Render (RNDR) Price Action Shows Bullish Momentum: Key Resistance and Support Levels

Render Network's RNDR token surges—bullish momentum builds as key technical levels come into focus.

Decentralized GPU rendering platform sees its native token carving higher lows, pushing against established resistance barriers. The distributed computing narrative gains traction as AI and metaverse development demands explode.

Technical Landscape: Critical Juncture

Chart patterns reveal a clear battle between accumulation and distribution. The token tests upper resistance repeatedly—each rejection less severe than the last. Support levels hold firm, creating a compression pattern that typically precedes significant moves.

Market psychology shifts as institutional players quietly accumulate positions in decentralized infrastructure assets. Render's unique value proposition—monetizing idle GPU power—resonates in an era of compute scarcity.

On-Chain Metrics Tell the Story

Network activity spikes correlate with price appreciation. Active addresses increase, transaction volume expands, and token velocity accelerates. Smart money flows into the ecosystem while retail remains distracted by memecoin mania—classic early-cycle behavior.

The Render Network's expanding partnerships with major studios and independent creators creates organic demand beyond speculative trading. Real utility drives adoption, not just exchange listing hype.

Risk Factors Lurk Beneath Surface

Regulatory uncertainty shadows all decentralized compute projects. Competitors emerge daily, though none match Render's first-mover advantage and existing network effects. Tokenomics face scrutiny as emission schedules and staking mechanics evolve.

Macro conditions could dampen enthusiasm—when traditional markets sneeze, crypto catches pneumonia. But decentralized infrastructure plays might prove more resilient than pure speculative assets during downturns.

The Verdict: Watch These Levels

Break above resistance confirms bullish thesis and opens path to previous highs. Failure to hold support suggests deeper correction ahead. Volume remains the ultimate truth-teller—watch for expansion on decisive moves.

Render represents more than just another altcoin—it's a bet on the future of distributed computing. Whether that future arrives next quarter or next decade depends on execution, adoption, and surviving the inevitable crypto winter that separates infrastructure from vaporware. Remember: in this space, 'disruptive technology' often means disrupting your portfolio first.

RNDR, the native token of Render, is once again in the limelight as the broader crypto market is showing signs of a new surge.

In addition to the optimistic mood concerning both AI and decentralized computing, RNDR price has begun to trend upwards after several months of consolidation.

The recent sharp reversal, backed by increasing volume indicates that traders are setting up a possible continuation MOVE instead of an immediate spike.

Currently, the price movement of RNDR shows confidence in its continued rise, yet the market continues to test key points that will determine the direction.

What Render (RNDR) Charts Reveal About the Next Move

Following several weeks of sideways movement, RNDR succeeded to break out of a key resistance zone of $1.80-$2.

At press time, Render Price was trading at $2.20, noting a weekly rise of over 60%. Its market cap has sharply surged to $1.14 Billion, denoting capital influx in the market.

Furthermore, RENDER (RNDR) price is eyeing to smash the $3-$4 zone where bears have positioned themselves.

However, after a sharp buying a retracement may be possible since traders usually book profits at key levels.

On the upside, a break above the $3 mark could open the doors toward the $5, whereas a drop below $2 may pause the bullish momentum.

Hope you caught the $RENDER dip.

Not a financial advice but just the beginning, IMO. https://t.co/zf7IbtRQpO pic.twitter.com/MOKwssXFhP

In addition to it, Analyst LLuciano BTC gave a bullish call in his recent post. He articulated that the Render price flipped from the demand zone and entered into the bullish trend. A continuation of the upmove may push the token toward $10-$12 in the next few weeks.

As long as RNDR is trading beyond the $2 support zone, the larger rally could be possible.

What Do Market Sentiment and Derivatives Data Hints?

Data from Coinglass shows that Render’s future open interest has increased rapidly from $30M to $59M in this week.

This significant surge hints that large institutions have made long positions. Amidst the OI surge, bearish traders were trapped.

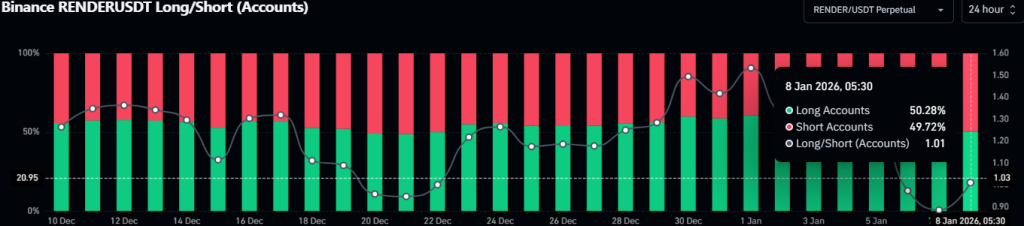

Furthermore, the OI-weighted funding rate stayed in the positive zone, replicating the bullish sentiment. Also, the long to short ratio stands above 1 hints that more traders are taking long positions.