Crypto Bloodbath Before Black Friday: Your Complete Survival Guide

Digital assets tumble as Black Friday approaches—traders scramble while institutions circle like sharks.

The Great Discount

Bitcoin leads the plunge with altcoins following suit. Market sentiment turns fearful just as retail investors prepare for traditional shopping sprees.Timing Is Everything

Historical patterns suggest pre-holiday volatility often creates prime buying opportunities. Smart money positions while weak hands panic-sell.Black Friday vs. Crypto Friday

While consumers hunt for discounted electronics, crypto veterans eye discounted digital assets. The real sales might be happening on exchanges rather than in stores.Institutional Playground

Major players quietly accumulate during dips—proving once again that Wall Street treats market crashes as Black Friday sales for the wealthy.

The crypto market today was swept into a sharp selloff ahead of Black Friday, as global risk aversion surged. Thereby, leading to billions being wiped from the industry’s valuation in a matter of hours.

From Bitcoin and ethereum to sector indices, almost every corner of the crypto ecosystem turned negative. This led to panic signals from traditional equity markets and a dramatic collapse in investor sentiment. Amid collapsing support levels and forced liquidations, traders are left navigating one of the year’s steepest downturns.

Black Friday Panic Spills Over?

Much of today’s turmoil can be traced to a sudden macro risk-off wave that started in equities. This is with the S&P 500 plunging 4% and wiping out $2.7 trillion in market value. With cryptocurrencies holding a relatively high 0.85 correlation to the Nasdaq, the rout in stocks sent shockwaves across digital assets too.

Further fanning the flames, the probability of a US Federal Reserve rate cut in December nosedived from 93% just a month ago to only 35% now. This environment has pushed the crypto Fear & Greed Index to just 11, an “Extreme Fear” reading.

Market Metrics: Signs You Cannot Ignore

- Total crypto market cap fell by 6.31% to $2.95 trillion.

- The CMC 20 index mirrored the slide, off 6.91% to $182.8.

- The average crypto RSI now sits at 38.88, signaling broadly oversold momentum.

- The Altcoin Season Index by CoinMarketCap prints 27/100, confirming BTC-led dominance.

Bloodbath for BTC, ETH, and XRP

Bitcoin endured one of its worst single-day losses in months, plunging 7% in 24 hours to $86,119.39 and 11.6% for the week. Key supports were shattered, bringing on $829 million in liquidations as bearish sentiment and record whale selling overwhelmed demand. Notably, long-dormant BTC wallets suddenly deposited tens of thousands of coins to exchanges, a classic capitulation signal.

Ethereum price mirrored the carnage, falling 7.94% to $2798.77 in 24 hours and losing grip on the crucial $3,000 mark. Over $20 billion in liquidations since October has drained liquidity and hammered confidence.

XRP wasn’t spared either. It dropped 7.73% to $1.97, as 200 million XRP worth $404 million was dumped onto the market within 48 hours. The token breached its critical $2.04 pivot and sank even as Bitwise’s XRP ETF saw lackluster debut activity, closing 7% lower with $22 million in volume.

Altcoins Widespread Pain

The crash was not limited to blue chips. Canton, Near Protocol, Starknet, and Toncoin ranked among the day’s worst performers, with losses ranging from 10% to nearly 17%. Successively, DeFi, GameFi, and SocialFi sectors fell between 3.1% and 3.9% apiece, as risk aversion punched through even generally resilient corners of the crypto ecosystem.

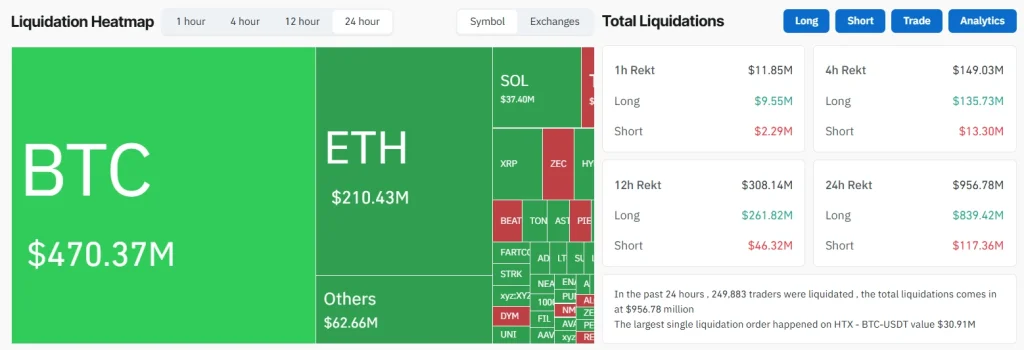

Liquidations: Leverage Unwinds and Forced Sales

Arguably, the most telling datapoint of today’s crash was the $829 million in crypto liquidations, the highest since October’s $20 billion deleveraging wave. As per CoinGlass, over 249,800 traders saw positions wiped out as cascades of forced sales aggravated the selloff, particularly in Bitcoin and Ethereum, which accounted for the lion’s share of liquidations.

Within 24 hours, $839.42 million in long positions and $117.36 million in shorts were liquidated. At the extremes, a single BTC-USDT order on HTX reached $30.91 million, underscoring just how brutal this squeeze became.

Conclusion

Recovery prospects hinge on macro stability and whether support can be re-established without triggering further forced deleveraging. In the meantime, traders face a highly uncertain landscape, with sentiment and price action stuck DEEP in bear territory.

FAQs

How much is the total crypto market cap today?The crypto market is at $2.95 trillion, down 6.31% in 24 hours

Why did the crypto market crash today?A sharp equity market selloff, collapsing Fed rate cut odds, and historic liquidations

Which tokens fell the most?Canton (-16.5%), NEAR Protocol (-14.9%), Starknet (-12.1%), Toncoin (-10.4%)

Why did Bitcoin and Ethereum prices drop?Combination of macro panic, Leveraged liquidations, and aggressive whale selling