India Tightens Crypto Grip: Live Selfie and Location Tracking Now Mandatory for All KYC

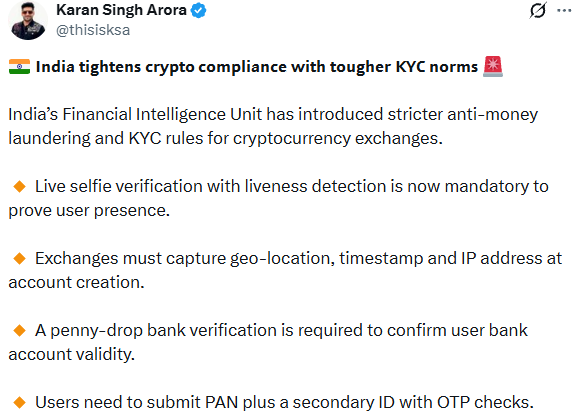

India's crypto landscape just got a major regulatory upgrade—or a surveillance overhaul, depending on your perspective. The nation's financial watchdogs have rolled out stringent new Know Your Customer (KYC) rules that demand real-time biometric verification and geolocation tagging from every user.

The New Compliance Playbook

Forget static document uploads. The new protocol requires a live selfie session to match your face with official ID in real-time. Simultaneously, your device's location must be shared and verified. It's a one-two punch designed to eliminate spoofing and anonymous transactions cold.

Exchanges Scramble to Adapt

Major trading platforms are now racing to integrate the mandated tech. The infrastructure shift isn't cheap—compliance costs always get passed down to someone, usually the user holding the bag. The move signals a clear intent: India wants a documented, traceable digital asset ecosystem, mirroring traditional finance's oversight with a 21st-century tech twist.

Privacy vs. Progress: The Eternal Trade-Off

Proponents hail it as a necessary step for legitimacy and consumer protection. Critics see it as another layer of financial surveillance, a cynical nod to the old guard who believe transparency is something you enforce on others while keeping your own ledgers opaque. The rules are live. The selfie camera is on. The market's next move is anyone's guess.

These changes aren't just for newcomers. Whether you're a pro or a casual trader on one of the 49 registered exchanges like WazirX or CoinDCX you're going to see these high-tech security steps pop up very soon.

What You Need to Know About the New India Crypto KYC Rules

So, why the sudden change? The government is trying to make it impossible for scammers to use "deepfakes" or stolen IDs to open fake accounts. To stop the bad actors, they’ve added three specific layers to the India crypto KYC process that every trader now has to navigate.

1. The "Blink Test" (Live Selfie Verification)

Forget about uploading a saved photo from your gallery. The new rules require a live selfie. You’ll use software that checks for "liveness" which just means you’ll have to blink your eyes or move your head while the camera is on. It’s a simple, two-second task that proves you aren't just a static photo or an AI-generated video trying to trick the system.

2. Location Tracking (Where are you right now?)

This is the one that might surprise you the most. Every time you open an account, the exchange is now required to log exactly where you are. We're talking actual GPS coordinates (latitude and longitude), along with your IP address and a timestamp. Think of it as a "digital check-in." The government's goal here is to make sure people aren't using VPNs to pretend they’re somewhere they’re not or trying to sidestep Indian laws from abroad. By doing this, the exchange creates a permanent trail that proves your account was legally set up right here in India.

3. The Re 1 Bank Test

Exchanges also have to do what’s called a "penny-drop" test. They’ll send a tiny amount—just Re 1 to your bank account. If the name on your bank account doesn’t perfectly match your ID, the account won’t be verified. On top of that, you’ll need to provide your PAN card plus a second ID (like a Passport or Voter ID), all backed by an OTP sent to your phone.

Why Is This Happening?

The government is basically trying to "clean up" the market. By tightening these India crypto KYC norms, they’re making it incredibly hard for anyone to use crypto for money laundering or fraud. They’re also taking a hard stance against things like Initial Coin Offerings (ICOs), which they see as high-risk projects that often leave investors with empty pockets.

Conclusion: Trading Gets a Little Safer

Even though these extra steps feel like a bit of a hassle, they’re actually meant to protect your money. By 2026, the Indian crypto world is looking more and more like a regular bank—highly regulated, transparent, and safe. Just keep your phone and your Aadhaar card handy the next time you log in, and you’ll be good to go!