations treating crypto like traditional assets. The regulatory net keeps widening—first banking reports, now full portfolio transparency. Another brick in the wall of mainstream adoption, whether the anarcho-purists like it or not.

One cynical finance veteran noted: 'They'll track your Satoshis closer than your pension fund—finally, equal opportunity surveillance.' The decentralized dream meets centralized reality. Your move, crypto Colombia.

This isn't just about local control; it’s part of a global team effort. Colombia is joining the OECD’s Crypto-Asset Reporting Framework (CARF), which is basically a global club of tax authorities that swap data to catch contribution evaders. If you are one of the five million people in Colombia holding bitcoin or Ethereum, the days of "voluntary reporting" are over.

From Privacy to Paper Trails: How Resolution 000240 Changes Everything

The biggest change in Colombia crypto tax reporting is the "automatic" nature of it. In the past, you might have decided whether or not to mention your crypto gains on your tax return. Now, the exchanges will tell the DIAN for you. The government is specifically hunting for big fish, but they’ve cast a very wide net.

If you transfer more than $50,000 in a single go, the system flags it instantly as a "reportable retail transaction." But don't let that number fool you into thinking you’re SAFE with smaller amounts. The DIAN is also looking at your total net balance and your contribution residency, even if you’re just a casual trader. Essentially, if you’re using a platform like Wenia or any other local service, your "on-chain" privacy has been traded for a government paper trail.

The Heavy Price of Mistakes

The DIAN is not asking nicely they are demanding accuracy. If an exchange or a middleman forgets to report your data, sends it late, or makes a typo, the fines are brutal. We’re talking about penalties ranging from 0.5% to 1% of the entire value of the transactions. For high-volume traders or big platforms, a simple paperwork error could turn into a multi-million dollar headache.

The "Show Your Homework" Era

Experts from top law firms like Holland & Knight are telling investors to start keeping their own "digital diary." Because the DIAN will be cross-referencing exchange data with your personal filings, you need to be able to prove exactly what you paid for your Bitcoin and when you sold it. If you can’t explain where the money came from, the authorities can treat those coins as "unexplained wealth," which comes with even bigger tax bills.

Conclusion

Wrapping things up, it is clear that Colombia is leading the charge in South America to bring the digital economy into the light. By 2026, the Colombia crypto tax reporting system has made it very hard to treat crypto like a secret bank account. While it feels like a lot of extra work, the goal is to make the market more professional and formal. For now, the best advice for any Colombian investor is to stay organized. The first big wave of mass reports is due in May 2027, which gives you just enough time to get your records in order before the taxman knocks.