Ripple Secures FCA Green Light: XRP Inches Toward UK Banking Integration

Ripple just cleared a major regulatory hurdle in the UK. The Financial Conduct Authority (FCA) has granted approval, positioning XRP for potential use within the British banking system.

The Regulatory Gate Opens

This isn't just another compliance checkbox. The FCA's stamp signals a willingness to engage with digital assets at an institutional level. For Ripple, it's a strategic beachhead into one of the world's most influential financial markets.

Banking's Slow Dance with Crypto

Traditional finance has treated crypto like a risky cousin—interesting but kept at arm's length. This move suggests that calculus is changing. The promise? Faster, cheaper cross-border settlements that could bypass the legacy correspondent banking web.

What's Next for XRP?

Approval is permission, not a mandate. The real test begins now: convincing risk-averse UK banks to actually build with the technology. Adoption will be a marathon, not a sprint, measured in pilot programs and gradual infrastructure shifts.

The move adds momentum to crypto's institutional narrative, proving that even the most traditional regulators can be navigated—with the right paperwork and patience, of course. It's a step toward making digital asset utility boring, predictable, and bankable. And in finance, boring is where the real money gets made.

Source: X (formerly Twitter)

Ripple FCA Approval Allows EMI License and Regulated Crypto Services

With the UK FCA Approval, they can now offer complete financial services in the UK. Their business clients possess the ability to make transactions, engage in the trading of digital assets, as well as transfer funds among crypto and fiat currencies.

President Monica Long said this MOVE will make it easier for businesses in the UK to use crypto safely. Additionally, this will help them reach its vision of providing financial infrastructure for the entire world by working together with governments and banks.

Why is that important? The reason is that banks only trust the platforms that strictly follow the rules and Ripple Labs is one of them.

Also Improving Its Technology

The digital assets firm is not only focusing on regulation. It is also working on better technology. Reports suggest Ripple is exploring Amazon Bedrock tools from AWS to improve how the XRP Ledger is monitored.

Right now, checking huge system logs can take days. With AI tools, the same work could take just a few minutes. That WOULD make the XRP Ledger faster, safer, and more stable.

RLUSD and XRP Move Closer to the Banking System

They are also entering the banking system. Ripple's partner BNY Mellon has launched tokenized deposit services, with Ripple Prime as an early user.

Source: X (formerly Twitter)

Since BNY is the main reserve custodian for RLUSD, this move brings RLUSD and XRP closer to real banking infrastructure, connecting traditional finance with digital assets.

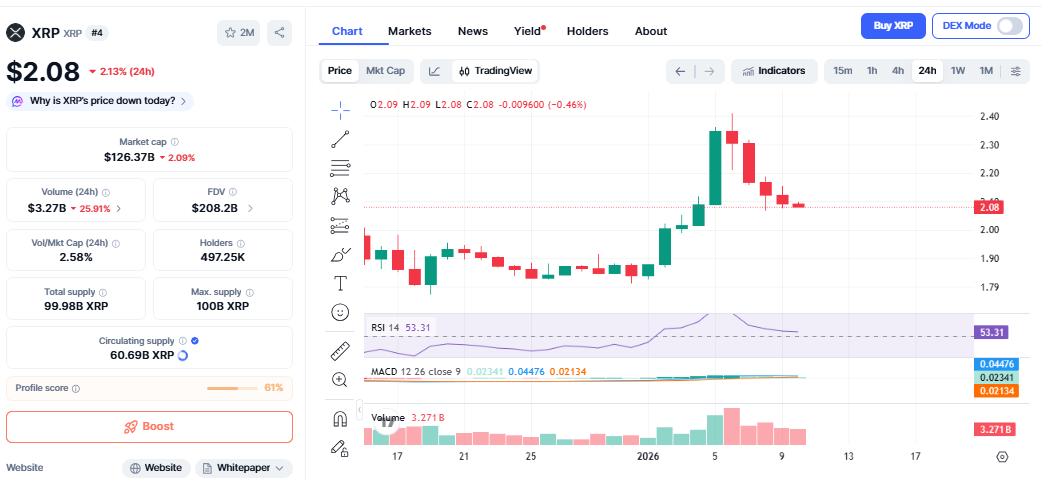

XRP Price Today Shows Caution

Even after the UK FCA Approval, xrp price is moving carefully. It is trading near $2.08, down around 2% in the last 24 hours.

Source: CoinMarketCap

This is because the whole crypto market is under pressure. Strong US jobs data reduced hopes of interest rate cuts, making investors more careful.

It also broke below an important support area between $2.09 and $2.11. When that happened, many automatic sell orders were triggered.

Still, It is doing well over longer periods. It is up around 2.6% in seven days and about 4.4% in one month.

XRP Price Prediction

If it stays below $2.11, it may test $2.04 and even $2.00. RSI is NEAR 53, which means the market is neutral. If it breaks above $2.20, it could move toward $2.35.

If the organisation keeps winning approvals like this and expands its regulated payments network, XRP could return to the $2.80–$3.20 zone later in 2026.

Why Ripple FCA Approval Is Still Very Important?

Short-term price moves come and go. The Ripple FCA Approval is about long-term trust. It shows they are serious about working with regulators and banks.

This approval makes this digital assets giant more attractive to financial institutions. It also strengthens the role of XRP in real payment systems.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing in the crypto market.