Tether Freezes $182M on Tron in Massive ’Coordinated’ Wallet Blacklist - Regulatory Hammer Drops

Stablecoin giant Tether just executed one of the largest coordinated wallet freezes in crypto history—locking down a staggering $182 million in assets on the Tron network. This isn't a routine compliance check; it's a targeted financial strike.

The Anatomy of a Blacklist Operation

Forget subtle interventions. This move saw Tether's issuer directly blacklist multiple wallet addresses in a single, sweeping action, rendering the funds within them untouchable. The scale suggests deep coordination with external agencies, pointing to investigations targeting specific illicit finance flows rather than random bad actors. The message to the ecosystem is clear: the long arm of traditional finance regulation can reach into decentralized ledgers—and it's getting faster.

Stablecoins: The New Compliance Battleground

The freeze highlights the double-edged sword of centralized stablecoins. They provide the liquidity and stability that fuel DeFi, but their issuers hold ultimate power—the 'kill switch' to immobilize funds. While hailed as a win for legitimizing crypto, it reignites the core tension: are we building a permissionless system or a more efficient, surveilled version of the old one? Some bankers are probably smirking, calling it 'finally bringing basic AML to the wild west'—ignoring that their own institutions have paid billions in fines for the same crimes.

The action proves that for all its disruptive potential, a significant portion of the crypto economy still dances to the tune of a few centralized entities. The market might barely flinch, but the precedent is set. The next freeze could be even bigger.

A Tether spokesperson said in a report that the funds were frozen following a formal request from law enforcement as part of an ongoing investigation. The company added that authorities had been working on the case for months and reiterated its policy of cooperating with global agencies by freezing illicit or санкtion-linked addresses when legally required.

Tether’s Wallet Freezes Accelerate Under Sanctions Pressure

The move on Jan. 11 is consistent with Tether’s policy of voluntarily freezing the wallets that the company officially implemented in December 2023 to meet the requirements of the sanctions regime of the Office of Foreign Assets Control of the U.S. Treasury.

Under its terms of service, Tether states it may freeze assets or share user information when ordered to do so or when it determines such actions are reasonable and necessary.

Since adopting this approach, Tether has emerged as the most active stablecoin issuer in assisting enforcement efforts.

The company’s report and blockchain analytics firm AMLBot statistics indicate that since 2023, Tether has been granted access to block well over 3 billion USDT, collaborating with over 310 law enforcement agencies in 62 locations.

![]() Tether and Circle froze $3.3B and $109M crypto in three years, showing major differences in how the two largest stablecoin issuers police illicit funds.#USDT #USDC #Tether #Circlehttps://t.co/iaWt2lU8Oh

Tether and Circle froze $3.3B and $109M crypto in three years, showing major differences in how the two largest stablecoin issuers police illicit funds.#USDT #USDC #Tether #Circlehttps://t.co/iaWt2lU8Oh

In its estimation of the blacklisted funds around 2023 and late 2025, AMLBot estimates that some $3.3 billion of funds are blacklisted, with approximately 1.75 billion of the funds being linked to Tron-based USDT.

The latest asset freeze reflects the growing role of stablecoins in countries facing sanctions and prolonged economic stress, particularly Venezuela and Iran.

In both markets, USDT has become a widely used substitute for local currencies, serving everyday payment needs and helping households preserve value amid inflation and banking distrust.

Blockchain Analytics Fuel Surge in Wallet Freezes for Sanctions Violators

In Venezuela, years of bolivar depreciation and limited access to reliable financial services have pushed individuals and businesses to rely on USDT for transactions ranging from basic services to commercial trade.

At the same time, investigations have linked the country’s state-owned oil company to the use of USDT to settle cross-border payments and bypass sanctions.

These findings prompted coordinated wallet blacklisting actions by Tether in cooperation with U.S. authorities.

Iran has shown similar patterns, with protests and political tension intensified alongside the collapse of the rial; Tron-based USDT emerged as one of the most commonly used digital assets.

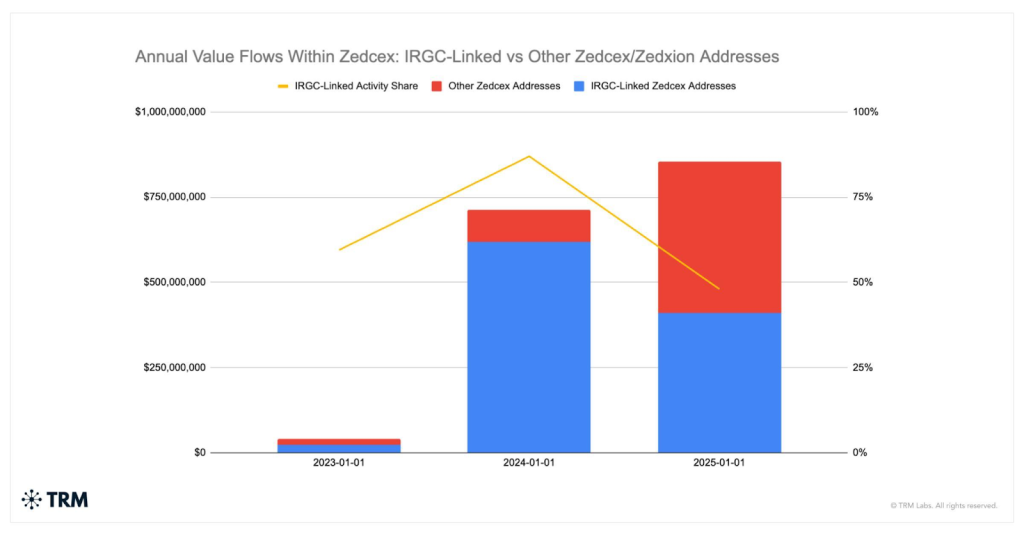

While stablecoins offer civilians protection against inflation and capital controls, blockchain analysts report that sanctioned entities tied to Iran’s Revolutionary Guard have also moved funds through stablecoin channels.

As a result, enforcement actions have increased rather than eased, driving a rise in wallet freezes.

Despite frequent attempts to evade sanctions using crypto, asset freezing has become more common because it is viewed by regulators as an effective, targeted tool.

Rather than showing failure, evasion efforts have led to tighter coordination, better analytics, and broader information sharing.

With the global stablecoin market now valued at roughly $307.8 billion and USDT alone accounting for about 60.7% of that total, enforcement actions carry growing weight.

Further growth in crypto asset freezes is expected in 2026, as regulators in the U.S., EU, and other major markets move from drafting rules to enforcing them, aided by stronger blockchain analytics and tighter AML and sanctions controls.