XRP Defies Gravity: Golden Cross Emerges After $2.10 Support Holds Firm Post-Leverage Reset

Forget the noise—XRP just flashed a textbook bullish signal while the rest of the market was busy panicking.

The Technical Reckoning

A massive leverage reset swept through derivatives markets, the kind that usually spells disaster. Instead of crumbling, XRP's price found an iron floor at $2.10. It didn't just hold—it sparked a recovery so sharp it triggered a Golden Cross, the holy grail for chart technicians where the 50-day moving average slices decisively above the 200-day.

What The Charts Are Screaming

This isn't just a bounce. It's a structural shift. The Golden Cross formation suggests the short-term momentum has officially overtaken long-term bearish trends. Traders who were betting on a breakdown got liquidated, while the underlying asset demonstrated shocking resilience. It's the market equivalent of a boxer taking a heavyweight's best punch and then smiling.

The Finance Cynic's Corner

Let's be real—half of traditional finance is still trying to figure out if crypto is an asset class or a digital pet rock. Meanwhile, assets like XRP are executing complex technical maneuvers that would give a quant hedge fund manager heart palpitations.

The leverage flush was necessary, painful medicine. Now, with cleaner books and a major technical buy signal confirmed, the path of least resistance looks decidedly higher. The crowd often gets the story wrong at the exact moment it matters most.

XRP is trading NEAR the $2.10 level after a strong move earlier this month. While the market has cooled and excess leverage has been cleared. On top of it, XRP has formed a Golden Cross, a signal that previously appeared before the token rallied to its all-time high, raising questions about whether the pattern could repeat.

Leverage Reset Pushes XRP Into a Tight Range

One of the biggest changes came from the derivatives market. XRP recently went through a rare two-sided liquidation event on Binance Futures. First, on January 5, the price pushed sharply higher, triggering around $4.4 million in short liquidations as late sellers were forced to exit.

Just a day later, the MOVE reversed. Nearly $5.5 million in long positions were wiped out, pulling the price back down.

This back-to-back cleanup removed leverage from both directions and left XRP trading in a narrow $2.07 to $2.17 range as traders waited for a fresh catalyst.

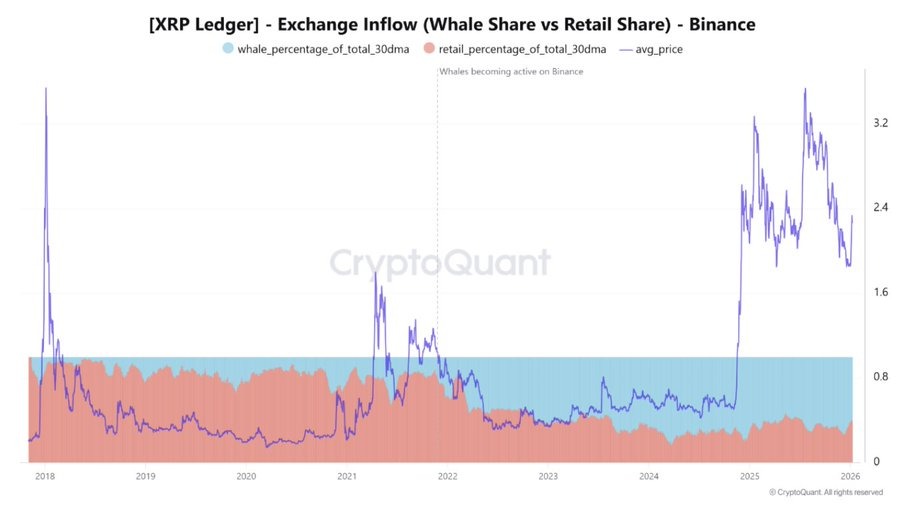

Whale Activity Cools After Months of Heavy Participation

With leverage flushed out, attention has shifted to on-chain and institutional signals. According to CryptoQuant data, whales are still the dominant force, accounting for about 60% of XRP inflows to Binance, while retail traders make up the rest.

However, whale activity has been slowly declining since mid-December. This suggests large holders may be stepping back after months of heavy involvement near the top of the rally, allowing the market to cool and stabilize.

Institutional & ETF Flows Remain Key Support

At the same time, institutional interest remains a key support. Spot XRP ETFs have attracted nearly $1.49 billion in inflows since launch, even though they saw a $40.8 million outflow on January 7 during the recent price dip.

This shows that while short-term sentiment can weaken, longer-term interest has not disappeared.

XRP Chart Forming Golden Cross

On the technical side, analysts are watching early signs of strength. Chart data shared by ChartNerd shows XRP printing a Golden Cross on the 5-day MACD, with the histogram turning positive. The last time this signal appeared was in July, just before XRP pushed to new highs.

![]() $XRP has printed a Golden Cross on its 5-Day MACD with a switch into positive on the histogram. The last time this signal printed was in July, where $XRP rallied to a new ATH. pic.twitter.com/LdCYU709Kt

$XRP has printed a Golden Cross on its 5-Day MACD with a switch into positive on the histogram. The last time this signal printed was in July, where $XRP rallied to a new ATH. pic.twitter.com/LdCYU709Kt

![]()

![]()

If the historical pattern follows again, xrp price will soon hit its all-time high of $3.68.