Why XRP Is Outperforming Bitcoin and Ethereum in 2026: The Regulatory Edge

Forget the old guard—XRP just flipped the script. While Bitcoin and Ethereum grapple with legacy bottlenecks, Ripple's flagship asset is posting gains that have traditional crypto investors scrambling. The narrative for 2026 isn't about store-of-value or smart contracts; it's about utility, speed, and a regulatory clarity that others can only dream of.

The Institutional Green Light

Years of legal wrangling finally paid off. A landmark ruling cemented XRP's status as a non-security for public sales, unlocking a floodgate of institutional interest that Bitcoin and Ethereum's ambiguous frameworks still struggle to attract. Banks and payment providers aren't betting on speculative tech—they're deploying a settled, compliant tool. It turns out that regulatory certainty is a more powerful catalyst than any halving or upgrade.

Real-World Utility Trumps Speculation

While debates rage over Bitcoin's energy footprint and Ethereum's scaling roadmaps, XRP's ledger is quietly settling billions in cross-border payments daily. Its consensus mechanism bypasses the energy-intensive mining and high gas fees plaguing its rivals. For enterprise adoption, efficiency isn't a feature—it's the entire product. The market is finally valuing execution over promise.

The Liquidity Advantage

Centralized exchanges, once wary, are now aggressively listing and promoting XRP pairs, drawn by its clear legal standing. This creates a liquidity flywheel that smaller, newer tokens can't match. Trading volume begets more volume, attracting capital that seeks less friction and lower regulatory risk. In a year where compliance officers hold more sway than crypto influencers, XRP's paperwork is its killer app.

A Cynical Take on the 'Digital Gold' Narrative

Let's be honest—the finance world loves a boring, predictable asset it can understand. XRP, with its bank-friendly messaging and settlement-focused use case, looks more like a efficient security to a traditional portfolio manager than an anarchic digital commodity. Its outperformance might just be the ultimate irony: the crypto that embraced the system is beating the ones that tried to overthrow it. Sometimes, the revolution is just a better plumbing solution approved by the regulators.

XRP has emerged as one of the hottest crypto trades of the year, even outperforming giant Bitcoin & Ethereum in performance and becoming the 3rd-largest cryptocurrency by market cap.

Since the start of the year, XRP has climbed more than 20%, briefly trading NEAR $2.40. What stands out is not just the price move, but the reason behind it.

XRP as a “Less Crowded Trade”

Speaking on CNBC, journalist Mackenzie Sagalos explained that XRP benefited from a shift in investor mindset during late 2025. She noted that many traders treated XRP as a “buy-the-dip” opportunity rather than a momentum trade.

With Bitcoin becoming more stable and crowded, traders were clearly hunting for assets with higher upside potential, and XRP fit that profile well.

This strategy paid off quickly. In early January, XRP jumped as new buyers entered, while selling stayed low. Institutional interest also played a key role, with steady money flowing into XRP ETFs during a quiet period.

Since the launch of the XRP ETF, total inflows have reached around $1.62 billion, showing sustained confidence from large investors.

CNBC declares $XRP the HOTTEST crypto trade of 2026![]()

![]()

“There is big money behind this trade”![]()

Already up ~20% YTD, surging to #3 spot as investors chase real utility & massive gains beyond BTC. pic.twitter.com/VCdlNHh15Z

She further added that, beyond trading dynamics, XRP continues to gain attention for its role in cross-border payments.

No IPO For Ripple In 2026

Despite XRP’s strong market performance, Ripple has confirmed it has no plans to go public. In a recent interview, President Monica Long said the “Currently, we still plan to remain private. The company is financially strong and prefers to grow privately through acquisitions and products.

Long said that Ripple had raised $500 million in late 2025 at a $40 billion valuation, giving it enough capital without needing an IPO.

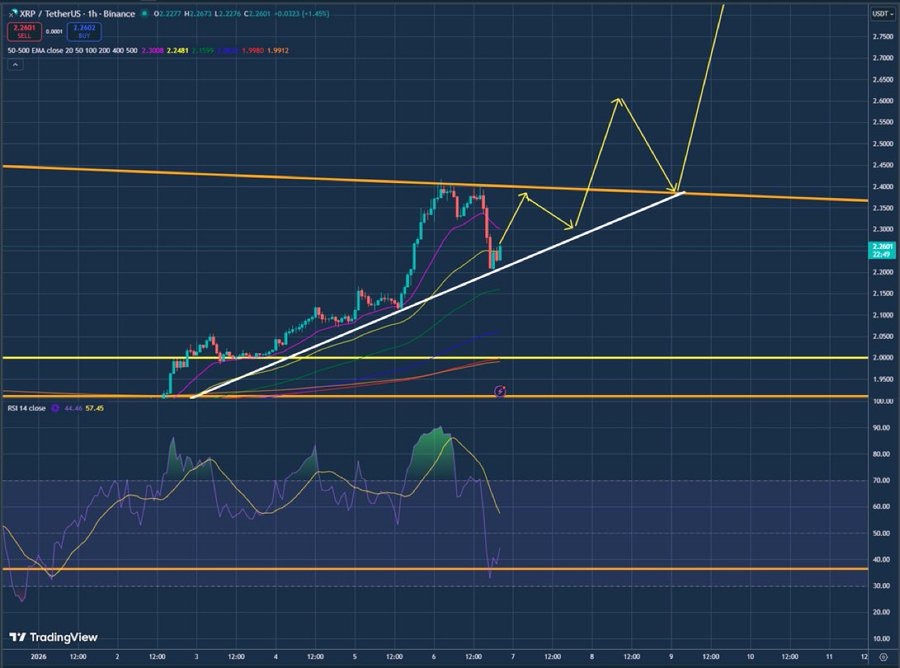

XRP Price Analysis

On the technical side, XRP is holding above a rising support trendline even after pulling back from recent highs near $2.41. The price briefly slipped below $2.32 and dipped toward $2.25, but buyers quickly stepped in.

Since early January, XRP has been forming higher lows, showing that buyers are entering earlier on each dip. As long as the price stays above the $2.20 zone, the structure remains stable, with room for a MOVE back toward $2.60 – $3 if momentum returns.

Meanwhile, the RSI has cooled to 45, which often acts as a healthy reset during ongoing uptrends.

Will XRP Hit $5 by the End of 2026?

With steady ETF inflows and supportive fundamentals, XRP has the potential to extend its current rally toward the $5 level later this year.

Although short-term volatility is expected, the recent pullback appears to be a healthy pause within a broader uptrend, not a full trend reversal.