Grayscale Registers BNB and HYPE ETF - Is Altcoin Season Finally Here?

Grayscale just dropped a regulatory bombshell—filing for both a BNB and a HYPE ETF. The move signals institutional appetite is expanding beyond Bitcoin and Ethereum, hunting for the next big crypto narrative.

Institutional Doors Swing Open

This isn't just another filing. Grayscale's pivot toward altcoin ETFs marks a strategic shift. It tells a story of asset managers scouring the crypto landscape for growth, betting that investor demand will follow them into new territory. The sheer audacity of targeting BNB—a token with its own regulatory shadows—shows how aggressive the chase for yield has become.

The Altcoin Domino Effect

When a giant like Grayscale moves, the market pays attention. Approval for these funds would funnel institutional capital directly into altcoins, providing a liquidity boost and validation that could ignite a broader rally. It creates a blueprint for other asset managers, potentially turning a trickle of altcoin interest into a flood.

Timing is Everything—Or Is It?

The 'altcoin season' question hangs in the air. Historically, these cycles follow Bitcoin's lead, but ETF approvals could rewrite the playbook. It introduces a new variable: Wall Street's schedule. Now, the crypto market's organic rhythms must dance to the tune of SEC review cycles and boardroom decisions—because nothing says 'decentralized revolution' like waiting for a government stamp of approval.

A cynical take? Traditional finance spent years dismissing crypto as a scam, only to now race each other to repackage it into the very fee-generating products they understand. They're not believers; they're extractors. But if their greed accelerates mainstream adoption, maybe that's a trade worth making.

The bottom line: Grayscale's filing is a flare shot into the sky. It doesn't guarantee an altcoin summer, but it proves the big money is preparing for one. The real season starts when—or if—the regulators give the nod.

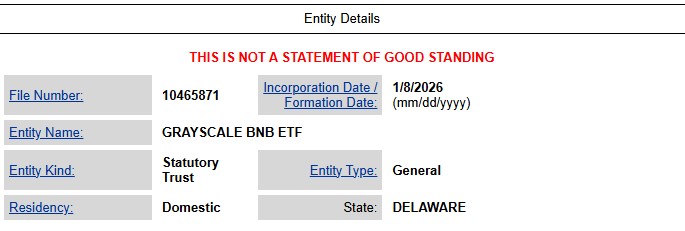

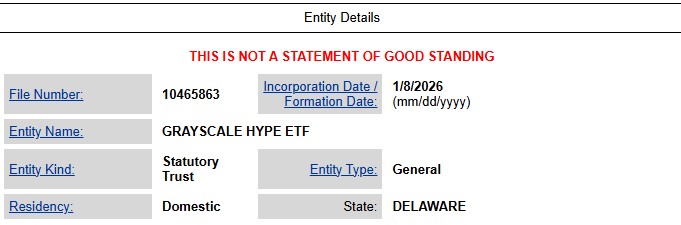

The registrations were filed on January 8, 2026, creating legal entities for potential spot ETFs. While this step does not mean SEC approval yet, Grayscale has historically used Delaware registrations as an early step before formal SEC ETF filings, i.e., like in Bitcoin and ethereum ETFs.

Why Grayscale Chose Binance and Hyperliquid's Token

BNB-HYPE represent two different but fast-growing parts of the crypto marketplace.

BNB is the Core token of the Binance Smart Chain ecosystem. It is widely used for DeFi apps, trading, payments, and exchange-related services. An exchange traded fund could allow traditional investors to gain exposure to this ecosystem without directly holding crypto.

HYPE powers Hyperliquid, a high-speed perpetual futures DEX running on its own Layer-1 blockchain. Hyperliquid has captured a large share of on-chain derivatives trading, making the token one of the most active DeFi-related tokens in the market.

Together, BNB and HYPE ETF give the asset manager exposure to both exchange infrastructure and decentralized trading.

Market Impact So Far: Change In Values

The short-term market reaction has been calm.

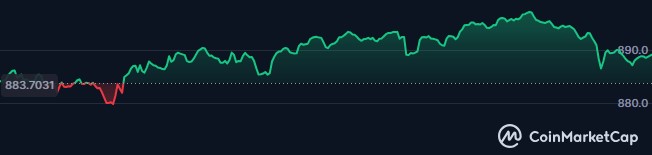

Binance coin reacted positively. The token saw gains of 0.54% in the last 24 hrs, currently trading at $889.10, after the news, following its monthly and yearly surges of 0.05% and 27.72% respectively.

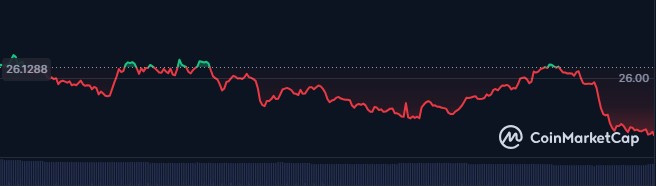

On the other hand, HYPE-prices fell 3.38% to $25.26 mostly amid broader market weakness. Analysts say this is expected, as trust registrations are only an early step.

Still, the Grayscale BNB and HYPE ETF move strengthens long-term sentiment. If approved, such ETFs could attract billions in institutional capital, similar to what happened with Bitcoin and Ethereum ETFs.

What Comes Next?

The Delaware registrations only create the legal framework. The next major milestone will be formal SEC filings, such as S-1 or 19b-4 forms.

Approval could take months or longer, and regulatory scrutiny, especially around Binance coin’s exchange ties, remains a risk. However, the MOVE clearly shows Grayscale’s confidence in altcoins and the expanding crypto ETF market.

As crypto products continue to evolve in 2026, could BNB and HYPE become the next assets to enter mainstream investment portfolios?

This article is for informational purposes only and does not constitute financial or investment advice.