$2.2B Bitcoin & Ethereum Options Expire Today as Open Interest Hits 2022 Low – What’s Next?

Massive crypto options expiry hits the market today—$2.2 billion in Bitcoin and Ethereum contracts come due while open interest sinks to levels not seen since 2022.

Why the squeeze matters

Open interest—the total number of outstanding derivative contracts—has been quietly bleeding out. That drop signals thinning liquidity and a potential reduction in speculative froth. Fewer open bets mean less fuel for sudden, violent price swings—but also less cushion against volatility.

Traders brace for pin risk

With billions on the line, market makers and large holders scramble to hedge or unwind positions as expiration looms. The result? Often a tug-of-war around key strike prices, especially for Bitcoin and Ethereum. Watch for unusual spot market activity as players defend or attack those levels.

A cleaner slate—or a warning sign?

Some see collapsing open interest as a healthy reset—flushing out excess leverage. Others read it as fading institutional interest or a wait-and-see stance ahead of macro cues. Either way, today’s expiry could act as a catalyst, breaking the lethargy that’s gripped crypto derivatives.

Remember: in traditional finance, they call this ‘risk management.’ In crypto, we call it Friday.

Bottom line: A $2.2 billion expiry amid multi-year lows in open interest sets the stage for a volatility spike. Whether it launches the next leg up or triggers a flush lower depends on who’s left holding the pin.

Bitcoin and ethereum witnessed a major options expiry event on Deribit as contracts worth around $2.2 billion expired today.

The timing is important, as investors are also watching two key U.S. events today, the Supreme Court’s ruling on Trump’s tariffs and the latest unemployment data, raising the risk of massive volatility in the crypto market.

Bitcoin To Face $1.84 Billion In Options Expiry Today

According to the expiry data released today, bitcoin options worth nearly $1.84 billion expired on Deribit. The max pain level was set at $90,000, and Bitcoin is trading very close to this level, around $90,236.

Options data shows strong positioning on both sides. A large number of put options sit below $85,000, showing that traders were prepared for a possible price drop.

At the same time, call options are heavily placed between $90,000 and $100,000, indicating continued hopes for higher prices.

Because of this balance between downside protection and upside bets, Bitcoin remained stuck near the $90,000 level.

$396 Million In Ethereum Options Expiry

Meanwhile, Ethereum saw around 126,000 options contracts expire, with a total value of $384 million. Ethereum’s max pain level was placed near $3,100, and ETH prices are currently trading below $3,092.

Notably, Ethereum call options were heavily positioned above $3,000, suggesting traders remain confident in Ethereum’s ability to stay elevated. If prices remain above the max pain level, dealers may become more sensitive to upside moves after expiry.

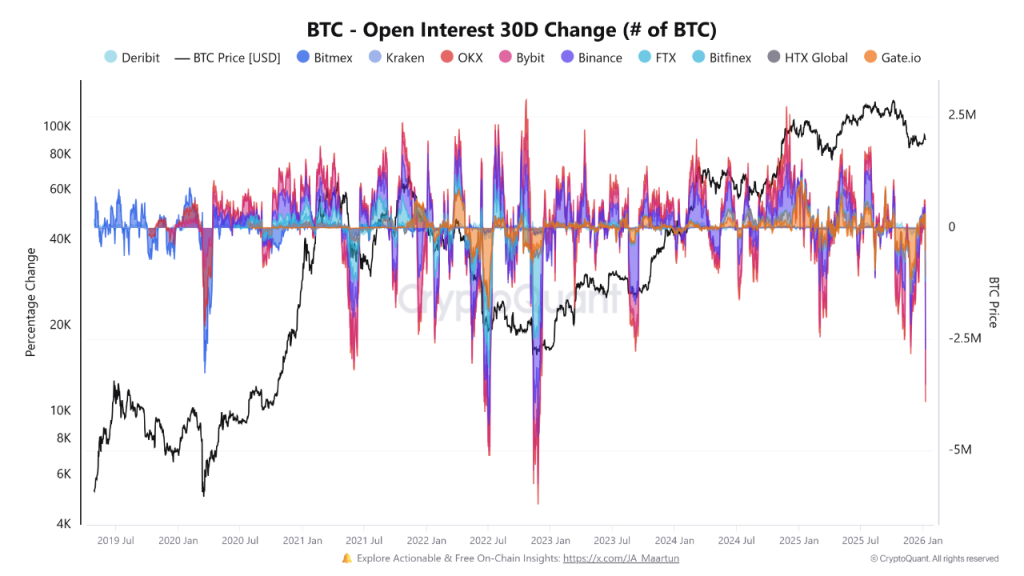

Bitcoin Open Interest Hit Lowest Levels Since 2022

Apart from the large option expiry, CryptoQuant data show that Bitcoin’s 30-day open interest (OI) change shows a sharp decline across derivatives markets, pushing open interest to its lowest level since 2022.

Binance recorded the largest drop, with open interest falling by around 1.53 million BTC. Bybit followed with a decline of roughly 784,000 BTC, while Gate.io and OKX saw drops of about 505,000 BTC and 395,000 BTC, respectively.

Similar declines were also observed on Deribit, Bitfinex, and HTX, confirming a market-wide deleveraging trend.

Historically, very low open interest signals a market reset. When excess leverage is cleared, prices often stabilize, and this phase can lead to consolidation or even a bullish rebound if buying interest returns.