Bitcoin Shatters Its 4-Year Cycle for the First Time in 14 Years

Bitcoin just rewrote its own rulebook. The digital asset's predictable four-year rhythm—a pattern etched into crypto folklore since its inception—has officially been broken. For over a decade, traders could set their watches by it. Now, the clock has stopped.

The End of an Era

That four-year cycle wasn't just superstition. It was a market mechanic, driven by Bitcoin's halving events that slashed new supply. It created waves of boom, bust, and accumulation that defined entire investing generations. The pattern held through three major cycles, creating millionaires and wiping out portfolios with metronomic regularity. Until it didn't.

What Changed?

The market outgrew its old skin. Institutional capital—once a skeptical observer—is now a dominant force, flowing in through ETFs and corporate treasuries. This new demand profile doesn't operate on a retail investor's emotional timeline. It's constant, strategic, and less reactive to the old supply shocks. The game's fundamental players have changed, and with them, the rules.

A New Paradigm

This isn't a delay; it's a divergence. The break suggests Bitcoin is maturing beyond its volatile, event-driven adolescence. Price discovery is now a complex dance between macroeconomics, regulatory tides, and its evolving role as a digital hard asset. The old cycle provided comfort, a narrative to cling to. Its absence forces everyone to look at the underlying value—terrifying for some, liberating for others.

Forward, Uncharted

So what replaces the cycle? Not chaos, but complexity. Analysts are tossing their old models—a delightful irony for an asset class built on disrupting legacy systems. The future path will be messier, less predictable, and arguably more integrated with global finance. It means trading folklore for fundamentals. After all, if traditional finance taught us anything, it's that the most dangerous phrase in markets is 'this time it's different.' Except, for Bitcoin in 2026, it genuinely is.

Bitcoin, the world’s largest cryptocurrency, ended its Q4 2025 with a nearly 28% drop, but the bigger story goes beyond price. For the first time in 14 years, Bitcoin failed to follow its famous four-year cycle, surprising traders and long-term holders alike.

As 2026 begins, whale accumulation, tight price action, and changing market forces are shaping what comes next.

Bitcoin Breaks Its 4-Year Pattern After 14 Years

For over a decade, bitcoin moved in a familiar rhythm. The halving year was usually closed in the green, the year after saw even stronger gains, and then a major top was followed by a deep correction. This pattern played out clearly in the 2013, 2017, and 2021 cycles.

That rhythm changed in the latest cycle. While the 2024 halving year closed strong, 2025 ended with a red yearly candle. This marks the first time Bitcoin has fallen in the year after a halving.

This shift does not automatically signal weakness. Instead, it points to a maturing market. With institutional investors, spot ETFs, and deeper liquidity now in play, Bitcoin is moving less on halving HYPE and more on broader economic conditions.

Bitcoin Whales Are Buying Again

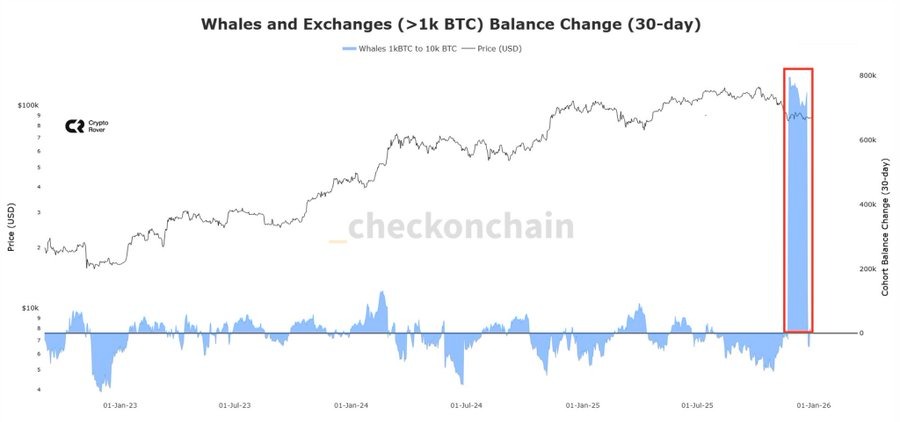

As 2026 begins, on-chain data is sending an important signal. Large Bitcoin holders, often called whales, are slowly adding to their positions after weeks of reduced activity.

Data shared by crypto trader Crypto Rover shows wallets holding more than 1,000 BTC have started increasing their balances. The 30-day trend has turned upward, suggesting fresh accumulation at current levels.

At the same time, Bitcoin balances on exchanges continue to fall. When coins MOVE off exchanges, it often means holders are planning to hold rather than sell, reducing available supply in the market. In past cycles, this setup has often appeared before strong rallies.

Bitcoin Stuck in a Tight Range

Looking at the chart, Bitcoin has been moving sideways for over a month. The price is trapped between a clear resistance zone NEAR $100,000 and strong support around 84000. These two levels stand out clearly and act as decision points for the market.

The $100,000 level is especially important. It previously acted as the lower boundary of Bitcoin’s all-time high range, making it a zone where selling pressure could return. A clean breakout above it could signal renewed strength.

On the downside, $74,500 is a critical monthly support. If this level breaks, some analysts believe Bitcoin could FORM a deeper bottom near $40,000 sometime in 2026.

As of now, Bitcoin is trading around $88,040, reflecting a slight rise seen in the last 24 hours, with a market cap hitting $1.75 trillion.